Gavin Wood is launching a new digital identity solution called Proof-of-Ink, which uses tattoos as proof of digital citizenship. Tron founder Justin Sun downplayed concerns following the removal of 12,000 Bitcoins from USDD reserves. Meanwhile, Grayscale launched a new investment fund for Avalanche’s native token AVAX.

Significant Step in the Web3 Space

Parity Technologies is releasing a Web3 individuality solution, a crucial missing element for mainstream Web3 adoption. The new solution, Proof-of-Ink, allows users to prove their digital individuality through a unique tattoo that serves as proof of digital citizenship while preserving privacy.

According to Wood, co-founder of Ethereum, Polkadot, and Kusama, Proof-of-Ink will be launched in the fourth quarter of 2024. In his keynote speech at the Web3 Summit in Berlin, Wood stated:

“We can deploy the basic palette and hopefully launch the application at some point this year, ideally in the last quarter. We aim to launch the other two mechanisms next year.”

Wood hinted that one of the additional digital identity solutions is still under development but did not share any details about the process.

Justin Sun Clarifies Controversies

Tron founder Justin Sun dismissed concerns following the removal of 12,000 Bitcoins used to support Decentralized USD, a stablecoin managed by Tron DAO Reserve. Blockchain explorer Blockchair showed that on August 19, over $729 million worth of 12,000 Bitcoins were removed from an address previously listed as holding collateral for Decentralized USD (USDD).

Discussions on X claimed Sun was responsible for the move, while others expressed concerns that the Bitcoins were removed from the TRON DAO Reserve without a vote. On August 22, Sun stated that USDD’s mechanism is similar to MakerDAO’s DAI, allowing the collateral holder to withdraw funds without approval if the collateral exceeds the system-specified amount.

Prominent Company Takes AVAX Step

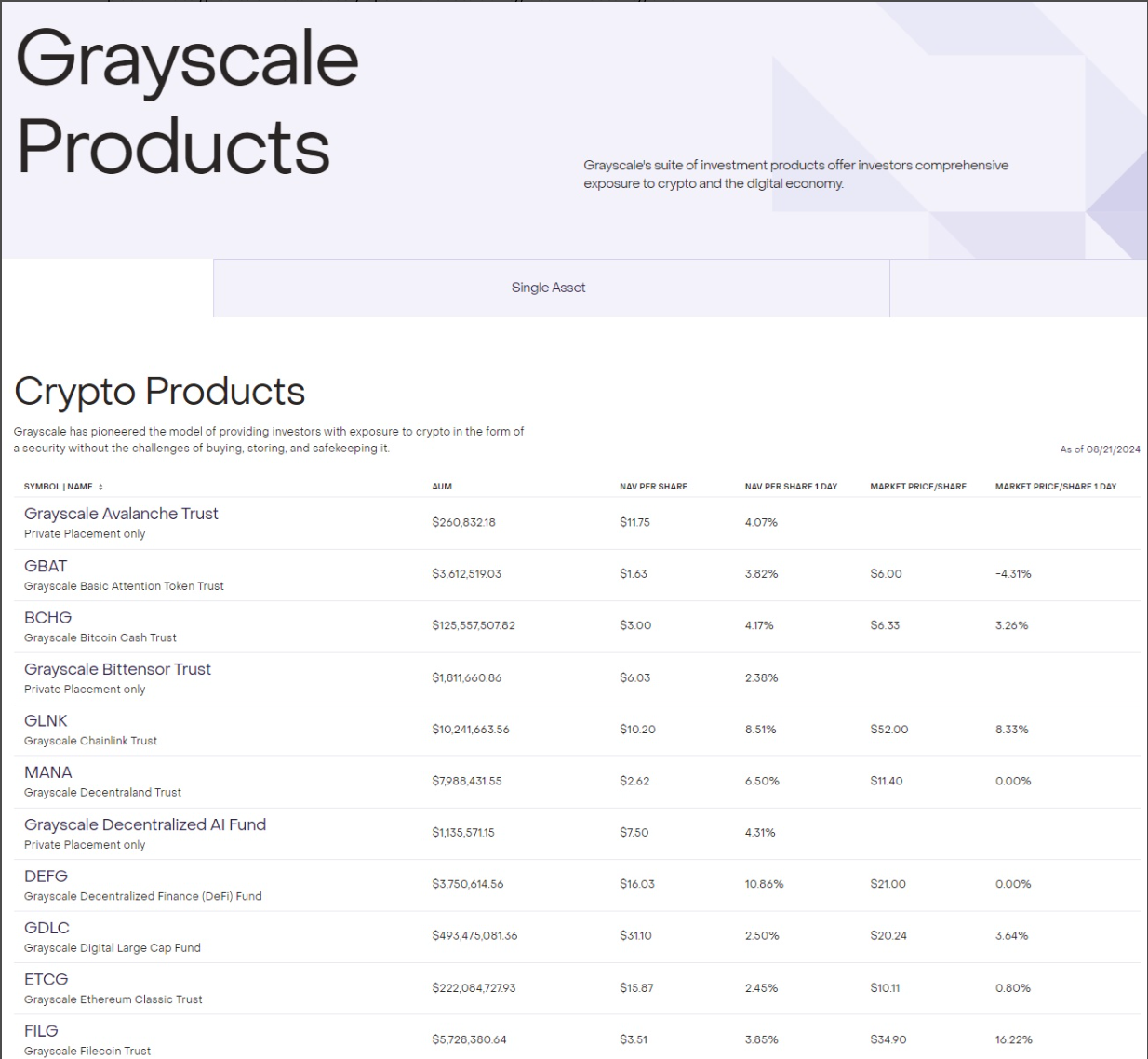

Crypto asset manager Grayscale Investments launched a new investment fund for Avalanche’s cryptocurrency. According to the August 22 announcement, the Grayscale Avalanche Trust will offer investors exposure to a three-chain smart contract platform designed to optimize scalability, network security, and decentralization simultaneously. Grayscale’s Head of Product and Research, Rayhaneh Sharif-Askary, said the trust would also provide investors with an opportunity to invest in Avalanche’s progress in RWA tokenization.

Grayscale is the world’s largest crypto asset manager, with over $25 billion in assets under management. Recently, it launched a trust to invest in MakerDAO’s Maker token. Grayscale also operates the Grayscale Bitcoin Trust and Grayscale Ethereum Trust.