The recent attack on the cryptocurrency exchange WazirX garnered significant attention due to the scale of the breach and the hacker’s subsequent actions. The hacker responsible for stealing $235 million from WazirX converted approximately $150 million worth of the stolen altcoins into Ethereum (ETH). This strategic move likely aims to prevent the funds from being frozen or blacklisted by authorities or token issuers.

Altcoins Converted to Ethereum

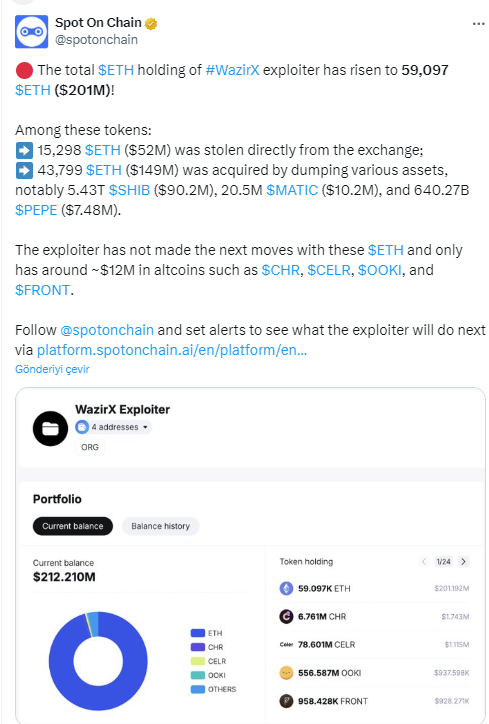

According to blockchain analysis firm Spot On Chain, the hacker converted $90.2 million worth of Shiba Inu (SHIB), $10.2 million worth of Polygon (MATIC), and approximately $7.5 million worth of Pepe (PEPE) into Ethereum between July 18-19.

The hacker’s actions increased the total amount of stolen funds held in ETH from the initial $52 million to $201 million. Blockchain security experts noted that this conversion to ETH serves multiple purposes. Spot On Chain explained that while some ERC-20 tokens have contract functions allowing addresses to be blacklisted, Ethereum does not. This step means that once converted to ETH, the funds cannot be easily frozen.

Additionally, the transition to ETH could help the hacker secure the funds quickly before any preventive measures are taken by authorities. Another blockchain security firm, PeckShield, emphasized that converting to Ethereum facilitates laundering through various cryptocurrency exchanges and mixer protocols due to its stability and liquidity.

Impact on the Market

The attack had a noticeable impact on the market, particularly on the prices of the affected altcoins. For instance, the price of Shiba Inu (SHIB) dropped by approximately 7% following the incident, while the price of ETH remained relatively stable, experiencing only a 0.1% decrease.

According to Spot On Chain, despite the large conversion, the hacker still holds approximately $12 million worth of other tokens, including Chromia (CHR), Celer Network (CELR), Frontier (FRONT), and Ooki (OOKI).

In response to the breach, WazirX halted all withdrawals on July 18, citing a force majeure event that compromised nearly half of its reserves. The exchange stated that it is doing everything possible to recover the stolen funds, including blocking deposits and contacting the relevant wallets.

Türkçe

Türkçe Español

Español