Grayscale recently announced its investment allocations in the crypto world, and Uniswap is one of them. So, what are the latest developments in this popular altcoin? Here are the details about Uniswap!

Grayscale’s Move on UNI

Grayscale’s portfolio includes the Ex-Ethereum fund and the Grayscale DeFi fund. The latter fund stands out particularly because of Uniswap, constituting the largest investment allocation in the DeFi fund at 41.02%. This situation may indicate that Uniswap will receive a significant amount of liquidity from Glassnode.

UNI has been on a downward trend for the past two months but recently showing signs of a potential relief rally in the coming weeks. UNI’s price of $4.36 has shown a 7% decrease compared to the highest weekly level achieved in the previous attempt to rise in the last week of September.

UNI’s recent pullback resulted in a retest of the current short-term support level. However, this situation has put the altcoin back at a crossroads. Will it make another attempt to rise or fall below the current support level?

On-Chain Data in UNI

On-chain data revealed that whales have been accumulating UNI for the past few months. The supply held by leading addresses is currently at its highest level in six months, which may indicate that whales have been buying this dip.

If whales continue to accumulate, the current price level of UNI can be considered oversold for long-term buyers. Additionally, despite the increasing amount held by whales, UNI’s open interest per USD remains low. This situation may indicate that demand is still low in the derivatives market.

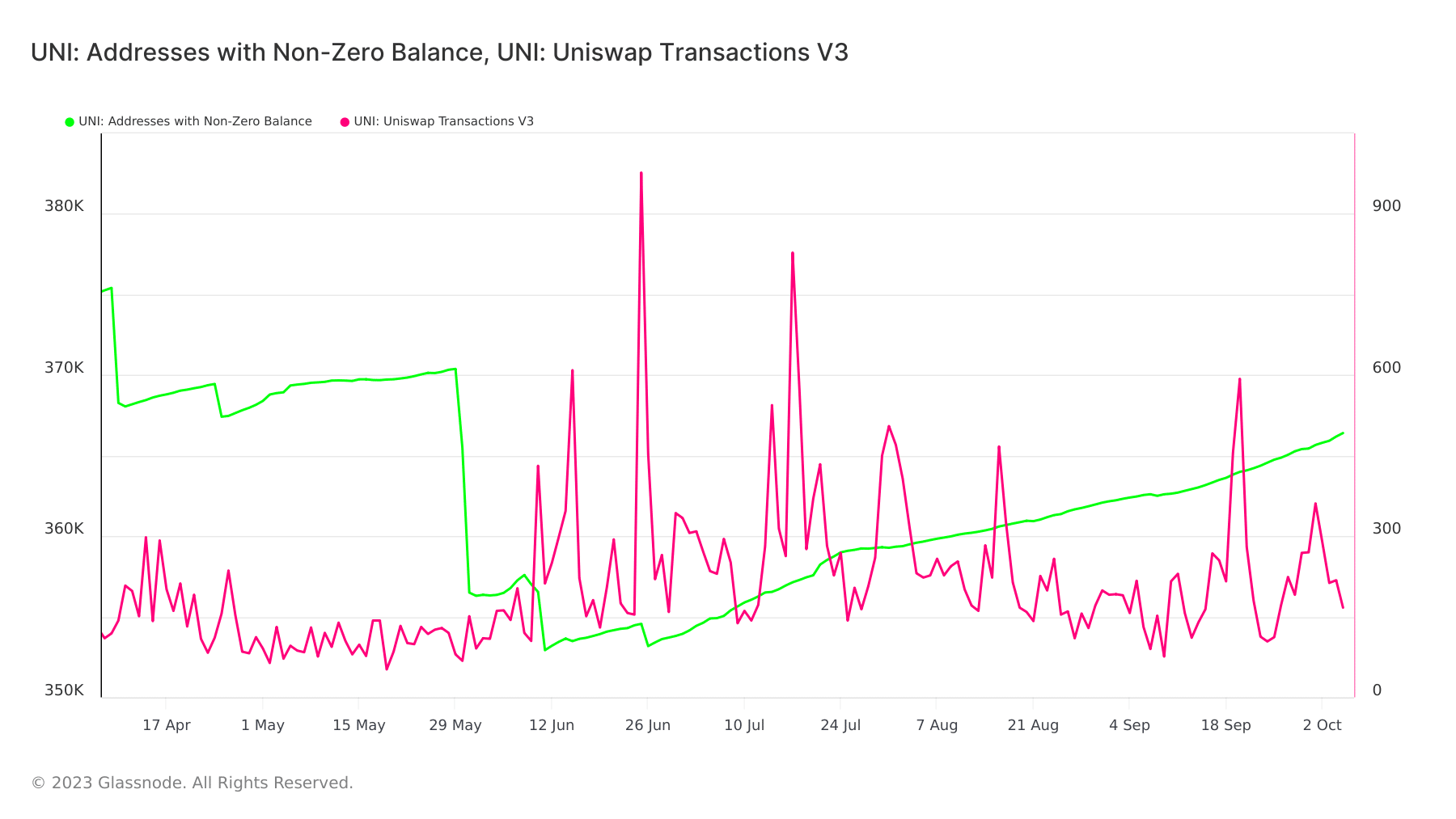

Furthermore, despite Grayscale’s announcement of investment allocation in favor of UNI, this situation also indicates that institutional demand is low. On the other hand, considering the increasing individual demand in the past few months, organic demand can be seen as a positive sign. This situation can be explained by the positive increase in the number of addresses with non-zero balances.

Türkçe

Türkçe Español

Español