VanEck and Grayscale took a new step today regarding ETFs. Asset managers became the latest companies to register for listing shares of spot Bitcoin exchange-traded funds (ETFs). While this was happening, another development took place across the ocean. The South Korean government is working on banning the use of credit cards to purchase virtual assets like cryptocurrencies. Finally, the founder of Matrixport stated that the company’s controversial report on spot Bitcoin ETFs was not prepared for the public.

Grayscale and VanEck’s Move

Grayscale and VanEck have become the latest asset managers to register for listing shares of spot Bitcoin exchange-traded funds.

According to separate applications to the United States Securities and Exchange Commission (SEC), VanEck Bitcoin Trust and Grayscale Bitcoin Trust have registered their shares through Form 8-A.

These shares are planned to be listed on the Cboe BZX Exchange in the case of VanEck. As for Grayscale, they are considered to be listed on the New York Stock Exchange Arca. In addition, Fidelity also registered this week for its Wise Origin Bitcoin Fund.

The SEC continues to evaluate multiple spot Bitcoin ETF applications after a series of rejections and a lost lawsuit. The entire financial world is expecting a decision to be announced by this Friday. Some analysts believe the SEC could approve multiple ETFs before January 10.

South Korea and Crypto Currency Ban

A proposal was put forward by South Korea’s top financial regulator. It suggested amendments to the country’s credit finance laws to ban the purchase of cryptocurrencies with credit cards by South Korean citizens.

The country’s Financial Services Commission made an announcement on January 3. It emphasized concerns about illegal money movements and money laundering that could arise from South Korean citizens purchasing cryptocurrencies from foreign exchanges.

The FSC made the following statement:

Card payments on overseas crypto asset exchanges have raised concerns due to money laundering, speculation, and the promotion of speculative activities, which could lead to the illegal outflow of domestic funds abroad. Accordingly, virtual assets are expected to be banned as a means of payment.

Statement from Matrixport’s Founder

The price of Bitcoin experienced a sharp decline on January 3 following news that the U.S. Securities and Exchange Commission (SEC) would reject a spot BTC ETF. Matrixport was indicated as the cause of the decline due to a report it presented suggesting that the SEC would not approve any spot Bitcoin ETF applications.

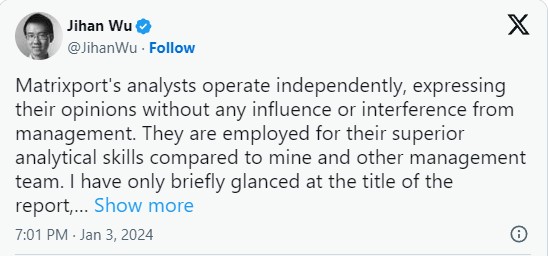

Matrixport’s founder Jihan Wu stated that the report containing the firm’s analysis was not intended to be shared with the market. Wu mentioned that the spread of the report was not planned by Matrixport and occurred outside of their control.

Wu also expressed that he does not agree with the idea that his company was responsible for the sudden crash of Bitcoin on January 3, and made the following statement:

Looking at Bitcoin’s history and future expectations, the current fluctuation and the potential uncertainty of a Bitcoin ETF approval in January 2024 ultimately carry no significance.

Türkçe

Türkçe Español

Español