Increased sales across cryptocurrency markets due to the BTC decline attracts attention. Bitcoin is testing $26,000. The main problem with Bitcoin, which risks falling as low as $25,500 in the coming hours, is the selling trend in short-term investors. However, BTC is not falling alone. It is dragging altcoins after it.

Cryptocurrencies Comment

At the time of writing, the Bitcoin price is near its daily bottom at $26,300. Consumer inflation expectation data has increased significantly in the long term. The reason behind this is that core inflation is not falling at the desired pace. Inflation, which continues its downtrend (albeit at a slower pace) with the retreat in energy prices, may push the Fed to maintain its tough stance.

All these prospects have prompted short-term Bitcoin traders to sell. On-chain analysts are predicting a local bottom at $25,000. However, if buyers don’t show up in this region, the risk of $20,000 will gain strength. Of course, in this scenario, some of the altcoins will go even lower than the November bottom.

Lack of liquidity is the most critical problem in the cryptocurrency markets and it is still not overcome.

Ethereum (ETH)

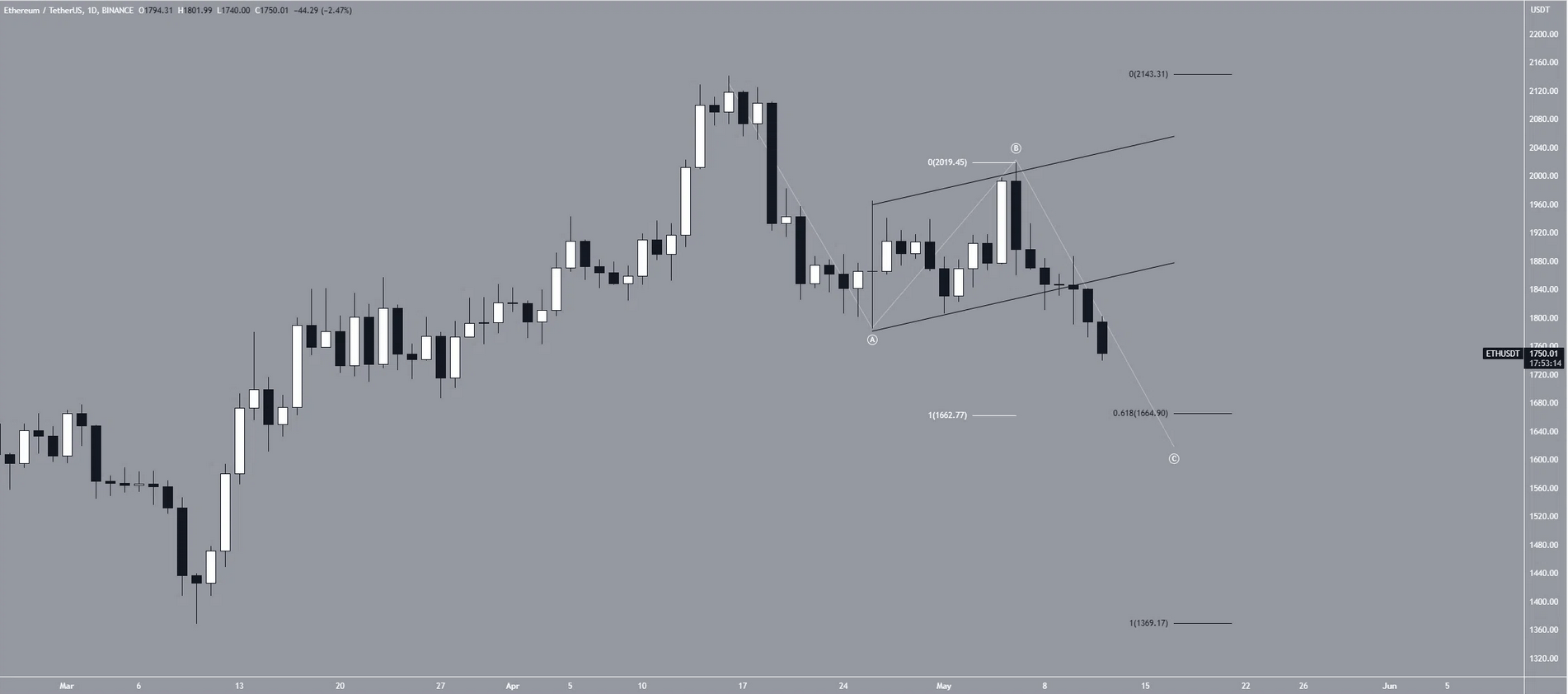

Things are not going well on the ETH front, which is the king of altcoins by market capitalization. Investors targeting $ 2,500 after Shapella were disappointed. In April, ETH reached its highest level of the year at $2,151. This apparently led to a break above the $1,950 resistance area. However, the following week saw a sharp decline and this price broke below this level.

This meant that the previous breakout was invalid. On the contrary, ETH price deviated above the zone before dropping below it. This divergence is also considered a bearish sign, indicating that buyers failed to sustain the breakout.

The nearest support area is at $1,670, while the next resistance is at $2,530. ETH continues its bearish trend on the short-term timeframe as well. On the other hand, the wave count suggests that the price might be in an A-B-C corrective structure. If so, the price has completed wave B and is now in wave C. This was confirmed by the break of the short-term channel. Accordingly, the price may test $1,660 by the end of the week.