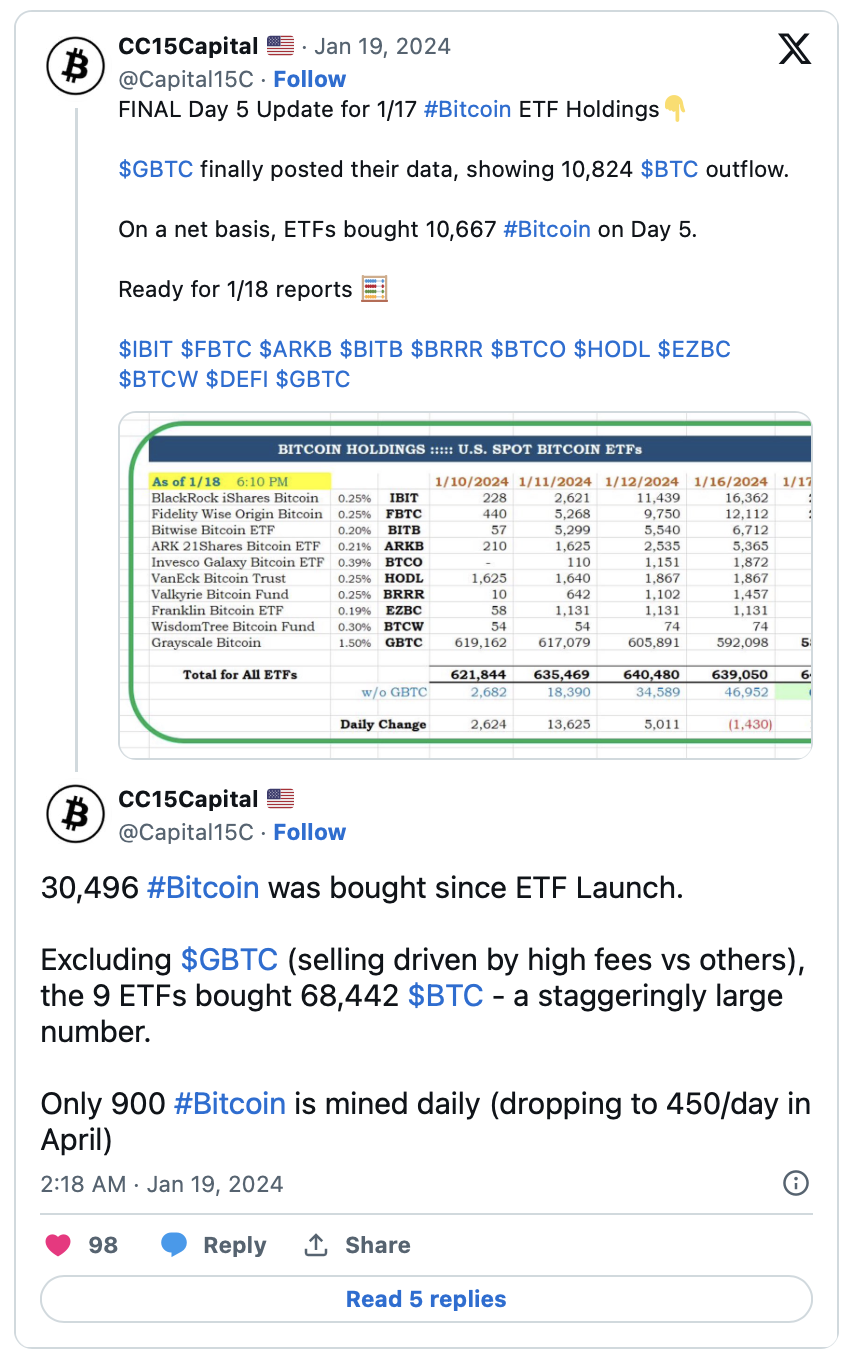

Since the start of trading for spot Bitcoin exchange-traded funds (ETFs), there has been a net inflow of 10,667 BTC into ETFs. Amidst increasing trading volumes, hundreds of BTC were seen entering ETFs on the fifth day of trading.

Spot Bitcoin ETFs Attract High Interest

According to data compiled by the account named CC15Capital for January 17, ETFs saw a net inflow of $440 million worth of BTC by the end of the day. BlackRock’s spot ETF accounted for the majority of these inflows with a net entry of approximately 8,700 BTC valued at $358 million.

The data also shows that since their launch, nine spot ETFs (excluding Grayscale) have seen an inflow of approximately 68,500 BTC, and ETFs currently hold about $2.8 billion worth of Bitcoin. The recent Bitcoin purchases linked to ETFs have been partially offset by ongoing outflows from Grayscale Bitcoin Trust (GBTC), which sold 10,824 BTC (valued at approximately $445 million) since its conversion to a spot ETF on January 11, resulting in an outflow of about 38,000 BTC.

Bloomberg ETF analyst Eric Balchunas reported a 34% increase in daily volume for the new spot Bitcoin ETFs (excluding GBTC) since their fifth day of trading. Balchunas highlighted the unusual trend of increasing trading volumes post-launch, emphasizing the high interest in spot Bitcoin ETFs. He also noted that the trading volume figures for each fund might be delayed due to issuers reporting BTC purchase data with a lag.

Another Bloomberg ETF analyst, James Seyffart, presented data showing that with investors flocking to new ETFs, the value of BTC assets in BlackRock and Fidelity’s spot Bitcoin ETFs each exceeded $1 billion at the close of the trading session on January 18.

Balchunas also mentioned that BlackRock and Fidelity’s spot Bitcoin ETFs ranked fourth and fifth, respectively, in weekly capital inflows among all US spot Bitcoin ETFs.

Bitwise ETF Records an Inflow of 491 BTC on January 18 Alone

CC15Capital also shared on January 19 that Bitwise’s ETF was the only asset management company to report its Bitcoin assets as of January 18, with an inflow of 491 BTC on that day.

Bitwise CEO Hunter Horsley expressed gratitude in a post dated January 18, stating, “Today, BITB saw an inflow of over $20 million. We are grateful for our clients’ trust in managing their assets.”

Türkçe

Türkçe Español

Español