According to blockchain data, Grayscale transferred $1 billion worth of Ethereum to Coinbase on July 22, signaling the asset manager’s preparation for the launch of spot Ethereum exchange-traded funds (ETFs) in the US. According to a July 23 post by data provider iChaininfo, about 10% of the 292,000 Ethereum transferred was moved from Coinbase’s hot wallet to Grayscale Mini Trust.

What’s Happening in the Ethereum ETF Space?

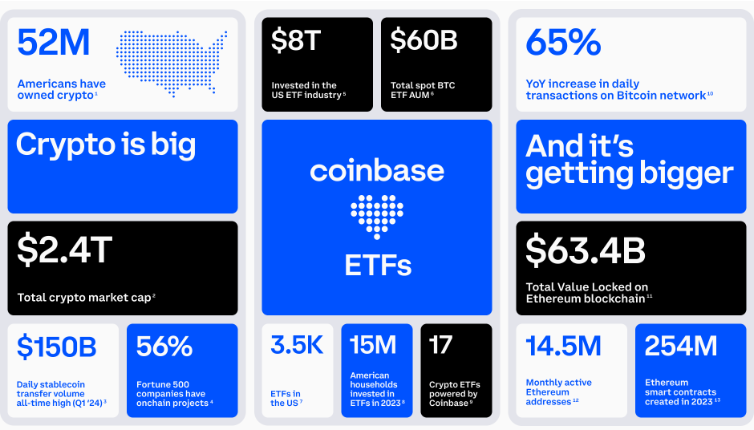

The billion-dollar transfer came a day before the first batch of US-based spot Ethereum ETFs started trading on July 23. Large transfers indicate that Grayscale is preparing funds in advance for the ETF launch. Coinbase will act as custodian for eight of the newly approved nine Ethereum ETFs. According to a July 22 announcement, the exchange already serves as the custodian for 10 out of the existing 11 spot Bitcoin ETFs.

On July 22, the US Securities and Exchange Commission approved the final S-1 registration statements required for the ETFs to be launched on exchanges. The approved Ethereum ETF issuers include BlackRock, Fidelity, 21Shares, Bitwise, Franklin Templeton, VanEck, and Invesco Galaxy.

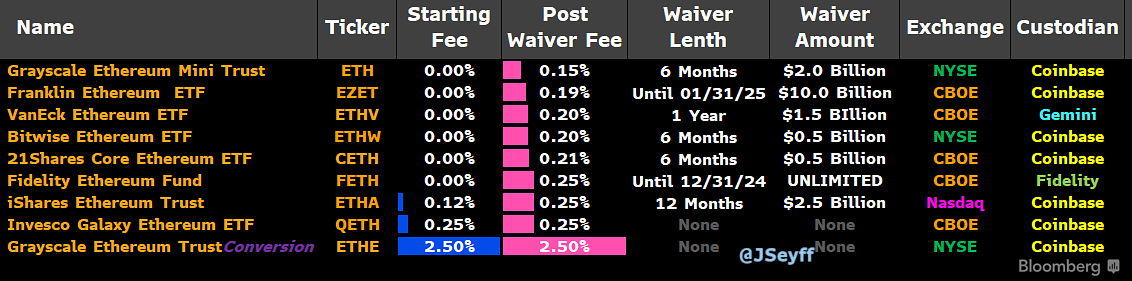

Grayscale’s Ethereum Trust will be listed on the New York Stock Exchange, while the iShares Ethereum Trust issued by BlackRock will be listed on Nasdaq. According to Bloomberg ETF analyst James Seyffart, Grayscale’s fund comes with the lowest waiver fee of 0.15% among potential Ethereum ETF issuers. The Grayscale Ethereum ETF will offer a 0% fee for the first six months of trading.

Details on the Subject

Speaking a week before the ETF launch, Bybit institutions head Eugene Cheung noted that institutional investors were more optimistic about Ethereum compared to individual investors:

“Our latest report shows that institutional investors are more optimistic about Ethereum than individual investors.”

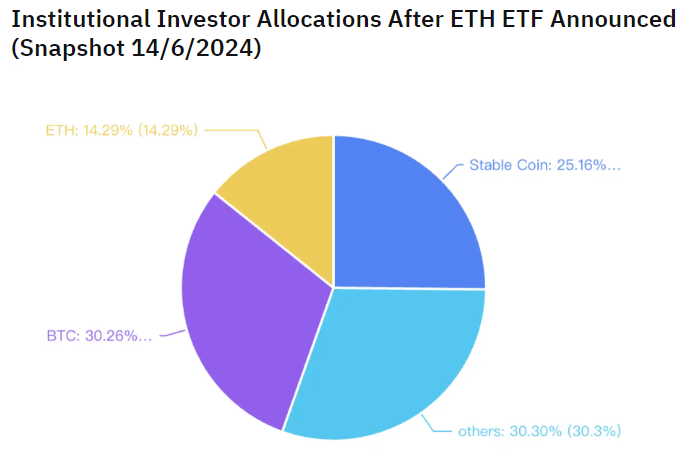

According to the report referenced by Cheung, institutional investors doubled their Ethereum risk from 6.54% to 14.29% shortly after the ETF announcement. During the same period, individual investor allocation rose from 7.4% to 9.52%, showing cautious optimism towards Ethereum’s price.

According to Bybit’s Cheung, the growing interest in ETF funds could help Ethereum’s price double in the next six months, and he added:

“I am optimistic about Ethereum’s long-term price, expecting it to double in the next 18 months and offer an excellent risk/reward ratio to potential investors.”

Ethereum is currently trading 28% below its all-time high of $4,800 reached in November 2021.

Türkçe

Türkçe Español

Español