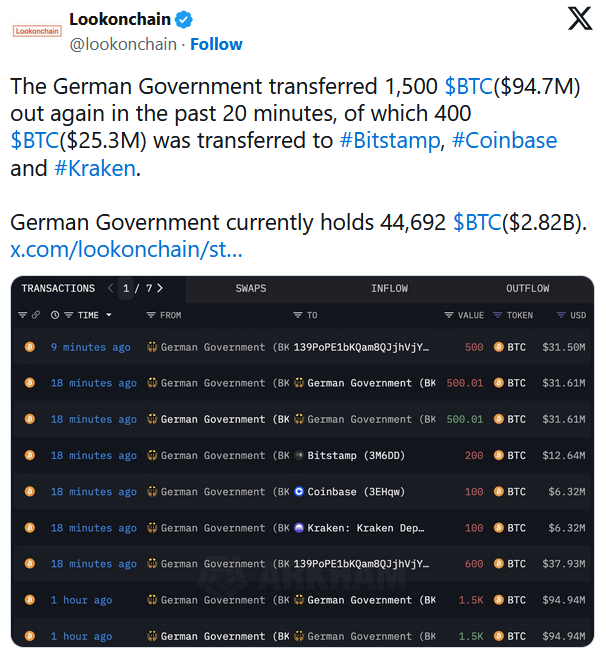

Cryptocurrency markets are abuzz with speculation following the German government’s recent transfer of 1,500 Bitcoin (BTC) worth approximately $95 million. Reported by Lookonchain, this move has alarmed both seasoned investors and market analysts. So, why do we occasionally witness such actions from Germany?

Investors in Fear

The primary fear among investors is the possibility of a significant market downturn. Historical examples, such as the German government’s transfer of $195 million worth of Bitcoin in June leading to a 3.5% price drop, fuel this concern.

BitsCrunch CEO Vijay Pravin and other experts warn that large-scale liquidations could trigger more pronounced declines. The influx of substantial Bitcoin amounts into the market could outpace demand, driving prices down and shaking investor confidence.

Germany’s Strategic Intentions

Beyond the fear of a potential sale, there are several theories regarding the German government’s strategic intentions. One possibility is that the transfer is part of a broader portfolio rebalancing effort. Like private investors, governments often diversify their assets to better manage risk. By reallocating a portion of its Bitcoin holdings, Germany may aim to achieve a more balanced and secure investment portfolio.

Another plausible scenario is that this transfer is a preparatory move for future commercial activities. The German government might be positioning its Bitcoins on exchanges to capitalize on price increases or strategically liquidate assets based on anticipated market movements. However, this maneuver carries inherent risks given the volatile nature of the cryptocurrency market.

A third theory suggests that the transfer could be an exploratory move to test market liquidity. By initiating a relatively small transfer, the German government might be assessing how well the market can absorb such transactions.

Impact of Institutional Players is Clearly Increasing

Arkham Intelligence indicates that the German government’s significant Bitcoin holdings, valued at approximately $2.82 billion, signify the growing influence of institutional players in the cryptocurrency market. Their decisions to sell, buy, or rebalance assets have substantial impacts on market trends and investor sentiment.

Despite the concerns and uncertainties sparked by Germany’s recent Bitcoin move, the overall outlook for Bitcoin remains positive. The leading cryptocurrency is currently trading at $62,548, with a market capitalization exceeding $1.24 trillion.

Türkçe

Türkçe Español

Español