Bitcoin price experienced a sharp correction shortly after reaching an all-time high of $69,324 on March 5th. During this period, altcoin projects led by memecoins and artificial intelligence-focused cryptocurrencies performed better than Bitcoin over the past week, sparking a debate on whether the altcoin season has arrived.

Is Altcoin Season Underway?

The brief surge of Bitcoin on March 5th, crossing $69,000, saw the global crypto market value surpass $2.5 million, reflecting the current upward momentum. According to data from CoinMarketCap, at the time of writing, this figure stands at $2.52 trillion.

Altcoin projects also demonstrated similar strength, with their total market value exceeding $1.1 trillion on the same day. This data measures the total market value of all crypto assets excluding Bitcoin and the increasing market value day by day suggests that the altcoin season may have indeed started.

In the last three months, this value has increased by approximately 64%, rising from $697 billion on March 7th to $1.14 trillion. This is a slightly better performance than the 56% increase recorded by Bitcoin in the same period. This rise proves the growing interest of investors in altcoin projects and the impressive performance this class of crypto assets has recently shown.

Memecoin and Artificial Intelligence Trends Continue

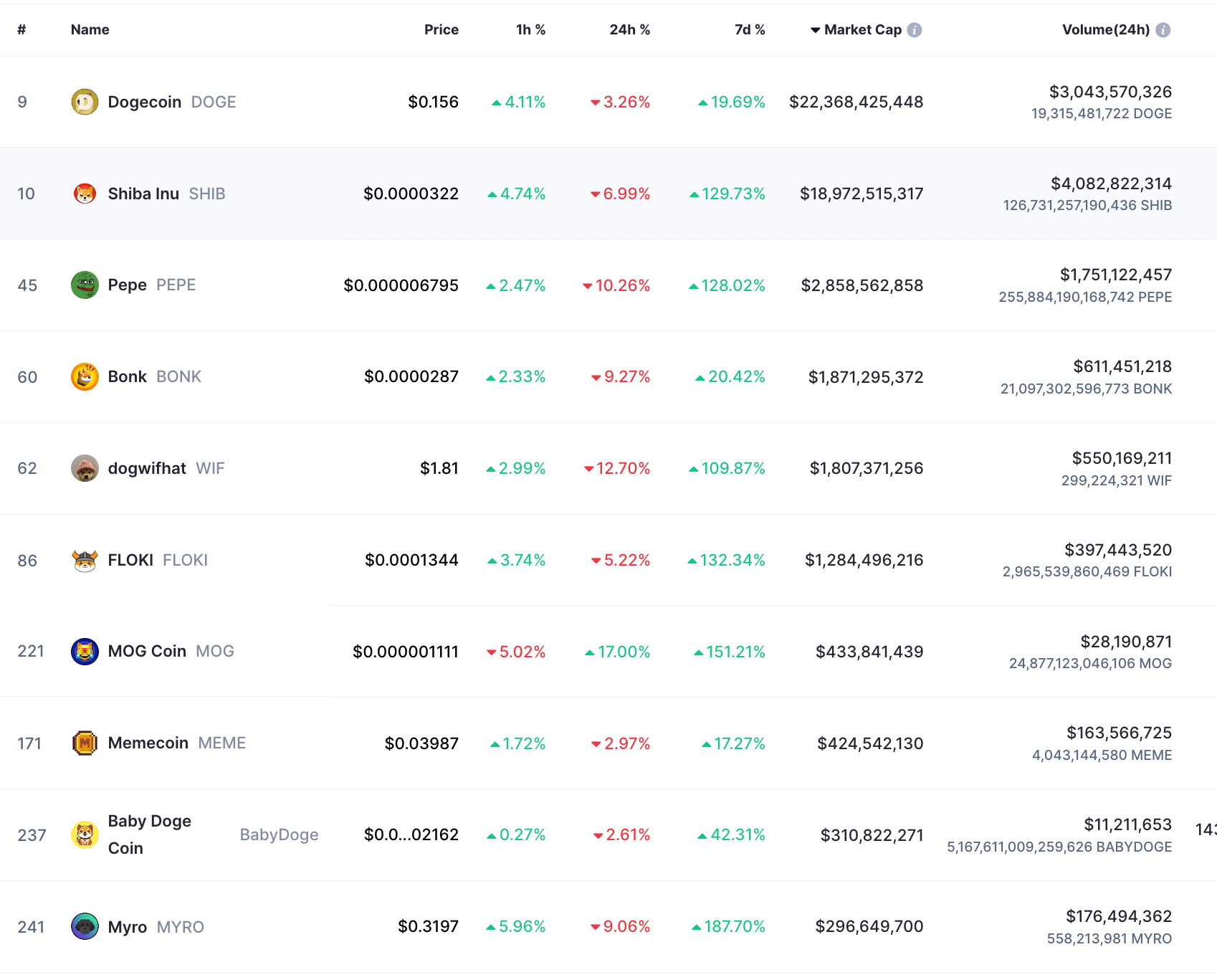

The tremendous rally displayed by memecoins and artificial intelligence last week could be a sign that the altcoin season has begun. Data from CoinMarketCap shows that memecoin projects have seen double and triple-digit gains in the last seven days. Notably, Dogecoin rose by 20% this week, while Shiba Inu managed a 130% increase. Newer tokens like Pepe, Bonk (BONK), and dogwifhat (WIF) also achieved double to triple-digit gains during the same period.

Other notable performances came from tokens in the artificial intelligence ecosystem, led by Fetch.ai (FET), Synesis One (SNS), SingularityNET (AGIX), and Theta Network, which also saw double to triple-digit gains over seven days. Bitcoin, in the same period, rose only by 8.5%.