Since March 20, days have been turning into a nightmare for cryptocurrency investors. As of today, things might be starting to turn around. The hopeful sign was the latest inflation data. The poorly reported figures in the first three months now indicate progress towards the 2% target, albeit delayed. Moreover, the likelihood of interest rate cuts starting in September has increased.

Cryptocurrencies Are Rising

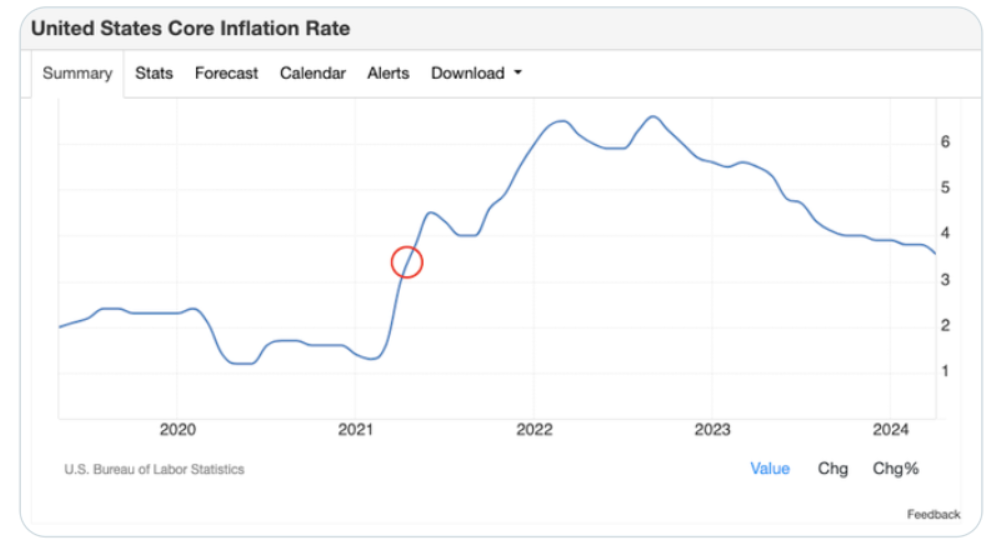

The monthly CPI for April came in at 0.3%, below the expected 0.1%, while annual headline and core inflation met expectations. The annual decline is noticeable, and core inflation has hit its lowest level since 2021. Of course, not everyone is happy; The Kobeissi Letter commented on the latest market developments:

“This marks the first decline in the last three months. However, yesterday’s PPI data showed an increase for the third consecutive month. The Fed will remain in a wait-and-see mode.”

Data from CME Group’s FedWatch tool is not that great. Investors who expected a 150bp cut at the beginning of the year and thought the first cut would be in March have pushed this expectation back significantly. The probability of rate cuts in June is only 3.1%, and 28.3% in July.

Will Bitcoin and Cryptocurrencies Increase?

We previously mentioned that closures above $65,000 are critical for further technical increases. Following today’s inflation data, the price is hovering around the $66,000 mark, having recently reached $65,986. The outlook in the exchange order books also changed after the data. According to data from CoinGlass, buyer liquidity is concentrated above $65,000.

Cryptocurrency analyst Skew expects the rise to continue towards $70,000 and $73,777 if the $65,000 level is maintained. However, not all obstacles have been removed. The SEC will announce its final decision on spot ETH ETF applications on May 23 and 24 or earlier.

If the SEC announces a decision against it, a normal decline in ETH and altcoins will occur, but if it rejects all applications, including BlackRock’s, it could trigger larger losses. Considering how it frustrated investors even during the BTC ETF process, we can say that the likelihood of approval after the latest lawsuits is very low.