Floki Inu (FLOKI) price today accompanied Bitcoin in recovery and performed better than BTC. FLOKI experienced a nearly 52% increase compared to Bitcoin’s (BTC) 31% rise after the incredible drop on August 5. Additionally, the 1-day charts for FLOKI also indicated an upward trend. This upward trend could pave the way for the meme coin to return to price levels before the price drops started at the end of July. As of the time of writing, there was a potential 20% increase for FLOKI.

Will FLOKI Rise?

Looking at the price movement on the daily chart, it was seen that FLOKI started an upward movement with the break of $0.00014. During this process, it can also be seen that FLOKI tested the $0.000138 region, which could trigger a movement to the next target resistance region of $0.000176.

Despite the MACD indicator remaining below zero, FLOKI’s upward trend was reflected in the charts, and the downward momentum quickly disappeared. At the same time, the OBV, an important indicator, continued to rise throughout the past week but still did not approach the peak performance seen in July.

The current situation reflects that FLOKI may have broken the downtrend in the daily timeframe but ultimately shows that it was forced to fall. The latest example of this situation dates back to July 21, when a local resistance region was breached but the bulls could not defend this region.

FLOKI Comments

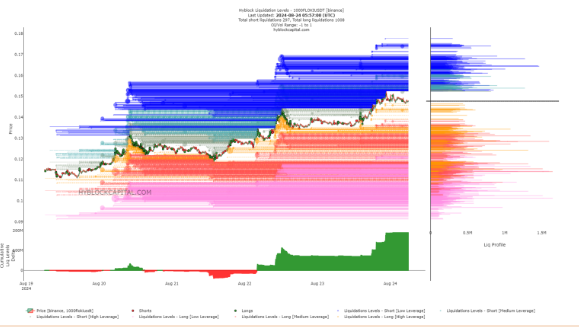

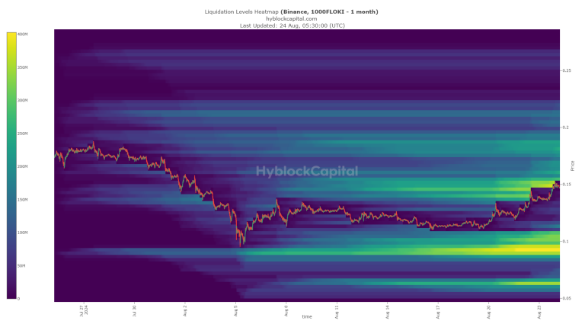

The cumulative liquidity levels delta reflected a significant difference between the liquidation levels of long and short positions in recent days, indicating a heavily positive outlook. The existing upward expectation in FLOKI could trigger a long squeeze, which could have a downward effect on the market, but this is not certain.

Despite this, the liquidation heat map for FLOKI also provided other views indicating downward expectations. The liquidation level at $0.00015 indicated a key liquidity region in the upper area, and this region was seen to have disappeared in the last 24 hours.

Given the existence of liquidation levels at higher levels, investors might benefit from being cautious against a short-term decline. A drop below $0.000128 could lead to a visit to the next target of $0.0001.

Türkçe

Türkçe Español

Español