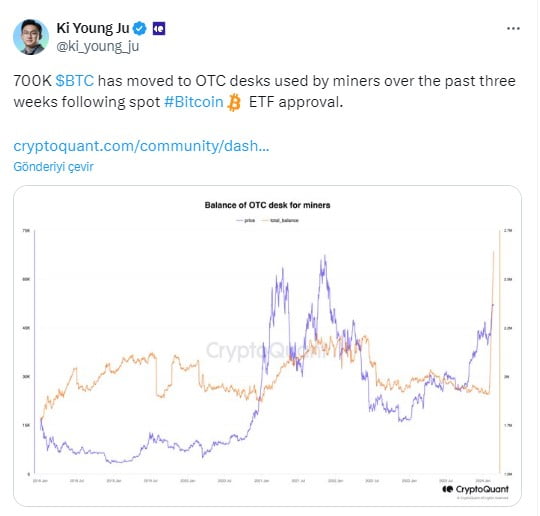

Cryptoquant’s founder and CEO, Ki Young Ju, 35, revealed significant data showing a massive transfer of 700,000 Bitcoins (BTC) worth $35.9 billion. These funds were moved by cryptocurrency miners to over-the-counter (OTC) traders in the three weeks following the recent approval of a Bitcoin Exchange-Traded Fund (ETF). So, what’s the current situation with Bitcoin?

Bitcoin Miners and Market Impact

While trading activity continues to rise, another notable development is the increase in Bitcoin block size.

According to a recently published cryptocurrency report, there has been a significant increase of 40-50% in Bitcoin network block size, which is associated with the increased network activities caused by Bitcoin’s recent price surge.

Normally, an increase in block size leads to higher transaction fees. However, despite the rise in block size, there has been no significant change in fees. This suggests that a substantial part of the increase is related to large-volume BTC trading transactions.

There has also been an increase in the difficulty level of Bitcoin mining, which has risen to 81.73T. Additionally, the network hashrate has approximately doubled over the last 12 months, from 303 EH/s to an average of 577 EH/s.

The increase in mining difficulty, combined with the rise in block size and BTC price, is creating pressure on miners to sell their Bitcoins to maintain their assets and profitability.

On the other hand, the approval of spot Bitcoin ETFs and the resulting increase in institutional interest could allow miners to position themselves differently. Miners could use their significant Bitcoin holdings to facilitate large-scale OTC transactions, providing liquidity and market access to institutional investors.

While providing this environment, miners can benefit from profitable transaction fees and potentially favorable price movements. The emerging trend could clarify the large OTC Bitcoin volume as indicated in the chart shared by Young Ju (above).

Outlook on Bitcoin

Despite concerns about the selling pressure created by miners and its potential impact on BTC price, inflows into spot Bitcoin ETFs continue. The most recent net inflow amount has been reported to be a total of $631 million.

Experts believe that due to the ongoing demand for Bitcoin ETFs, the BTC price rally is expected to continue. As of writing, the market value is still over $1 trillion, with Bitcoin trading at $51,592 after a 0.48% decrease in the last 24 hours. The 24-hour trading volume also decreased by 9%, amounting to $26 billion.

Türkçe

Türkçe Español

Español