Significant developments continue in the cryptocurrency market. Accordingly, Bitcoin and Ethereum option contracts worth a total of $2.4 billion will expire on May 3, which could increase market volatility. A Bitcoin option contract allows investors to speculate on Bitcoin price movements without owning the Bitcoin itself.

Option Contracts and the Crypto Market

There are two types of option contracts; put and call options. Put options give investors the right to buy cryptocurrency at a certain price before a specific date. Call options allow investors to sell a cryptocurrency unit at a certain price before the expiration date.

Investors often use the put/call ratio as a measure to assess the overall market condition. If investors are buying more puts than calls, it is considered a sign of a downturn, and if they are buying more calls than puts, the market sentiment is considered bullish. A put/call ratio below 0.7 is considered a bullish trend, while a ratio above 1 is considered a bearish indicator.

What to Expect in the Market?

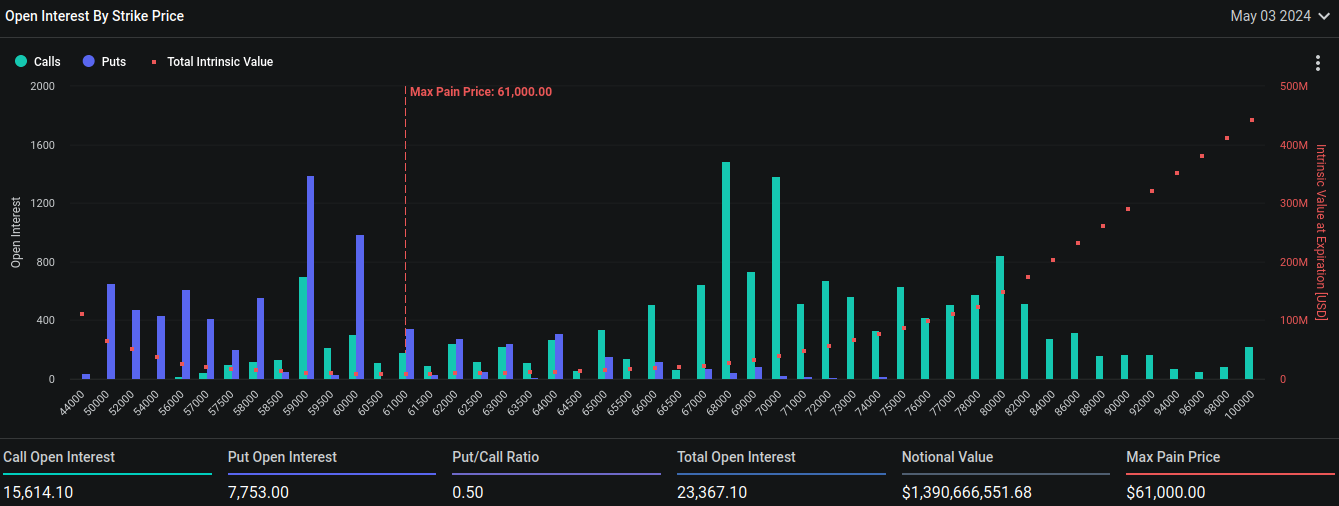

On May 3, a total of 23,367 Bitcoin contracts worth $1.39 billion will expire. According to data from the Deribit exchange, the current put/call ratio for Bitcoin option contracts is at 0.5, and the maximum pain point is $61,000. The maximum pain point represents the price that would cause the most financial losses for the largest number of asset holders.

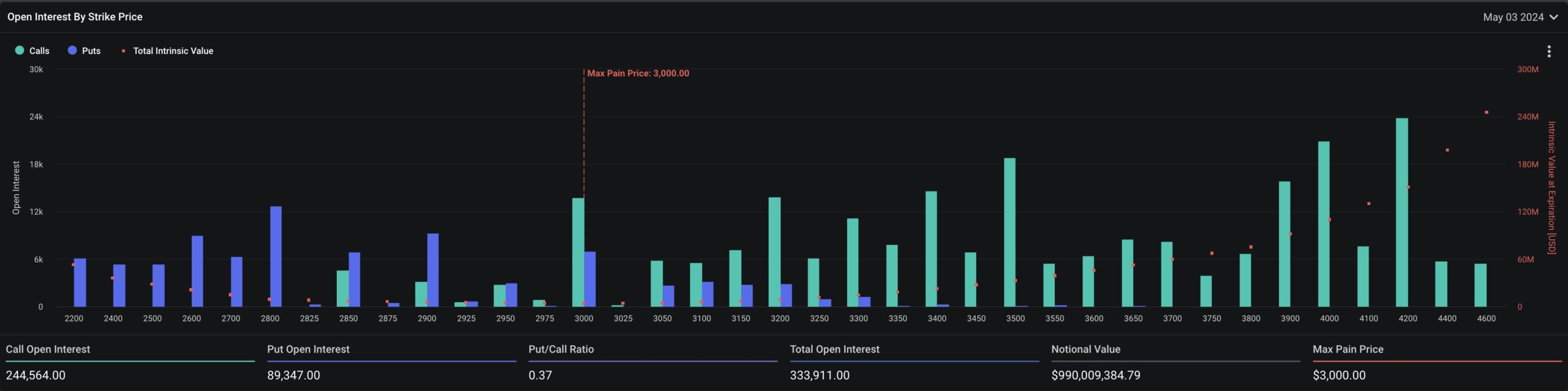

Similarly, a total of 334,248 Ethereum contracts with a nominal value of $1 billion are also expected to expire on May 3. The put/call ratio for these expiring contracts is 0.37, and the maximum pain point is $3,000. Historically, the expiration of option contracts has been followed by short-term price volatility in the spot crypto market. Bitcoin and Ethereum have been under downward pressure for the past few weeks.

The price of Bitcoin has fallen below $60,000, indicating a nearly 20% correction over the past week. The price of Ethereum also dropped below $2,900. The crypto market is generally known to rebound from the volatility caused by options a few days after expiration.