As the U.S. Securities and Exchange Commission (SEC) nears a decision on the country’s first spot Bitcoin ETF, institutional interest in Bitcoin (BTC) appears to be rapidly increasing. This interest is confirmed by data from both the spot and futures markets, especially with expectations that the SEC will approve at least one spot ETF, leading to a historic level of open interest in Bitcoin futures at the Chicago Mercantile Exchange (CME).

CME’s Bitcoin Futures Open Interest Reaches a Historic Level

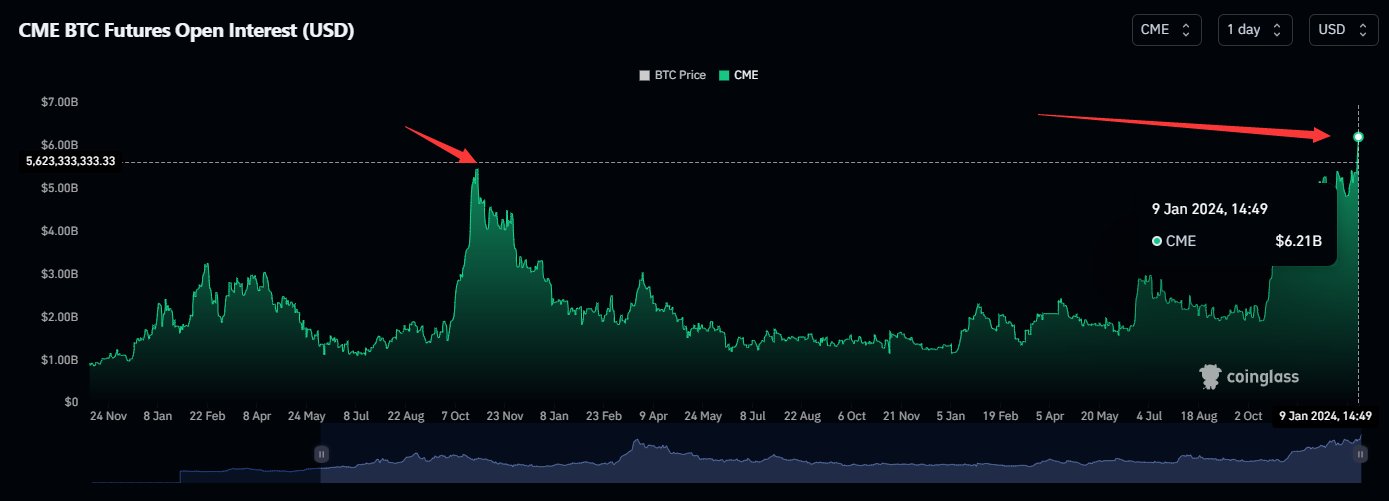

The overall rise in the cryptocurrency market sparked by the spot Bitcoin ETF has caught the attention of investors. According to data provider CoinGlass, CME’s Bitcoin futures open interest has reached a historic level of $6.21 billion.

The open interest in CME’s Bitcoin futures last saw a significant increase during the October-November 2023 period, reaching up to $5.45 billion. The open interest is now well above that level, indicating an extreme increase. CoinGlass also added a note saying, “They must know something.”

What is Bitcoin Open Interest?

As known, Bitcoin open interest refers to the total number of outstanding Bitcoin futures or options contracts in the market. This metric is a measure of the amount of money invested in Bitcoin derivatives at any given time.

Bitcoin futures and options contracts allow investors to speculate on the price movements of Bitcoin without having to own the underlying asset. When investors enter into Bitcoin futures or options contracts, open interest increases. Open interest decreases as contracts are closed or expire.

The open interest in Bitcoin futures provides insight into market participants’ sentiment towards cryptocurrencies. For example, rising open interest indicates an increasing bullish trend among investors, while falling open interest may indicate a growing bearish trend.