On-chain metrics are sending important signals for the biggest altcoin according to market value and BTC is at $26,500. The current status of the king cryptocurrency has limited the losses for altcoins. On the other hand, in order for a true bull run to begin, we need to see an improvement in the bullish sentiment of investors.

Current Data for Ethereum

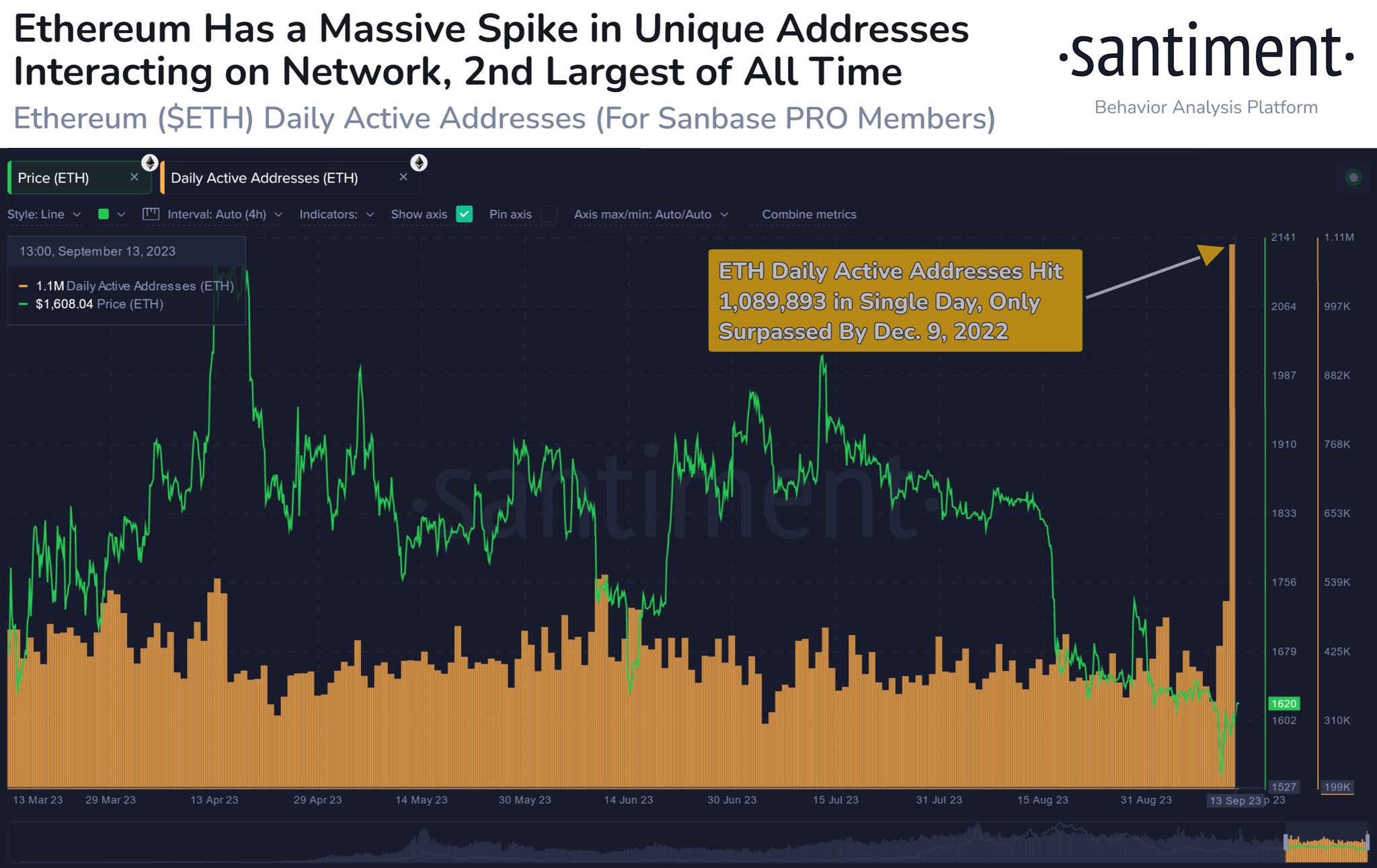

The latest report published by Santiment highlights the recent increase in the number of unique wallets on the Ethereum network. This data supports the expectation of price increase. Ethereum exchange flow data indicates that inflows are dominant, meaning that the selling trend of investors continues. In this case, although the increase in the number of wallets on the network is a strong signal for an upward movement, we may not see the results of this in the short term.

Despite the dominance of inflows in exchanges, the price of ETH has increased by about 5% in the last few days. The supply held by whales reached its peak in the past 24 hours. Although the increase in unique addresses for ETH may not be for price increase, it could be a sign of increased volatility in the short term.

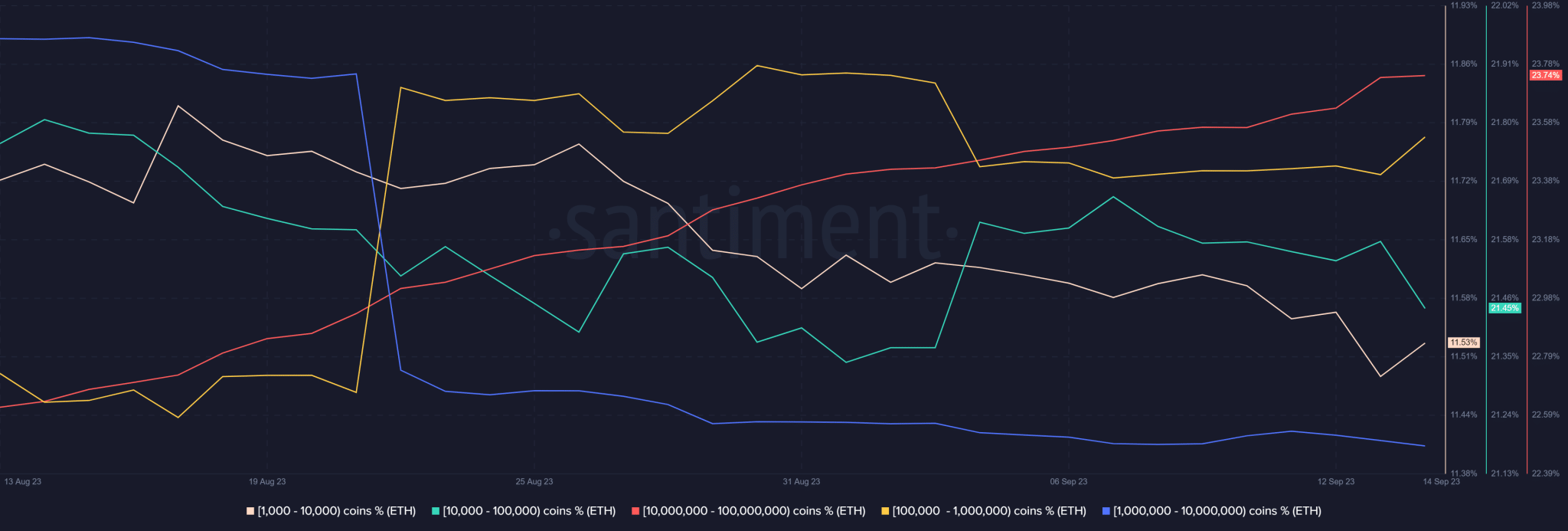

Despite the accumulation of whales, the overall sentiment of ETH indicates that the current rally is supported with low confidence. Some whales were still contributing to the selling pressure. This prevents ETH from achieving further potential gains. According to the supply distribution metric, addresses holding 10,000 to 100,000 ETH have decreased significantly. The same applies to addresses holding at least 1 million ETH. The remaining whale addresses continue to accumulate.

ETH Price Prediction

In our evaluations throughout August, we mentioned that the price was trading in a narrow channel and approaching a breakout. Although the support was violated several times in September, we saw that the clear breakout occurred 5 days ago. The price of ETH reached its local bottom at $1,532 on September 11. This was followed by a V-shaped recovery and at the time of writing the article, the price had returned to the channel.

In the future, it can be aimed to surpass the resistance zone at $1,695 with closings above $1,663. If the bulls can achieve this, a strong recovery up to $1,855 would not be surprising.

Despite the increase in network activity and many other positive news, negative sentiment in the crypto market continues to make things difficult for ETH. On the macro front, the Fed interest rate decision to be announced on Wednesday evening next week seems to shake the markets.

Türkçe

Türkçe Español

Español