Bitcoin miners have started to enjoy overcoming the expected supply shock as transaction fees on the Runes protocol soar, while block rewards decrease. Two of the largest mining companies in the United States highlighted the positive financial and functional impact of Runes. Here are some notable statements on the matter.

The Halving Process and Mining Field

Stronghold Digital Mining CEO Greg Beard mentioned that the first week following the halving event led to a drop in mining revenues due to reduced Bitcoin mining rewards. However, Beard stated that Runes was a welcome consolation against the expected drop in Bitcoin rewards, sharing the following:

“This drop was unexpectedly balanced by a significant increase in transaction fees. Simply put, we compensated for what we lost in rewards with transaction fees.”

Marathon’s executive responsible for growth, Adam Swick, emphasized that the launch of Runes and increased network activity after the halving event led to higher fees, echoing these sentiments and sharing:

“This definitely helped mitigate or delay the impact of the halving event depending on how long the fees last.”

According to Swick, the most immediate effect after the halving event was the increased transaction fees, which nearly compensated for the halving process. He added that Marathon meticulously planned around potential volatility in Bitcoin prices and the global hash rate, ensuring that the company’s daily operations were not affected.

Notable Statements from Prominent Figures

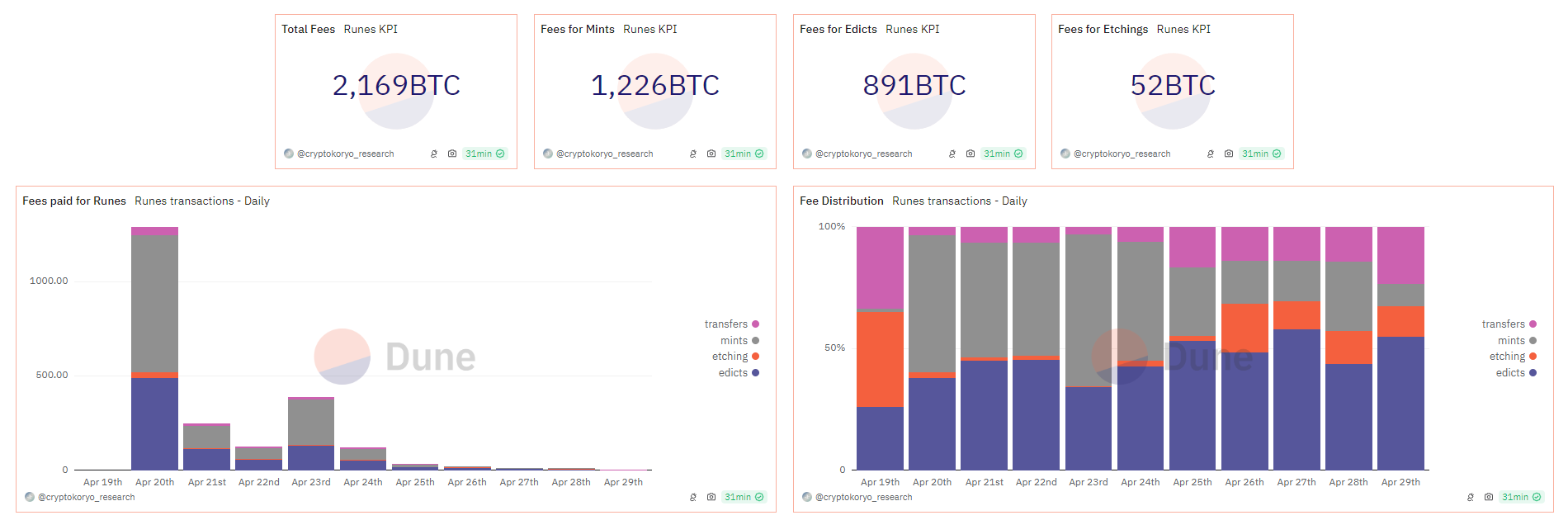

According to Swick, Rune transactions added transaction fees worth 1,200 Bitcoins to miners since the Bitcoin halving event took effect. The introduction of Runes, a new token standard in Bitcoin that allows users to create more efficiently tradable tokens on the leading cryptocurrency’s blockchain network, has sparked reactions within the Bitcoin community.

Bitcoin maximalists argue that the emergence of BRC-20 tokens, made possible by Casey Rodarmor’s Inscriptions and Runes, deviates from the network’s primary purpose. Both Beard and Swick believe that mining companies have a more positive outlook considering the impact of Runes just two weeks after the halving event.

Beard; speculated on the impact of Runes and blockchain tokens and the rising transaction fees. He compared the latest Bitcoin halving event to the Super Bowl of Crypto, noting that increased interest in Bitcoin also played a role in rising fees.

The CEO of Stronghold believes it is important to consider where these fees will eventually stabilize. Beard mentioned that as more functionality is built on Bitcoin, future trends could lean towards higher transaction fees.

“From a miner’s perspective, it’s still too early to rely on these potential increases without firsthand witnessing the tangible benefits of these technologies and their broader adoption.”

Türkçe

Türkçe Español

Español