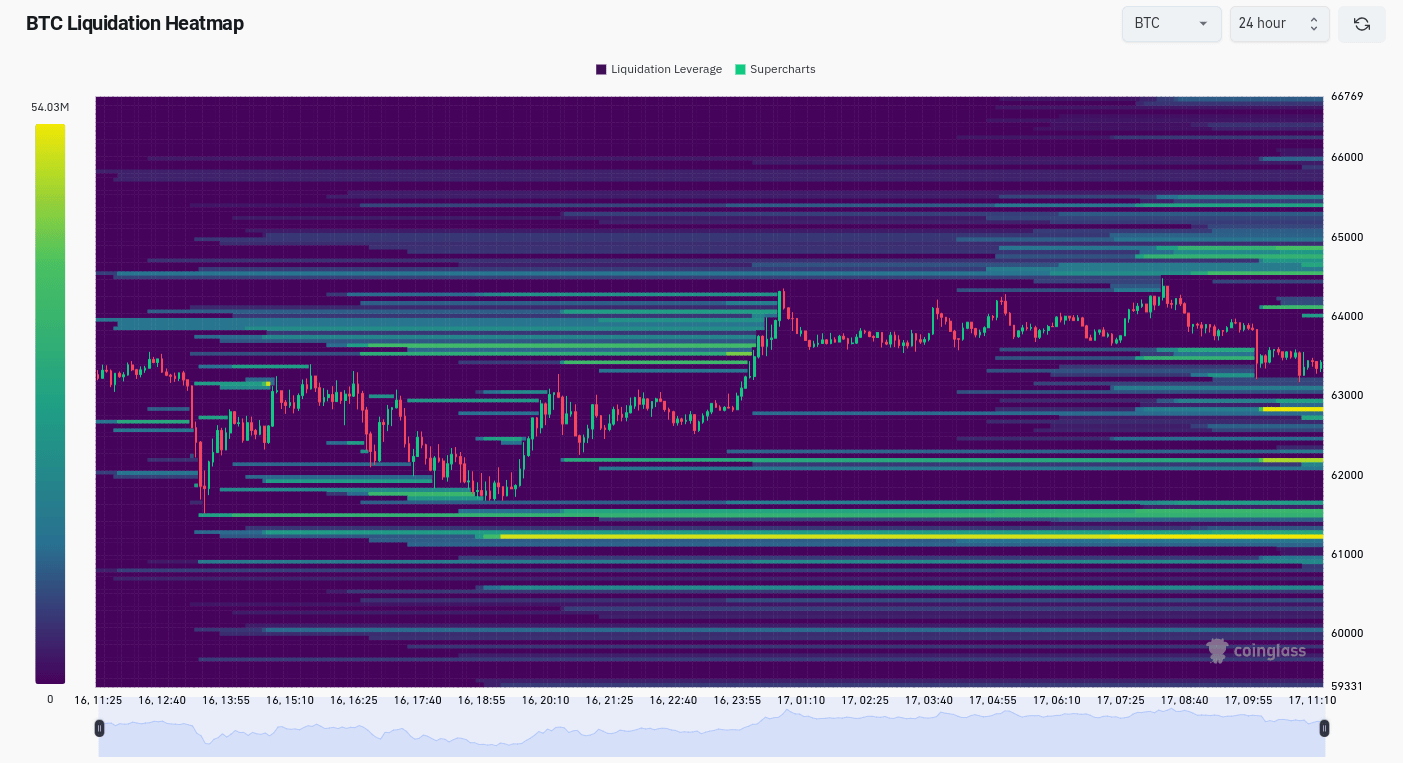

Bitcoin investors are calling for a price increase as new battles for liquidity favor bulls. Data from Blockchain data monitoring source CoinGlass shows that bid liquidity approached the active trading range above $60,000 on April 17th. What’s happening on the Bitcoin front? We explore with notable data.

What’s Happening on the Bitcoin Front?

This week, Bitcoin saw significant long position liquidations in the futures market, instantly evaporating millions of dollars. However, bulls have yet to restore balance, and the BTC/USD pair remains stuck around $63,000, continuing to threaten a new breakout. The latest order book data shows that bids are currently being met just below the spot price; this is a common practice aimed at pulling the market lower.

As Keith Alan, co-founder of trading source Material Indicators, explained, this situation ultimately provides relief for a market in need of an upward surge. In a video analysis uploaded on April 16th, he argued that seeing more bid liquidity is what we ultimately want to see before making a move that might have a better chance of breaking through without encountering general resistance:

“This is what we ultimately want to see before making a move that could have a better chance of breaking through, and it’s something more similar to what we’ve historically seen.”

According to CoinGlass data, as of the time of writing, the largest bid concentrations in the last 24 hours were found at $61,200, $62,200, and $62,800.

Investor Psychology and Bitcoin

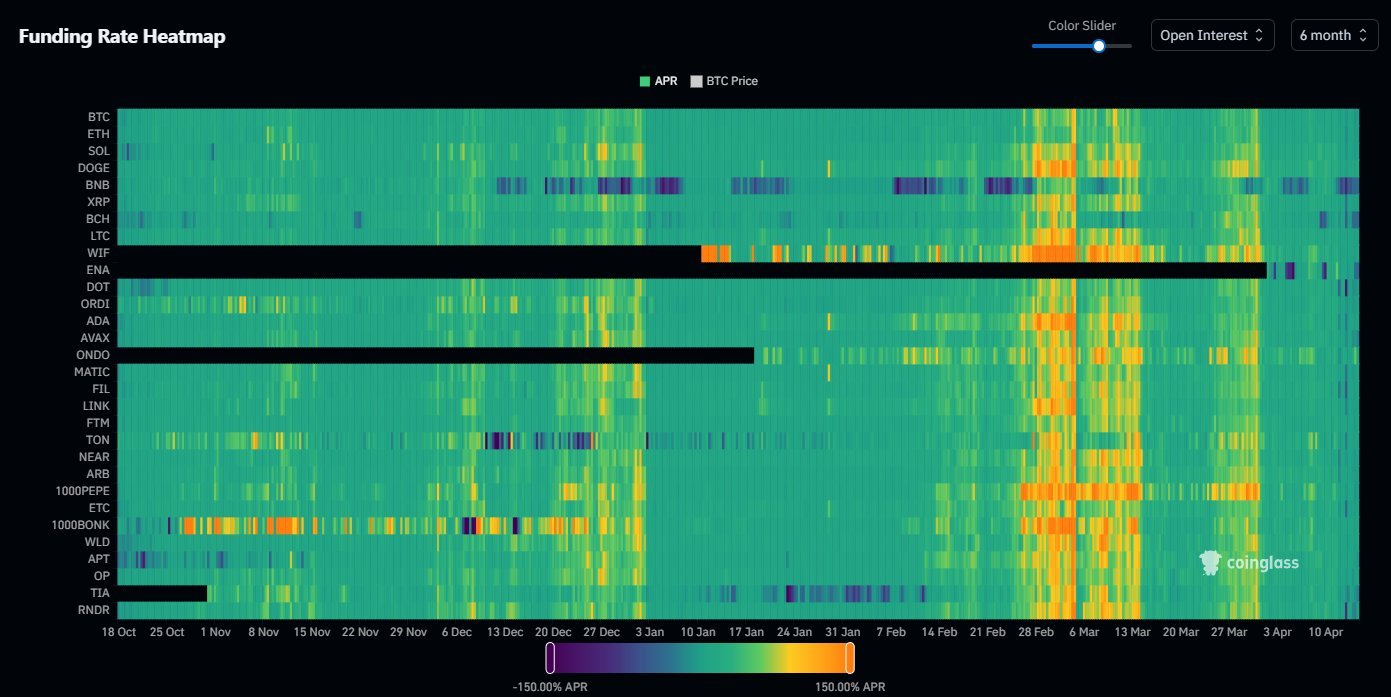

Meanwhile, investor sentiment is reflecting negative funding rates for the first time since October 2023. In recent weeks, especially around the all-time high levels of March, a significant shift occurred, causing funds to revert to a downtrend where short positions pay more than long positions. Popular investor Daan Crypto Trades shared in an X post:

“When you look at the funding rate heat map of the last six months, you can see how much hotter March was compared to others. It’s normal when prices trade near all-time high levels, but it also occasionally causes leverage volatility.”

DecenTrader, noted that despite the short-lived period of negative funding, it indicates an overall cooling atmosphere in the market. DecenTrader shared in an X post:

“Funding rates have returned to positive, but this was a sign that the excitement in the futures space had calmed down.”

Türkçe

Türkçe Español

Español