Bitcoin (BTC) price has once again rebounded to $27,200, disappointing those who were expecting deeper lows. The recent surge can be attributed to the finalization of the GBTC decision. The crypto community, which has been waiting for the approval of a Spot Bitcoin ETF for years, is now closer than ever. But how do we know this?

Expectations for a Spot Bitcoin ETF

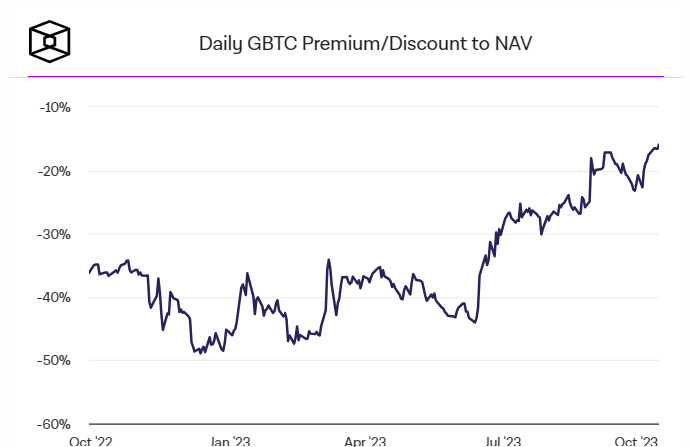

We previously mentioned that the discount of Grayscale Bitcoin Trust (GBTC) would decrease as the expectation for ETF approval increased. Since the SEC did not appeal the decision last week and accepted defeat, the discount is approaching zero. In fact, the negative premium of GBTC has dropped to the lowest levels in two years.

Under normal circumstances, this negative premium would rise above zero during the bull season (due to excessive demand) and drop to -35% during the bear season (due to excessive selling and lack of demand). If the conversion of GBTC to an ETF is approved, the negative premium will be directly eliminated, and those who bought at -35% will make quick gains.

According to the latest data, the discount of GBTC’s net asset value (NAV) (i.e., how much lower each share’s market price is compared to the value of Bitcoin it represents) is trading below 16% for the first time since December 2021 and reached 15.9% at the market close on Friday.

GBTC gains have reached 146.4% since the beginning of the year, while BTC has remained at 67.6%.

Will Bitcoin Rise?

According to experts, ETF approval is now certain, and the only uncertain thing is when it will happen. Bloomberg experts mention a 95% approval probability for the coming year. The expectation for a 75% approval by the end of this year is also maintained. The deadline for GBTC’s appeal for a court decision expired last Friday, and this Friday the file will be closed. Then, the application made by Grayscale will go to the SEC for reapproval.

The SEC may tell Grayscale to file a new ETF application to prolong the process, thus delaying it by 8 months. Alternatively, they may continue to reject ETFs by finding excuses other than the price. However, these excuses should not contradict approved Bitcoin futures ETFs. That is why the SEC’s job seems difficult, and this is the reason behind the experts’ expectations of a definite approval.

K33 Research Senior Analyst Vetle Lunde and Vice President Anders Helseth believe that the current process will have significant positive results on the Bitcoin price. The SEC, which has strengthened its communication with BlackRock and others, seems to have given the green light to ETF issuers.

Türkçe

Türkçe Español

Español