A significant portion of altcoins started March 26 on a positive note, with Bitcoin being above $70,000 as this article was prepared. The week began well compared to the previous week’s nightmare. Moreover, barring any bad surprises, the net outflows from last week might have reversed as of yesterday. So, what is the outlook for FTM Coin? What dollar value is it targeting?

FTM Coin Analysis

Investor demand is strong, and the RSI is at 77, indicating an overbought condition. Normally, for example, at the start of a bear market, if the RSI is at its peak, a price drop is expected before it can climb back to that region. However, during the days when bull markets are seized by high-risk appetite, the RSI can linger at the peak in the overbought region for an extended period.

Despite a slight 4-point drop in RSI from last week, investor appetite for FTM Coin continues. If the RSI remains above 70 while BTC maintains the $70,000 level, it could open the door to a new rally. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

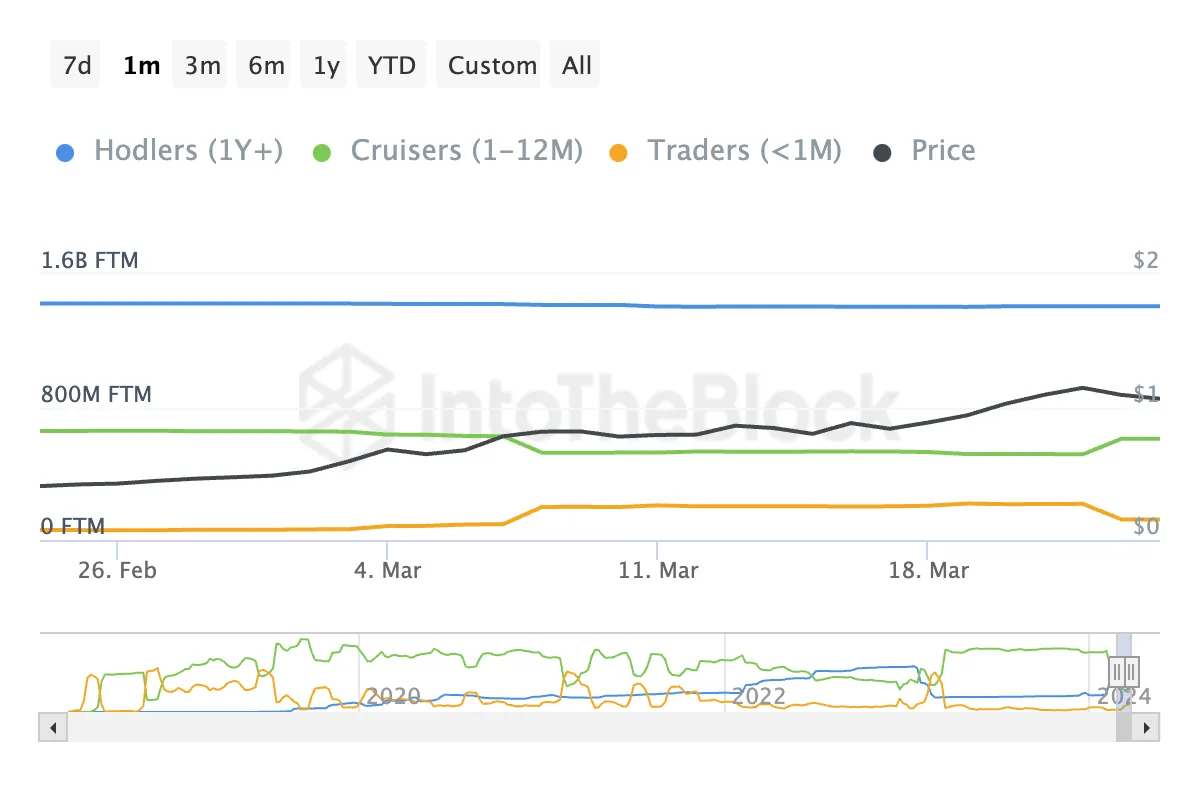

On the other hand, there is growth in the group of investors who bought in less than a month ago. The balance held by the short-term investor group climbed from 59.8 million to 198.9 million within 30 days. The 232 percent increase shows that the appetite that has been ongoing for several weeks is being fueled by new investors.

While the price climbed from $0.4 to $0.81, the amount of assets held by short-term investors increased rapidly. However, there was a subsequent drop from the peak of 217 million to 124 million on March 22. This sudden drop is likely linked to the significant price increase witnessed in the previous days. It is normal for investors to convert their profits to cash after such a rapid rise. Since this supply is being met by medium-term investors, optimism for FTM Coin continues.

FTM Coin Analysis

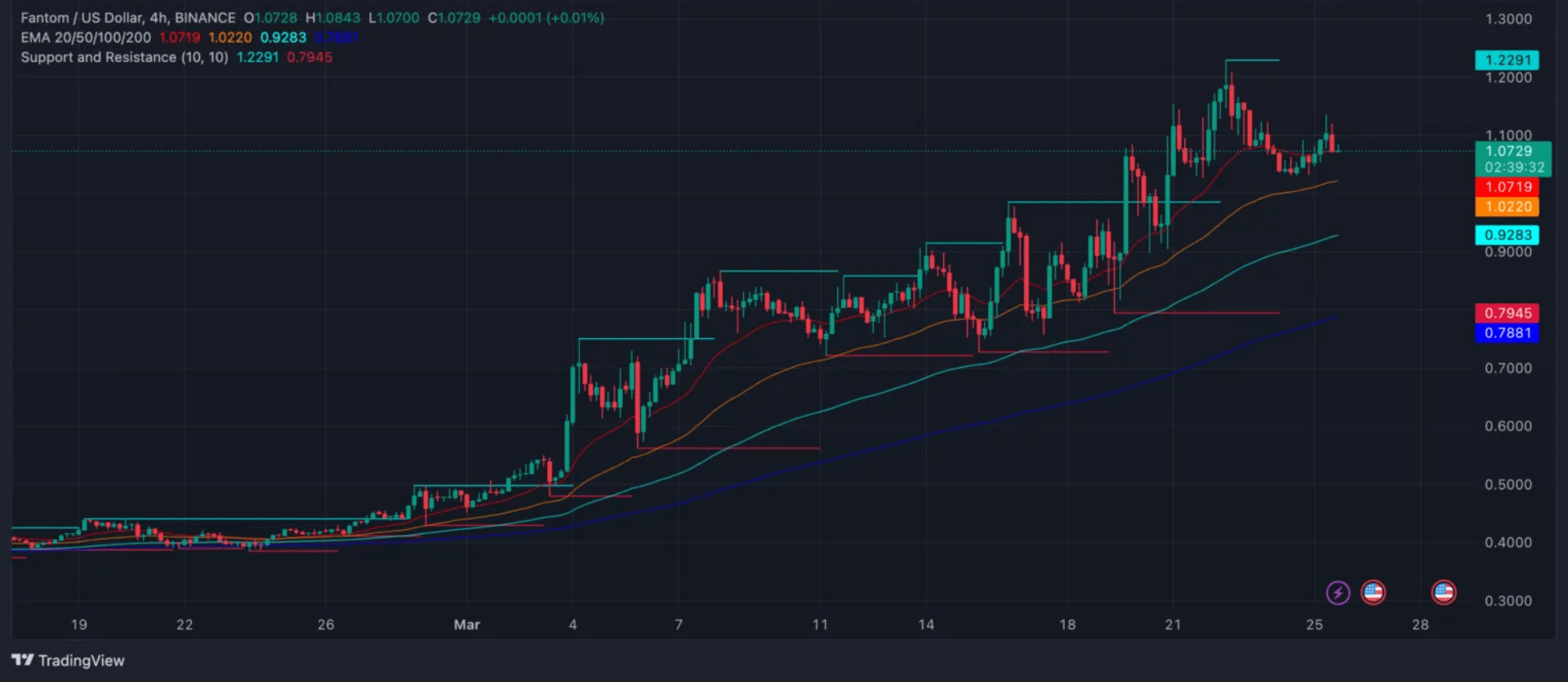

The four-hour chart shows a bullish outlook as short-term EMAs cross above long-term ones. As long as the current price remains above the 20 EMA, the narrative of a technical uptrend can continue.

So, what is the target for FTM Coin if the momentum continues? The first target is the resistance level at $1.22, and if the rally continues, the 2-year peak of $1.5 could be tested. However, if medium-term investors also join the selling bandwagon, the targeted region will be between $0.7 and $0.6.

Türkçe

Türkçe Español

Español