Cryptocurrencies are developing and growing faster than the internet did in its formative stages, but are still not at the desired level. Years ago, Google Earth was a wonder for the first generation of children and teenagers getting familiar with computers. Subsequently, more advanced products, platforms, and applications were developed, just like the future of crypto.

Future of Cryptocurrencies

If you’re of a certain age, you’ll surely remember the days when push-button phones were the trend. Looking back from today, it seems almost magical to access Instagram and play sophisticated games on those button phones. The rapid pace of technological advancements in recent years has made it truly enchanting. But what about the future?

As technology grows, the speed of transformation accelerates with the advancement of tools. Cryptocurrencies are extremely fortunate in this regard. Successful brands have already emerged in various fields, and the technical infrastructure is much better compared to when Bitcoin was born. For instance, you no longer need to keep your computer continuously switched on to run a 24-hour node. For around $10 a month, you can rent servers to do this job, and beyond that, Cloud companies have even launched special products for running nodes.

Chainlink, meanwhile, has monopolized blockchain-based Oracle solutions in crypto’s future. That’s why renowned analyst Michael Poppe frequently declares it his favorite altcoin.

Chainlink (LINK) Review

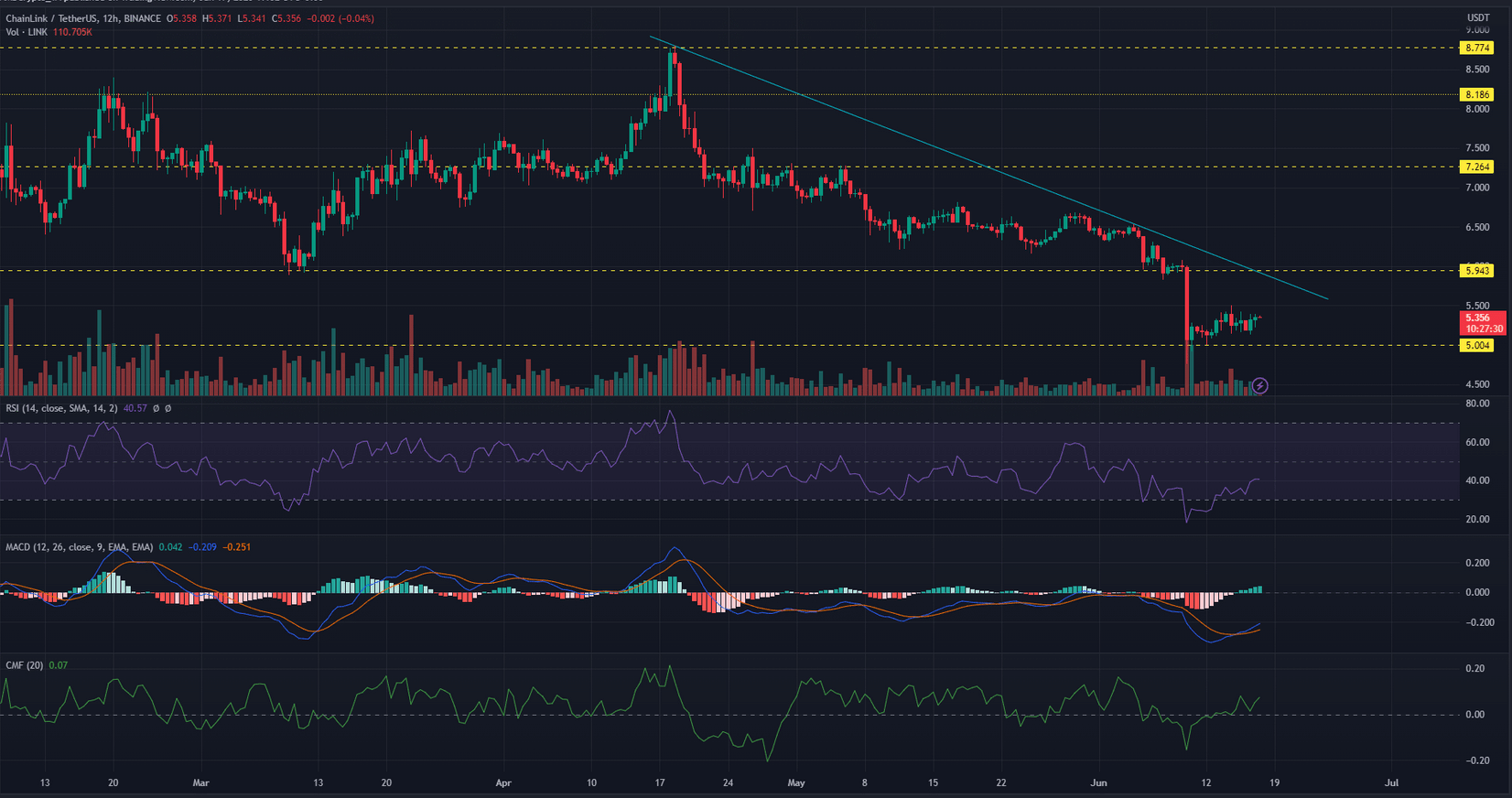

LINK hit its highest level of the year on April 18, reaching $8.77. However, this price region has been a strong area for bears, causing a significant dip like in November 2022 when the price last approached this area. This time was no different as the price rejection from here led to a significant fall for LINK, pushing it down to the support levels of $8.18 and $7.26.

When LINK hit its March low of $5.94, a bullish response was expected. Yet, the bears prevailed, dropping the price to $5.

Bulls showed signs of life in the last 24 hours with a gain of 3.9%. However, substantial barriers lying on the downtrend line and resistance congestion ($5.50 – $6) might prevent buyers from breaking the bearish structure.

Indicators on the chart provided promising signals in the 12-hour timeframe. The MACD released a bullish crossover with green bars above the zero line. While the CMF remained above the zero mark with a value of +0.07, the RSI moved out of the oversold area and remained at 40 at the time of writing.

Looking at LINK’s on-chain measurements, it’s noticeable that there’s a lack of interest in a bullish rally. The Spot CVD remained on a steady decline, indicating a lack of demand for LINK. Conversely, the Funding Rate has been negative since June 16, and investors are hesitant to make any move. This suggests that bulls might be about to walk into a trap.