Helium (HNT) has recorded a 47% increase over the past four days, and its price rise is ongoing. The altcoin’s price performance continues as the daily price chart reverses the market structure in a bullish direction.

The Bullish Struggle in HNT

However, the $9 resistance zone had repelled HNT bulls in December, and this could happen again. Technical analyses highlight a strong bullish trend for the token. Combined with recent gains, breaking the $9 area seems likely. Experts have drawn a range from the $5 level to $8.9 for the cryptocurrency, with the middle range level at $6.95 according to the data.

Over the past six weeks, all three levels have been significant. Therefore, another rejection from the $9-$9.6 region could be highly probable. The market structure break on January 27th, combined with a rise, makes a rejection above $9.6 seem more likely. However, this could depend on Bitcoin‘s (BTC) rally.

Critical Levels in HNT

Another factor supporting the breakout idea is the Fibonacci retracement levels. The price did not close below the 78.6% retracement level of $5.18 during the early January decline. Therefore, a move towards $10.96 or higher was a possibility supported by Fib levels. The OBV and Relative Strength Index (RSI) indicated a clear uptrend in the market despite last month’s volatility.

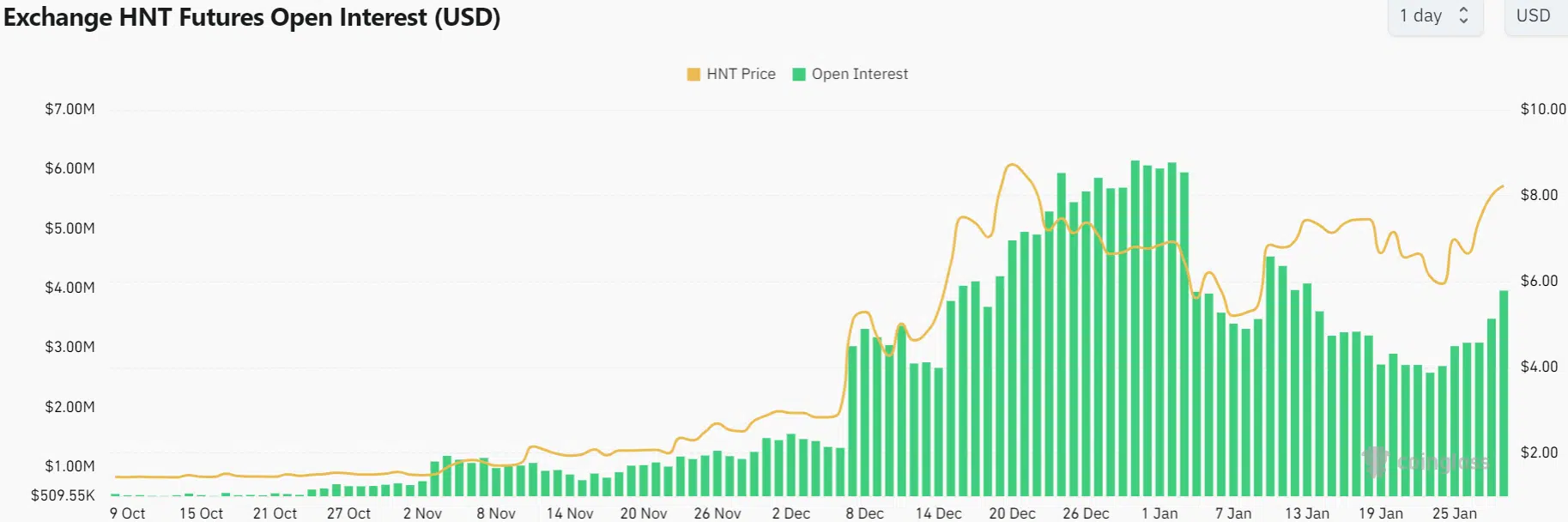

However, the open interest chart could show that sentiment was bearish for most of January. Coinglass also noted that open interests have been declining since January 1st. There were days like January 9th and 10th when OI rose along with the price. The decreasing OI for the rest of the time highlighted a bearish trend among speculators. Since January 25th, OI has been rising along with HNT prices. This could signal a strong bullish trend and willing buyers in the futures market, potentially allowing HNT to surpass the $9 threshold.