Last month, a statement was released by 10x Research, an institutional crypto research company founded by Markus Thielen, who was previously involved in a major sensation with Matrixport. The statement provided investors with clues about the end of the month for Bitcoin (BTC) and crypto prior to the US FOMC meeting and Federal Reserve Chairman Jerome Powell’s FOMC announcement.

Markus Thielen’s Crypto Recommendations

Analyst Markus Thielen, who made price predictions about Bitcoin and foresaw a drop to $38,000, warned asset managers and other medium and long-term crypto investors to reshape their portfolios in the coming month.

Aiming for a balanced portfolio, Thielen limited each cryptocurrency to 20%. In this diversification, it appears he has created a basket consisting of Bitcoin 20%, Ethereum 20%, BNB 9.3%, Solana 9.2%, XRP 7.9%, Cardano 7.2%, Avalanche 6.8%, Tron 6.6%, Chainlink 6.5%, and Polkadot 6.5%.

This portfolio, consisting of 10 different cryptocurrencies, had provided returns parallel to the gains demonstrated by Bitcoin over the last 12 months. Bitcoin had risen over 150% during this period, renewing the hopes of its investors.

In the last 24 hours, Bitcoin accounted for 41% of the trading volumes in cryptocurrencies, while Ethereum dominated 18%. On the other hand, Bitcoin’s dominance was at 52.75%. With Bitcoin dominating more than 50% of the market, it may be too early to discuss a potential rally in altcoins.

While all this information was being shared, Bitcoin and Ethereum had only shown increases of 1% and 2%, respectively. On the other hand, TIA rose by 58%, BLUR by 35%, ASTR by 31%, and SEI by 24%, positioning themselves as the leaders of the year so far, while APT fell by 36%, LUNC by 30%, ALGO by 27%, and BSV by 27%.

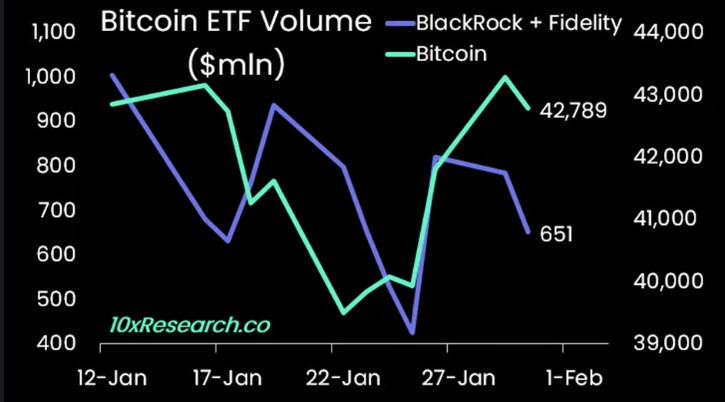

The report also drew attention to ETFs, with BlackRock and Fidelity ETFs experiencing the most significant inflows.

Despite this, both of the mentioned ETFs only had a daily trading volume of $651 million against Bitcoin’s total trading volume of $23 billion, which surprised market traders. Many continue to blame the corrections from $44,000 to $38,500 on Grayscale’s GBTC outflows.

Bitcoin Price Prediction After FOMC

According to Markus Thielen, the fifth wave is starting for Bitcoin, which could indicate an upcoming Bitcoin (BTC) price rally. The analyst suggests that the BTC price could reach $50,000 by the end of this quarter.

However, Thielen also mentioned that before reaching the $50,000 level, BTC’s price could continue to consolidate for a few days. Despite resistance found between $43,000 and $44,000, Thielen indicated that Bitcoin purchases could be made above $43,000.

On the other hand, well-known figure Michael van de Poppe pointed to a trend that could form between $38,000 and $48,000. According to Poppe, a short-term correction could be followed by a price movement towards $48,000 before the Bitcoin halving.

As of the time of writing, the price of Bitcoin was trading at $43,538, up 1.31%. Having recovered $1,000 from its intraday low of $42,500, Bitcoin might still be experiencing pre-FOMC jitters. The positions investors take following the announcement at 22:30 could become clearer.