The International Monetary Fund (IMF), which has been a subject of news in the Turkish and global media, has now made a proposal for the cryptocurrency ecosystem. A document prepared by the IMF presents a series of security vulnerabilities and potential policy recommendations for the cryptocurrency sector. The IMF and the Financial Stability Board had previously collaborated on policy recommendations for cryptocurrency markets.

IMF’s Policy Recommendations Draw Attention

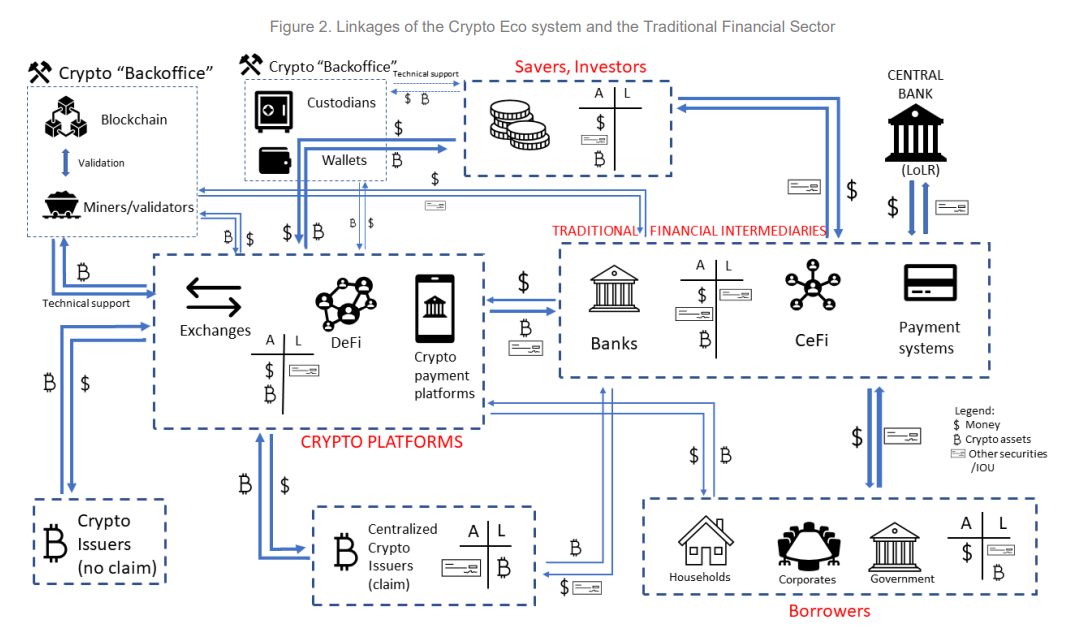

A study document titled “Assessment of Macrofinancial Risks Arising from Crypto Assets” was published by the IMF on September 29. The proposal, called Crypto-Risk Assessment Matrix (C-RAM), aims to identify potential risks and triggering conditions. The article, written by Burcu Hacıbedel and Hector Perez-Saiz, summarizes countries’ potential responses to these risks.

The topic covered in the article consists of three stages. The first step involves the use of a decision tree, which addresses the macro-criticality of the crypto sector or its potential impact on the macroeconomy. The second step involves the use of traditional market data in the cryptocurrency market. The final step covers global macrofinancial risks that will affect the risk assessment based on countries’ macroeconomic data.

El Salvador Example Reveals Risks

Burcu Hacıbedel and Hector Perez-Saiz illustrate the matrix used as an example in the article by highlighting El Salvador, which legalized and adopted Bitcoin as a currency in September 2021. According to the article, C-RAM was applied to determine the country’s risks, covering market, liquidity, and regulatory risks associated with Bitcoin usage:

“The use of crypto assets in El Salvador can also be assessed as macro-critical because recent regulatory and legal changes bring significant risks of crypto adoption, undermining financial stability and affecting major labor remittances and other capital inflows in the country.”

The IMF criticized El Salvador’s decision and spent considerable effort to persuade the country to reverse its implementation. In January 2022, the IMF legally warned El Salvador to abandon this decision. According to the IMF, the use of BTC as a legal tender poses serious risks in areas such as stability, financial integrity, and consumer protection.

As the cryptocurrency market continues to evolve, regulators in many countries are rapidly taking precautions against potential dangers in this field. On September 7, at the request of the G20 presidency of India, the IMF and the Financial Stability Board (FSB) collaborated on policy recommendations for cryptocurrency markets. As a result, various proposals were presented to the parties regarding the risks associated with activities in the crypto sector.

Türkçe

Türkçe Español

Español