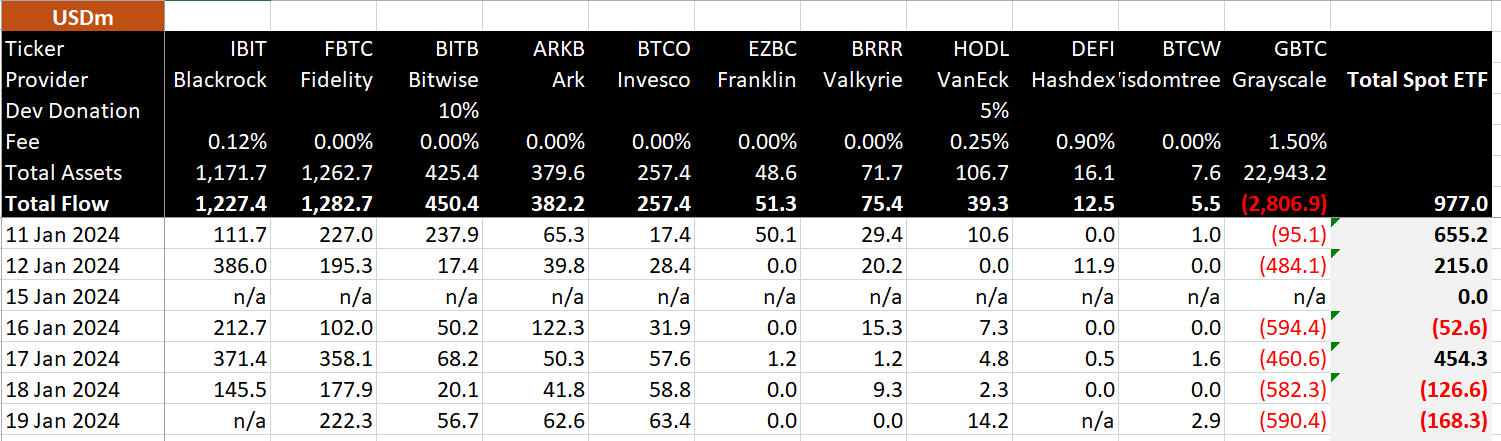

Grayscale Investments’ transformed Grayscale Bitcoin Trust (GBTC) continues to drag down the largest cryptocurrency, Bitcoin. On the sixth trading day of the spot Bitcoin ETFs, there was an outflow of $590 million from GBTC. This outflow brought the total GBTC outflows to $2.8 billion.

The Selling Pressure Caused by GBTC Could Continue for at Least Another 3-5 Weeks

Data shows that there were outflows of $95.1 million on the first day, $484.1 million on the second day, $594.4 million on the third day, $460.6 million on the fourth day, $582.3 million on the fifth day, and $590.4 million on the sixth day GBTC started trading on the exchange. According to data compiled by the research arm of the cryptocurrency exchange BitMEX, BitMEX Research, there is an average daily outflow of approximately $550 million from GBTC.

Experts, assuming this average outflow continues, expect the fund to deplete in 9 weeks and the selling pressure on Bitcoin to end. It is important to note that this is an assumption. Moreover, the depletion of the fund is not a possibility. Therefore, the most realistic expectation is for the selling pressure GBTC exerts on Bitcoin to end within 3-5 weeks, with a moderately negative outlook.

Current Status of Spot Bitcoin ETFs

On the other hand, BitMEX Research reported that on the sixth trading day of spot ETFs, Bitwise‘s BITB saw an inflow of $56 million. The total inflow to the ETF over six trading days reached $450 million. VanEck‘s spot Bitcoin ETF HODL saw an inflow of $14.2 million on the sixth trading day, with the total inflow over six trading days exceeding $39.3 million. WisdomTree‘s BTCW saw an inflow of $2.9 million on the sixth trading day.

Ark Invest‘s ARKB saw an inflow of $62.6 million on the sixth trading day, bringing the total inflow for ARKB over six trading days to over $382 million. Fidelity Investment‘s FBTC saw an inflow of over $222 million on the sixth trading day, while Invesco‘s BTCO saw an inflow of $63.4 million on the same day.

In addition, the sixth trading day inflow data for Franklin‘s EZBC and BlackRock‘s IBIT have not yet been announced, but an inflow of over $250 million is expected for IBIT in particular.