The action of the U.S. Securities and Exchange Commission (SEC), chaired by crypto opponent Gary Gensler, against Binance and Coinbase, the two largest crypto exchanges, is pushing Bitcoin price towards a pivotal point. Investors are expecting Bitcoin (BTC) and Ethereum (ETH) prices to move sideways for at least a week. Bitcoin seems to be preparing for a rally despite lawsuits against Binance and Coinbase, forthcoming CPI and PPI data, the Fed’s interest rate decision next week, and the issuance of bonds by the U.S. Treasury.

Bitcoin Price Nears Turning Point

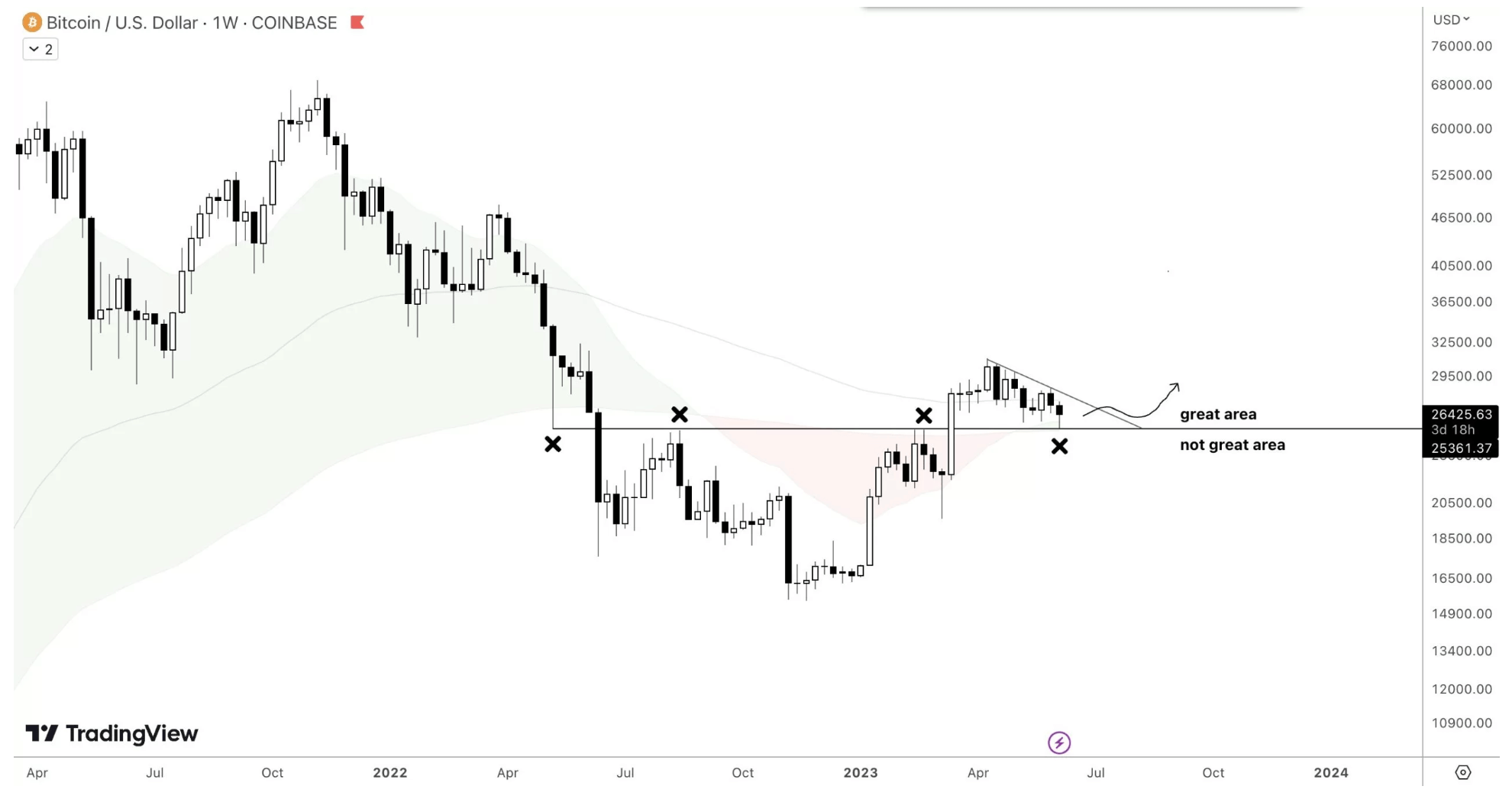

Bitcoin’s price bounced off the 200-week simple moving average on the weekly timeframe. The formation of a triangle pattern between the descending resistance trend line and the horizontal support line indicates that the BTC price could explode upwards at any moment. This triangle formation also suggests that the leading cryptocurrency will mostly move sideways in the coming weeks. It is expected that the price will start to rise as it approaches the declining trend line of the triangle formation formed in July or early August.

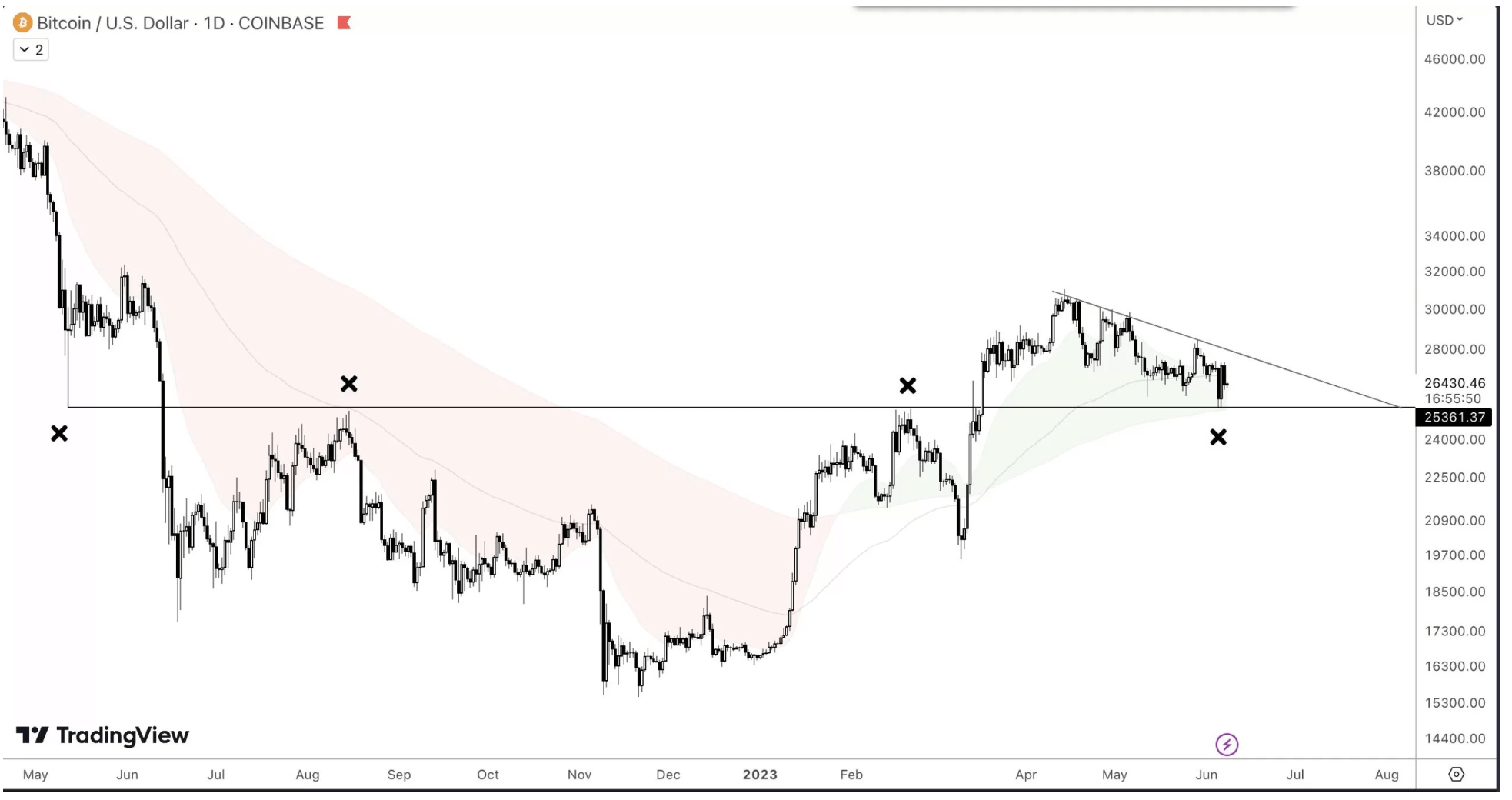

On the daily timeframe, Bitcoin is retesting the bottom of the Ichimoku Cloud, and a bounce off its 200-day simple moving average is expected. The price movement will largely depend on market volatility and macro factors until then. However, it does not seem impossible for the BTC price to exceed $30,000 before August.

On the other hand, the “whales,” the big crypto investors, seem to start buying the dip after the lawsuits SEC filed against Binance and Coinbase. Famous crypto analyst Credible Crypto believes Bitcoin will continue on its path to its all-time high if it rises above $27,500 again.

What’s Next for Bitcoin and Ethereum?

As the U.S. Treasury Department is expected to issue $1 trillion in treasury bonds by the end of the third quarter, Bitcoin and Ethereum prices will continue to be under pressure. Due to the issuance of the treasury bond, a decrease in the liquidity of the U.S. dollar and a greater impact on the stock market than the crypto market are expected.

The CPI and PPI data, along with the Fed’s interest rate decision to be announced on June 14, will help investors determine the market reaction for the next few weeks. Market observers expect the Fed to pass the June rate hike. The CME FedWatch Tool also confirms this expectation, showing a 70% probability that the Fed will keep the policy rate unchanged.