The first quarter was disastrous, marked by constant sales in cryptocurrencies due to tariff concerns. The second quarter, however, began a new downward journey with the announcement of tariffs. This chaos signifies much more for cryptocurrencies. The Federal Reserve’s interest rate trajectory has shifted, and Powell will speak this evening. So, what direction do the 2025 interest rate predictions take?

2025 Fed Interest Rate Predictions

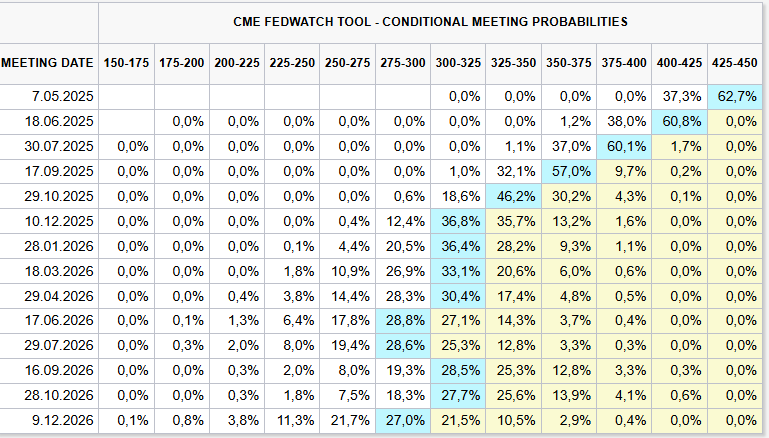

Due to the halt in the decline of inflation, there was an expectation that the Fed would make one interest rate cut this year, which was prevalent in December and January. Subsequently, the median forecast was announced as two cuts. Now, with tariffs being expected to induce a recession, a total of four rate cuts is anticipated throughout the year.

Experts foresee a 60% chance of a recession this year. China has been injecting liquidity to sustain domestic demand and circumvent the downturn. Current market expectations also suggest that the Fed will follow a similar path.

China has retaliated with additional tariffs of about 35%. Since the U.S. and China have both raised tariffs, trading between the two has become increasingly difficult. It is certain that global trade balances will be disrupted. Unless there is a significant surprise or a move towards reconciliation, countries will trade within smaller alliances and struggle to maintain domestic demand.

Short-term interest rate futures traders expect a 50 basis point cut by June. Meanwhile, Trump, during the article’s preparation, stated, “It’s a great time to get rich; my policies will never change for investors coming to the U.S.,” inviting them to become wealthy in America.

Non-farm payroll data did not create a significant impact as it reflected strike returns. Unemployment rose above expectations, and average wages remained below expectations. All eyes are now on Powell’s upcoming remarks at 18:25.

Cryptocurrency Predictions for 2025

The Fed will hold a meeting 33 days from now to announce its interest rate decision. This timeframe is considered sufficient for the central bank to address recession risks and tariffs pushing for economic expansion. The Fed must act while closely monitoring incoming data and leading indicators. With Trump determined to maintain his stance, there are thoughts that the risk of recession, which is worse than inflation, will compel action.

In his speech at 18:25, it is hoped that the Fed will address tariffs and quantitative tightening. The institution has already taken the first step by slowing the pace of balance sheet reduction. Following the fastest rate hikes in history, with global trade balances disrupted, it is now time to act swiftly once again.

This situation could pave the way for further increases in cryptocurrencies for the remainder of the year. As China, the EU, and Canada pursue expansion, the U.S. joining this movement could yield favorable outcomes for risk markets. We will wait and see together.

Türkçe

Türkçe Español

Español