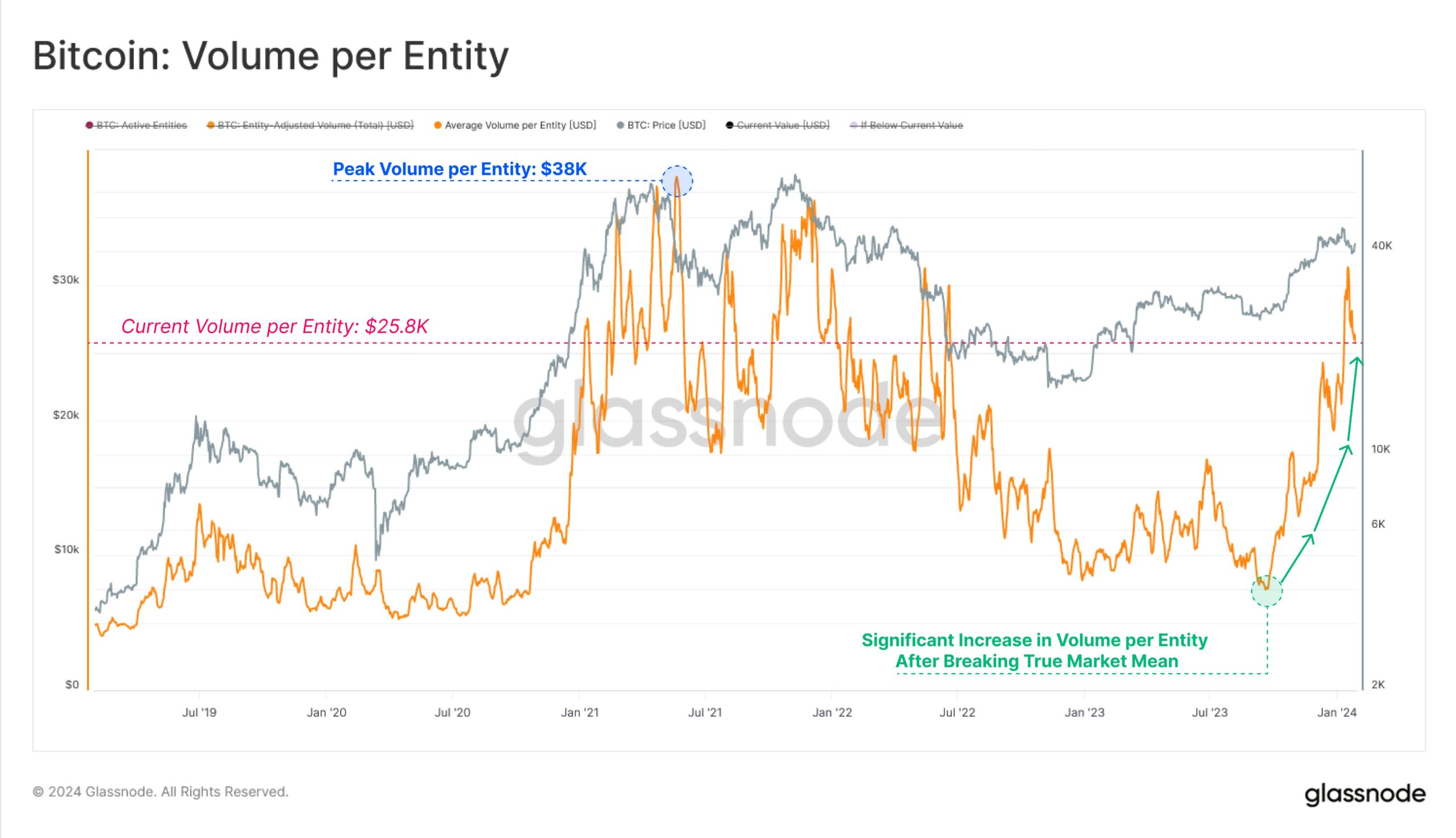

Glassnode’s latest data reveals an impressive daily economic volume of $7.7 billion in Bitcoin transfers. Despite this strong performance, a notable trend emerges with large institutions dominating the scene. Recent developments have increased the Average Volume Per Asset to a surprising $25,800 per transaction.

Rise in Bitcoin Transfer Volumes

In the world of cryptocurrency where every transaction matters, understanding the nuances of Bitcoin transfer volumes has become very important. Glassnode, a leading analytics platform, sheds light on emerging trends shaping the crypto world, providing invaluable insights into market dynamics.

The current stage shows a daily processed economic volume of $7.7 billion. This significant figure underscores the ongoing strength and importance of Bitcoin in financial markets. As Bitcoin continues to gain widespread acceptance, transfer volumes reflecting increased adoption and trust among users are also rising.

Dominance of Large Entities Becomes Apparent

Beneath this impressive volume, a nuanced trend emerges: the prevalence of large-sized assets. Glassnode’s data highlights a significant presence of entities conducting Bitcoin transactions on a notable scale. What sets them apart is the impressive figure of $25,800 in Average Volume Per Asset per transaction.

The dominance of large institutions adds a layer of complexity to market dynamics. Understanding the behaviors and motivations of these players is becoming very important for both investors and enthusiasts. Are these large institutions accumulating or distributing? What strategies are in play? Glassnode’s insights offer a roadmap to answer these questions, enabling a better understanding of market sentiment.

Navigating the Landscape: Implications for Investors

For investors navigating the constantly changing crypto environment, the emergence of large institutions dominating Bitcoin transfer volumes has significant implications. The increase in Average Volume Per Asset indicates a differentiation in the nature of transactions and potentially points to strategic moves by institutional players.

Glassnode’s data not only presents a snapshot of the current scenario but also lays the groundwork for analyzing future trends. Investors can use this information to make informed decisions, understand the pulse of the market, and strategically position themselves.

In conclusion, Glassnode’s announcement that Bitcoin transfer volumes have reached $7.7 billion per day reveals a dynamic crypto environment. The dominance of large institutions adds an intriguing layer to the narrative, encouraging investors and enthusiasts to delve deeper into market dynamics.

Türkçe

Türkçe Español

Español