Hong Kong’s move highlights its ambition to lead in new spot Bitcoin and Ethereum Exchange Traded Funds (ETFs). However, it’s intriguing to see how it will perform compared to the U.S. Spot Bitcoin ETFs, which hosted over $28 billion in the first quarter.

Hong Kong ETFs or the U.S.?

Bloomberg’s renowned ETF analyst Eric Balchunas updated his forecasts, suggesting that the ETFs could see up to $1 billion in managed crypto assets within the first two years, doubling his previous estimate of $500 million.

This prediction by Balchunas appears in light of some regulatory challenges targeting potential investors from China. Balchunas made the following statement on platform X:

Chinese investors, who are prohibited from purchasing virtual assets, will likely not be eligible to buy the spot Bitcoin and Ether ETFs listed in Hong Kong.

This statement aligns with the views of Bloomberg’s Rebecca Sin. Although Chinese individual investors could theoretically use their annual $50,000 remittance quotas to invest in these ETFs, Sin noted that this route is largely unexplored due to regulatory and practical uncertainties.

Institutional investors seem to face a stricter process. Given the current regulatory environment, the likelihood of the Qualified Domestic Institutional Investor (QDII) quota being approved for virtual asset ETFs might be lower than expected.

Despite these limitations, the launch of spot Bitcoin and Ethereum ETFs is considered a significant milestone for Hong Kong’s financial markets. Sin highlighted the broader potential situation:

Hong Kong’s spot Bitcoin and Ether ETFs could gather up to $1 billion in managed assets. However, achieving this target largely depends on the pace of infrastructure improvements and the expansion of the ecosystem supporting these digital assets.

Eric Balchunas also made broader comments about Hong Kong’s potential position in the global ETF market, saying:

Let’s move to some good news about Hong Kong; our asset forecast for the first two years is $1 billion (IMO a healthy estimate but still far from some claims of $25 billion), but much depends on infrastructure improvements. We also believe this will help Hong Kong become a leader in ETFs in the Asia region.

How Much is Bitcoin Now?

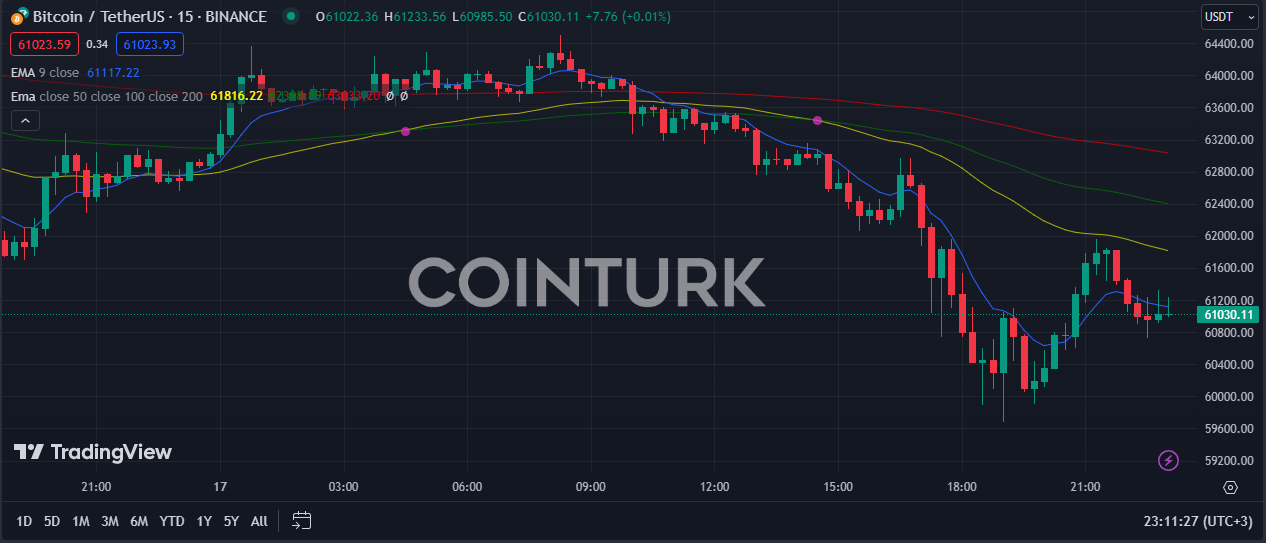

While all this is happening, eyes are also on Bitcoin (BTC) as it continues to drop, momentarily dipping below $60,000 today.

As of writing, BTC price has rebounded above $61,000, demonstrating how strongly bulls are defending the region above $60,000.

Türkçe

Türkçe Español

Español