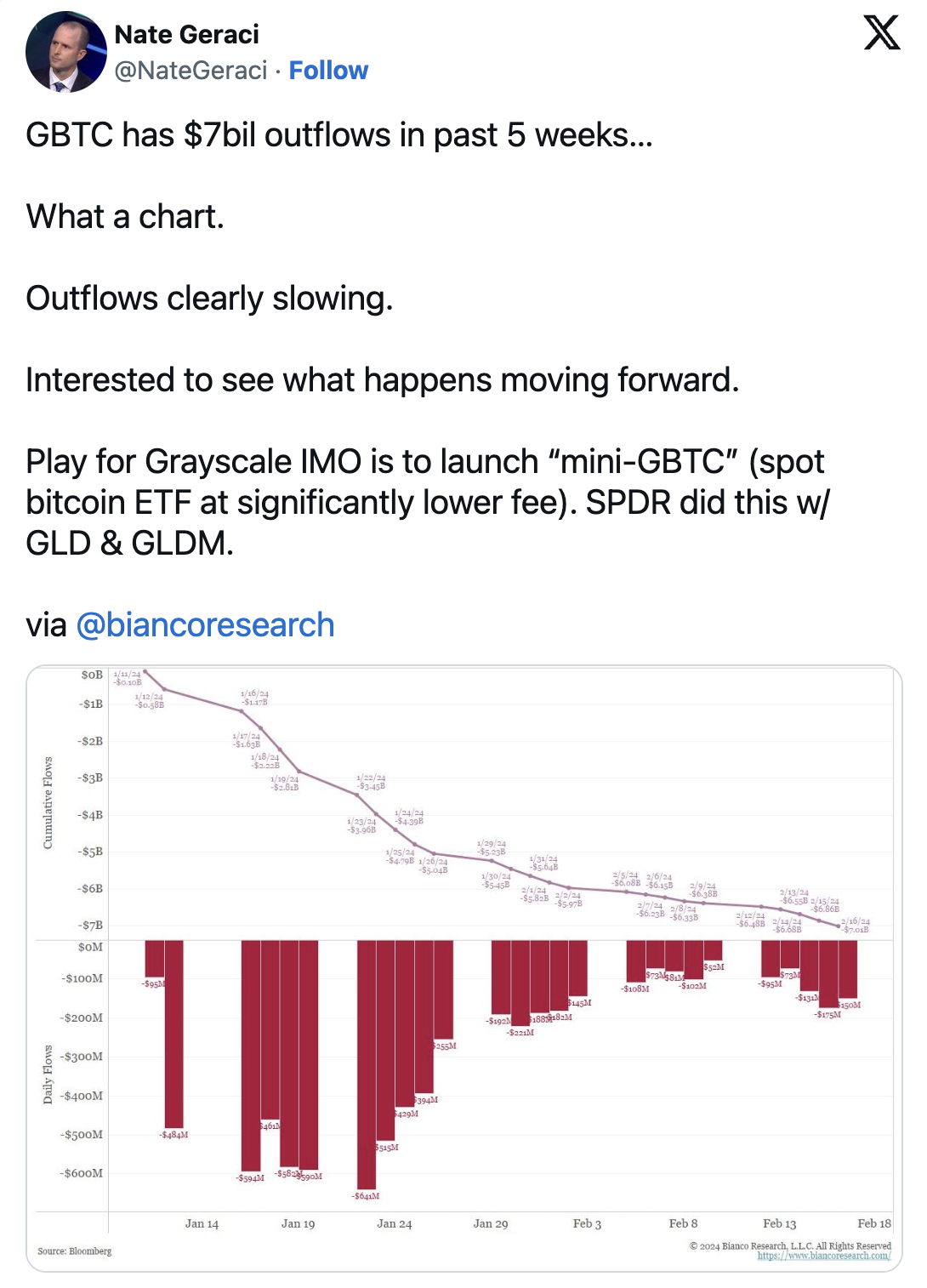

Crypto asset manager Grayscale continues to see a slowdown in outflows from its spot Bitcoin ETF fund, but observers still believe there is room for more sales. According to data from Bianco Research and Farside, the total fund outflow from Grayscale Bitcoin Trust (GBTC) reached $7 billion on February 16 since its conversion to a spot Bitcoin ETF fund.

What’s Happening with GBTC?

Despite these developments and a significant slowdown in the rate of outflows, observers, including ETF Store President Nate Geraci, say that sales may not be finished.

January saw the largest part of the outflows with $5.64 billion leaving GBTC, while only $1.37 billion has been seen in February so far. Jim Bianco, founder of Bianco Research and former Wall Street analyst and commentator, believes in an article published on February 18 that most of the outflows are due to investors rebalancing their portfolios and moving to lower-fee spot Bitcoin ETF funds.

He added that a group of newly launched ETF funds have reduced their fees to 0 to 12 basis points, while Grayscale still charges a fee of 150 basis points. Bianco provided another reason for the ongoing outflows from GBTC.

Will GBTC Sales Continue?

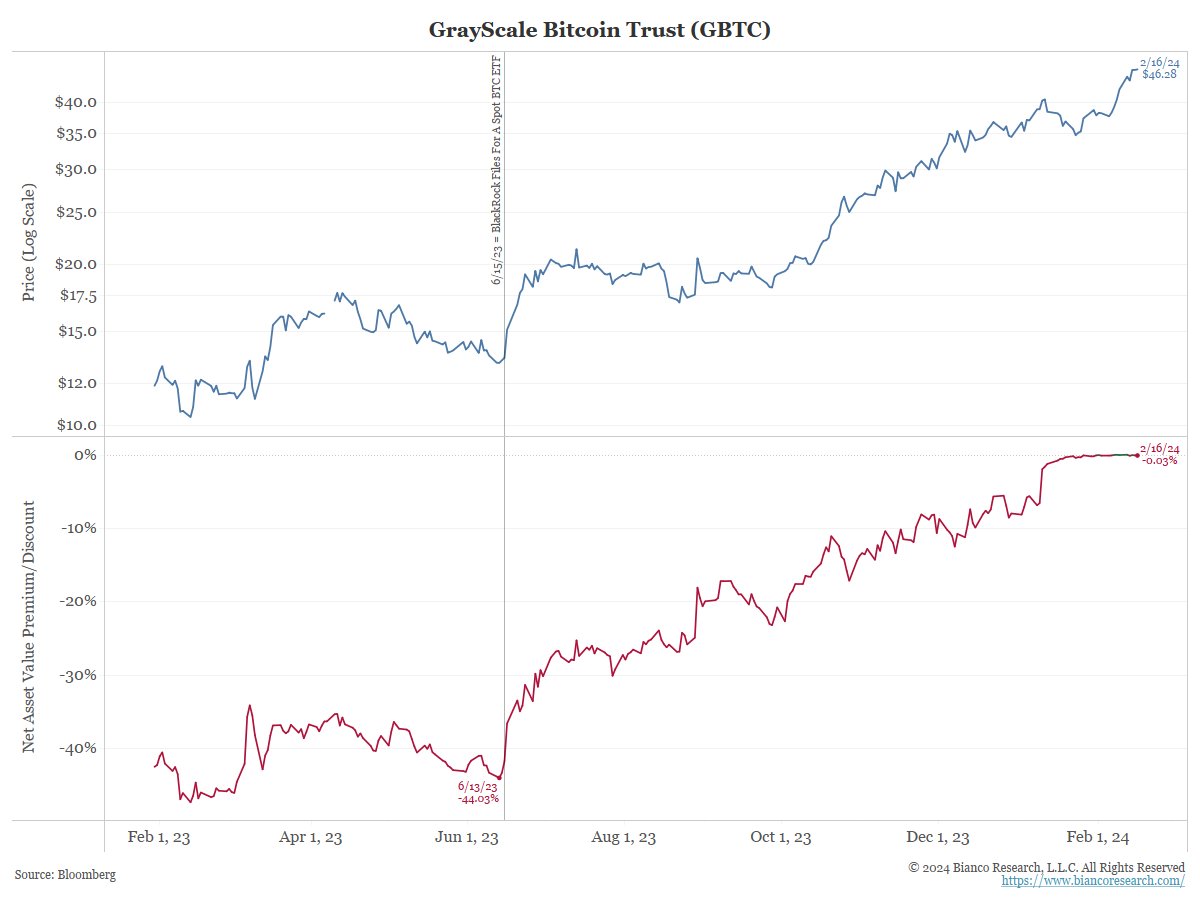

BlackRock filed for a spot ETF fund in June 2023, at which time the fund was trading at a significant discount to the Bitcoin market price. It is possible to talk about a discount of approximately 44% compared to Bitcoin. Bianco made the following statement regarding the issue:

“A lot of money is flowing into cheap Bitcoin. They started to close this arbitrage-type trade process when Grayscale ETF converted on January 11, 2024, as they reached their targets.”

Meanwhile, Geraci believes it is still early and asset sales will continue. Geraci stated:

“They could reduce their assets by 90% and still earn more than all other issuers combined.”

Furthermore, Geraci believes that Grayscale could next launch a mini-GBTC, a separate and new spot Bitcoin ETF fund, at a much lower price. More sales could follow after a judge recently signed an order allowing the bankrupt crypto lending firm Genesis to sell some of its investments in Grayscale.

Court documents indicate that Genesis had approximately $1.6 billion worth of shares in GBTC, Grayscale Ethereum Trust, and Grayscale Ethereum Classic Trust.

Türkçe

Türkçe Español

Español