The value of ImmutableX’s native token IMX, which offers a Layer-2 scaling solution for NFTs in the Ethereum ecosystem, increased by 22% last week. This price rise boosted the token’s activity in the futures market. At the time of writing, IMX was trading at $1.58. Last week’s sudden rise in the Layer-2 market led to double-digit growth in the token price. Consequently, activities in the futures market increased.

What Is Happening on the Immutable X Front?

As of the time of writing, the token’s open interest was $23 million. The rise in open interest began on July 7 after it dropped to its lowest level of the year at $14 million. Since then, IMX’s open positions have increased by 39% and are currently at their highest level since June 6, according to Santiment’s data.

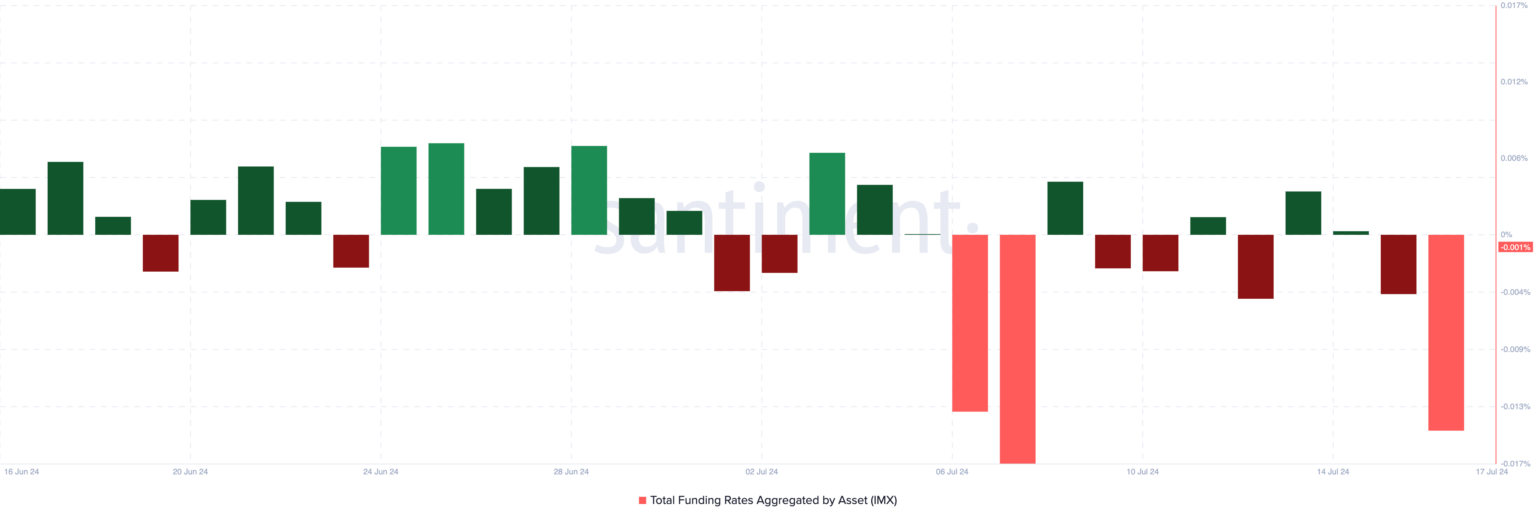

An asset’s open interest refers to the total number of outstanding derivative contracts such as options or futures that are yet to be settled. When it rises this way, more investors enter new positions, bringing fresh liquidity to the market. However, many new entrants to the IMX derivatives market prefer short positions. This can be seen in the predominantly negative funding rates recorded since July 6.

Funding rates are a mechanism used in perpetual futures contracts to ensure that an asset’s contract price stays close to its spot price. Negative rates mean more investors are buying the asset and expecting a decline than those buying and expecting a rise. IMX’s funding rate on cryptocurrency exchanges was recorded at -0.001% at the time of writing.

IMX Chart Analysis

IMX recently rose above the 20-day Exponential Moving Average (EMA), preparing to continue its upward trend. The 20-day EMA of an asset measures its average price over the last 20 trading days. When the price surpasses this level, the short-term price movement starts to outperform the average of the last 20 days, strengthening the bullish trend.

Traders typically see such a breakout as a buy signal. If the buying pressure continues, IMX will climb to $1.75. However, if profit-taking occurs and IMX starts a downtrend, it could trade at a low level of $1.13.

Türkçe

Türkçe Español

Español