One of the world’s largest crypto asset management firms, Grayscale, reported that the fourth Bitcoin block reward halving could differ from previous ones due to lower selling pressure and increased interest in new Bitcoin-based applications, potentially leading to a steady price increase after the halving.

“Bitcoin Has Transformed Into Something More Significant Than Digital Gold”

Ordinals have revitalized Bitcoin’s on-chain activity, supporting the demand for spot Bitcoin ETFs, which are likely to sustain higher future prices. Grayscale, in a research note published last week, stated that Bitcoin’s technical fundamentals and use cases have significantly improved over the past year, potentially positioning the leading cryptocurrency for stronger historical rallies triggered by the upcoming block reward halving compared to previous years.

Grayscale researcher Michael Zhao said, “Despite short-term issues with miner revenues, fundamental on-chain activity and positive market structure developments make this block reward halving fundamentally different from others,” and added that “Although it has long been heralded as digital gold, recent developments show that Bitcoin is transforming into something even more significant.”

As is known, the block reward halving is a crucial part of Bitcoin’s code designed to reduce inflationary pressure on the network by cutting the BTC reward amount miners receive per block by 50%. This reduction in the new BTC supply makes mining much more challenging and has historically preceded strong bull runs.

The report emphasizes that beyond the generally positive on-chain fundamentals, Bitcoin’s market structure appears to be in a very favorable position for price post-halving. The lower block reward will require relatively lower buying pressure to sustain prices, which, coupled with increasing demand, could lead to higher prices.

Zhao also noted in the report, “Historically, block rewards have introduced potential selling pressure to the market, and the possibility of all newly minted BTC being sold could affect the price. Currently, the reward per block mined is 6.25 BTC, which is equivalent to about 14 billion dollars annually (assuming a Bitcoin price of 43 thousand dollars). To maintain current prices, an annual buying pressure of 14 billion dollars is needed. With the block reward dropping to 3.25 BTC, these requirements will decrease by 50%, reducing the annual selling pressure to 7 billion dollars, significantly easing the selling pressure.”

The Impact of Ordinals on Bitcoin

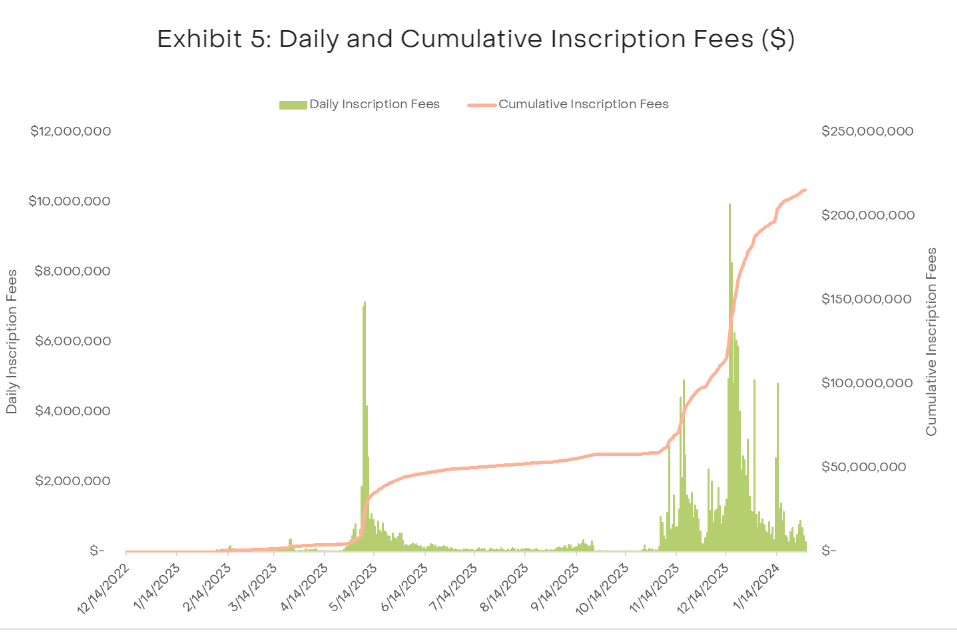

Zhao stated that the emergence of Ordinals and BRC-20 tokens has revitalized Bitcoin’s on-chain activity, bringing in over 200 million dollars in transaction fees for miners as of February 2024, and “This trend is expected to continue, supported by renewed developer interest and ongoing innovations on the Bitcoin Blockchain,” he said.

BRC-20 token standard (short for Bitcoin Request for Comment) was introduced in April to allow users to issue transferable tokens directly on the network for the first time. These tokens, called Ordinals, operate on the Ordinals Protocol. The protocol enables users to embed digital art references into small Bitcoin-based transactions, allowing for data placement on the Bitcoin Blockchain.

During times of high demand on the network, fees generated from Ordinals accounted for more than 20% of miners’ monthly income, emerging as a significant new revenue source for one of the network’s most important stakeholders.

Türkçe

Türkçe Español

Español