According to Arkham Intelligence, the German government has finally sold off its remaining Bitcoin assets. A wallet associated with Genesis Trading began moving Bitcoin to Coinbase, potentially marking the start of asset liquidations. Meanwhile, Bitcoin entered the extreme fear zone, its lowest point since January last year, as the sector continues to recover from FTX’s bankruptcy.

German Government’s Bitcoin Sale Ends

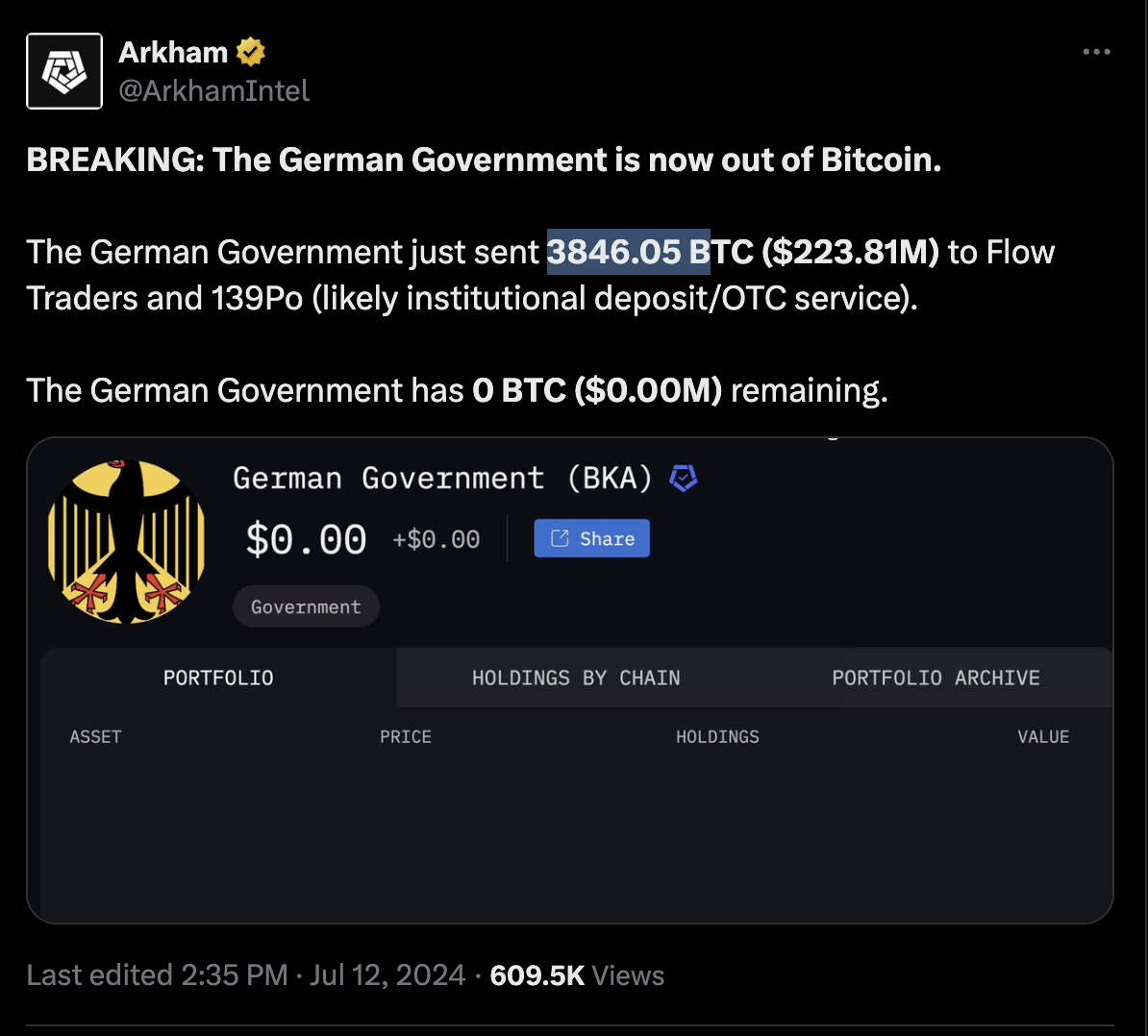

After weeks of releasing seized Bitcoin into the market, the German government had nothing left to sell as of July 12. According to Arkham Intelligence, the German government sent the last 3,846.05 Bitcoin for liquidation on July 12. As previously reported by Arkham, the government likely began selling over $2 billion worth of Bitcoin through Coinbase Global, Kraken, and Bitstamp three weeks ago.

The selling frenzy in Germany is believed to have contributed to Bitcoin’s significant decline in recent weeks. Since the beginning of June, the largest cryptocurrency has fallen from around $71,000 to below $58,000, including a brief dip below $55,000 on July 7.

Not every member of the German government supported the mass liquidations. German MP and Bitcoin activist Joana Cotar argued that the seized Bitcoin could be part of a strategic reserve currency to hedge against risks in the traditional financial system.

Notable Development for Genesis Trading

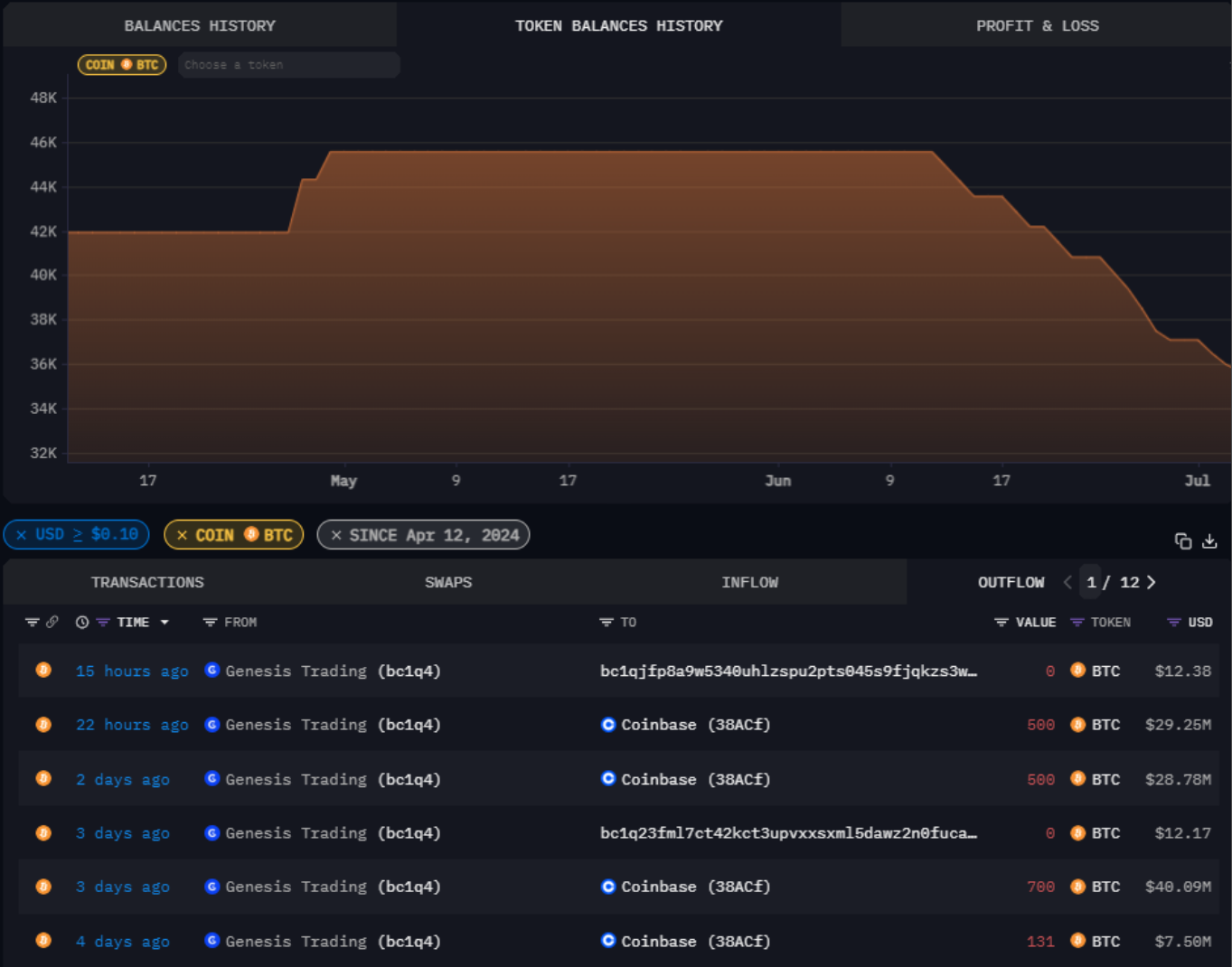

A crypto wallet associated with Genesis Trading transferred approximately $720 million worth of Bitcoin to the Coinbase exchange last month, indicating the potential start of asset liquidations. The Genesis Trading-labeled wallet moved over 12,600 Bitcoin worth $719.9 million in the last 30 days, mostly in transactions of 500 to 700 Bitcoin.

According to Arkham Intelligence, the address currently holds 33,356 Bitcoin, down from over 46,000 Bitcoin on June 12. The multi-million Bitcoin transfers occurred two months after New York State Attorney General Letitia James’ office announced a settlement with Genesis, requiring the company to pay $2 billion to investors defrauded by its Earn program.

Worrying Development for Bitcoin

The Crypto Fear and Greed Index, an indicator that tracks market sentiment towards Bitcoin and crypto, fell to extreme fear, its lowest level since January last year. The declining index score came as Bitcoin failed to surpass $60,000 for the second time in 48 hours.

Crypto analyst Justin Bennett told his 111,000 followers on July 11 that Bitcoin’s price level once again rejected $60,000 and pointed out a potential rising wedge formation, indicating further declines in the coming days.