The pulse of the digital economy is strongly felt in the cryptocurrency market, where recent growth and changes are strikingly evident in the 2024 RWA-Real World Asset Report. In particular, the report sheds light on the increasing role of US dollar-pegged stablecoins in the adoption of crypto assets.

Notable Findings in the Report

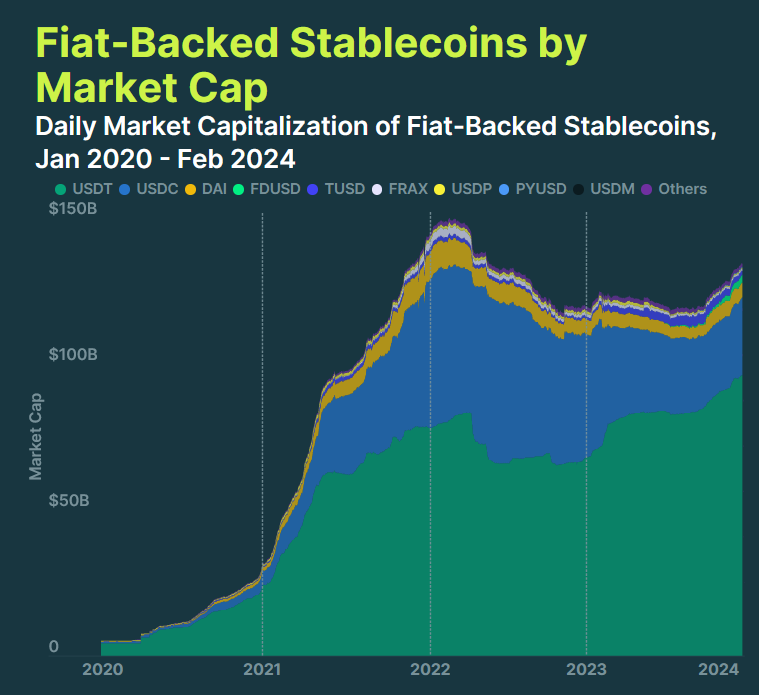

Among the standout findings of this report is the dominance of US dollar-pegged stablecoins in the cryptocurrency market. With an enormous market value of $103.9 billion, Tether (USDT) sits at the top of the list, followed by USDC with a market value of $26.8 billion and Dai with $4.9 billion.

Tether’s market share of 71.4% maintains its leading position, which can be seen as an indicator of the dollar’s dominance in the industry. However, we observe that USDC is still striving to recover from a brief de-pegging event during the US banking crisis in March 2023.

Is There a US Dollar Hegemony?

The report also reveals that stablecoins pegged to currencies other than the USD still hold a very small share in the crypto market. This situation indicates that the dominance of the US dollar in the crypto ecosystem remains strong.

The dollar-focused structure of the crypto market reflects the global financial system’s dollar dominance, but it also presents an opportunity for increased diversity and competition in the sector.

A Closer Look at the Stablecoin Market

Digging deeper into the landscape, we encounter a reality of minimal diversification beyond US dollar-pegged stablecoins. Alternative fiat-backed stablecoins such as Euro Tether (EURT), CNH Tether (CNHT), Mexican Peso Tether (MXNT), EURC (EURC), Stasis Euro (EURS), and BiLira (TRYB) collectively make up only 1% of the market share.

The latest report sheds light on the total value trajectory of the stable asset market over the years. The stablecoin market reached an unexpected peak of $150.1 billion in March 2024 from a modest level of $5.2 billion at the beginning of 2020, but then fell to $149 billion amid market fluctuations at the time of writing.

It seems that there is still room for diversification and expansion of market shares among stablecoins, but the dominance of those pegged to the USD appears to continue.