Bitcoin price continues its movement within the range it has been stuck in. The price has tested the bottom and top of this narrow range in the last 24 hours. Failing to sustainably breach $71,500 led to a drop to $68,000. So, what does the current outlook for DOGE indicate? Has DOGE’s price rise come to an end?

Dogecoin (DOGE)

DOGE price recently rose from $0.12 to $0.23. At the time of writing, the price had retreated to the $0.20 support area. BTC fell below $69,000, leading to daily losses nearing 7.5%. Now, let’s examine the current situation on the Dogecoin front by looking at different metrics.

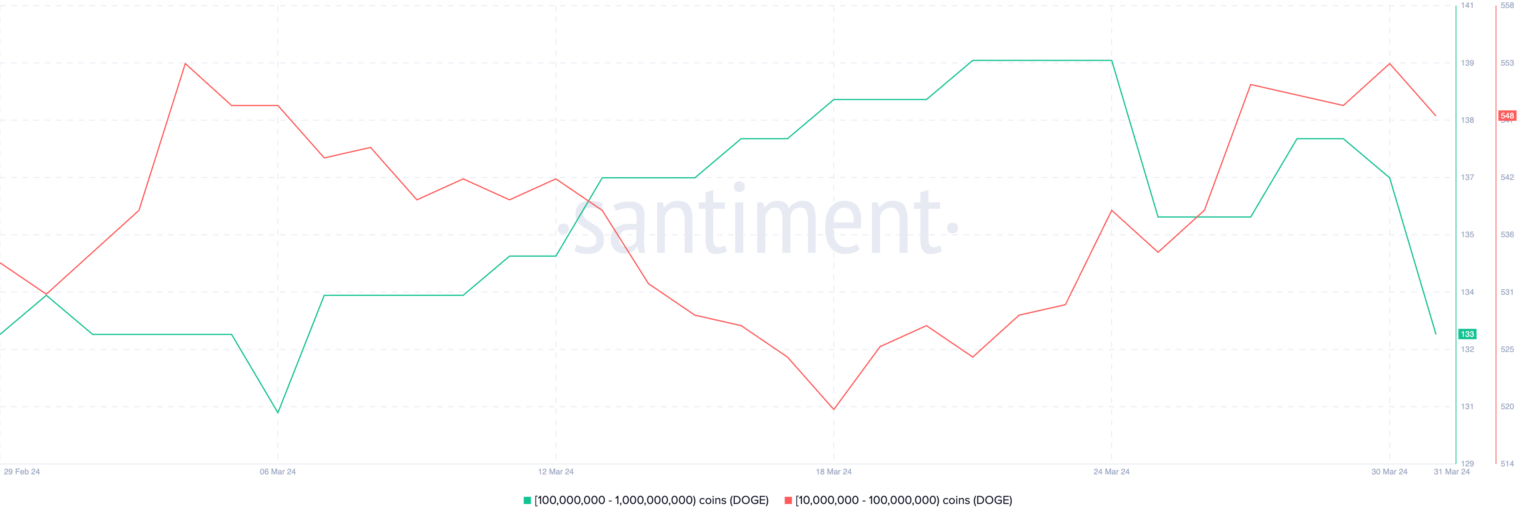

Dogecoin Whales

Whales holding between 10 million and 100 million DOGE have started to decrease their assets. The number of whales increased from 520 to 553 between March 18 and March 30, but within just one day, it fell from 553 to 548. Those holding between 100 million and 1 billion DOGE also decreased from 137 to 133. This largest group of whales had peaked at 140 on March 24.

The notable decline in whales indicates the strength of profit-taking. As the price reached a satisfactory level, whales believed a local peak was set and began selling. The supply on exchanges also contributed to the price decline.

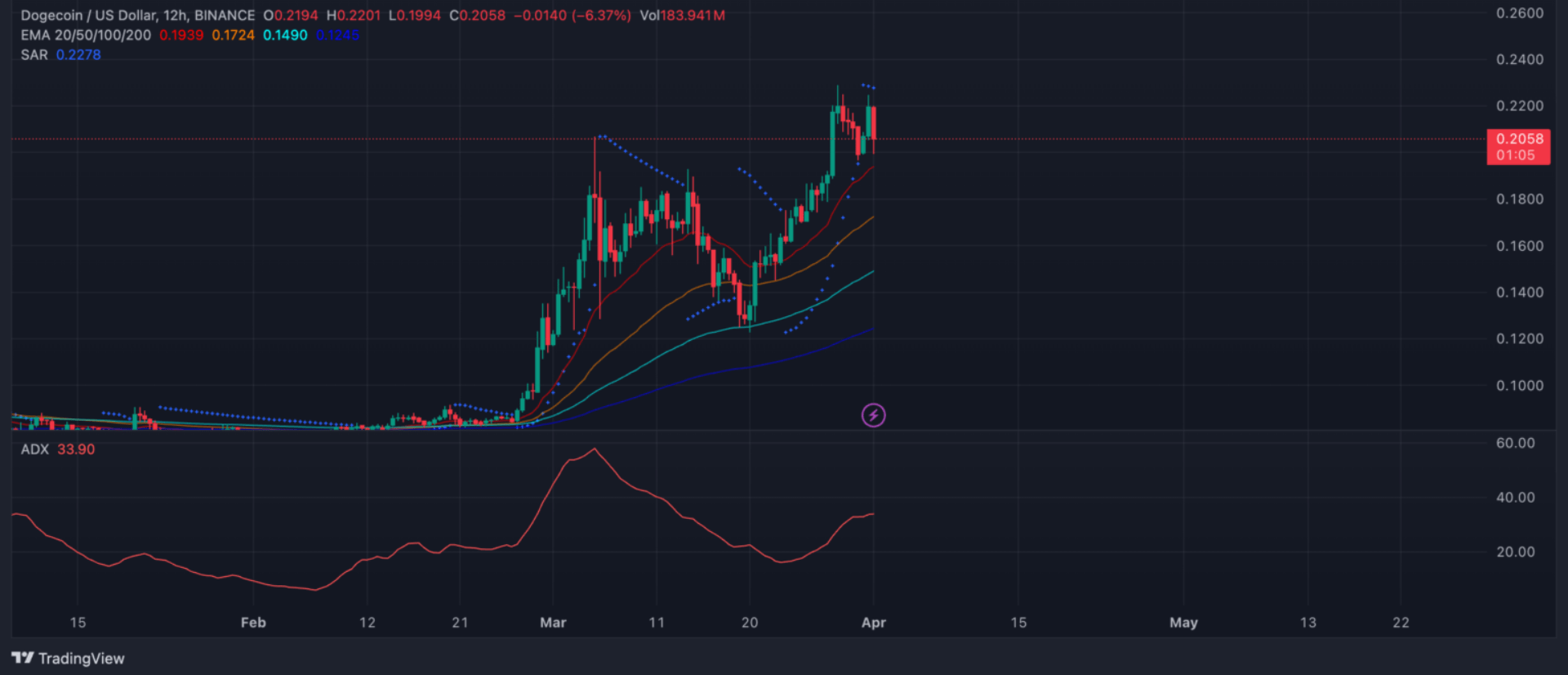

ADX and SAR Metrics

On the four-hour chart, metrics like ADX and SAR suggest that the rise may have come to an end. After indicating an uptrend for a week with price candles positioned below the SAR indicator, it now signals weakness.

The ADX value of 33.9 also implies that the credibility of the uptrend is weakening. Combined with whale trends, it can be said that DOGE may not continue its move towards $0.30 in the near term.

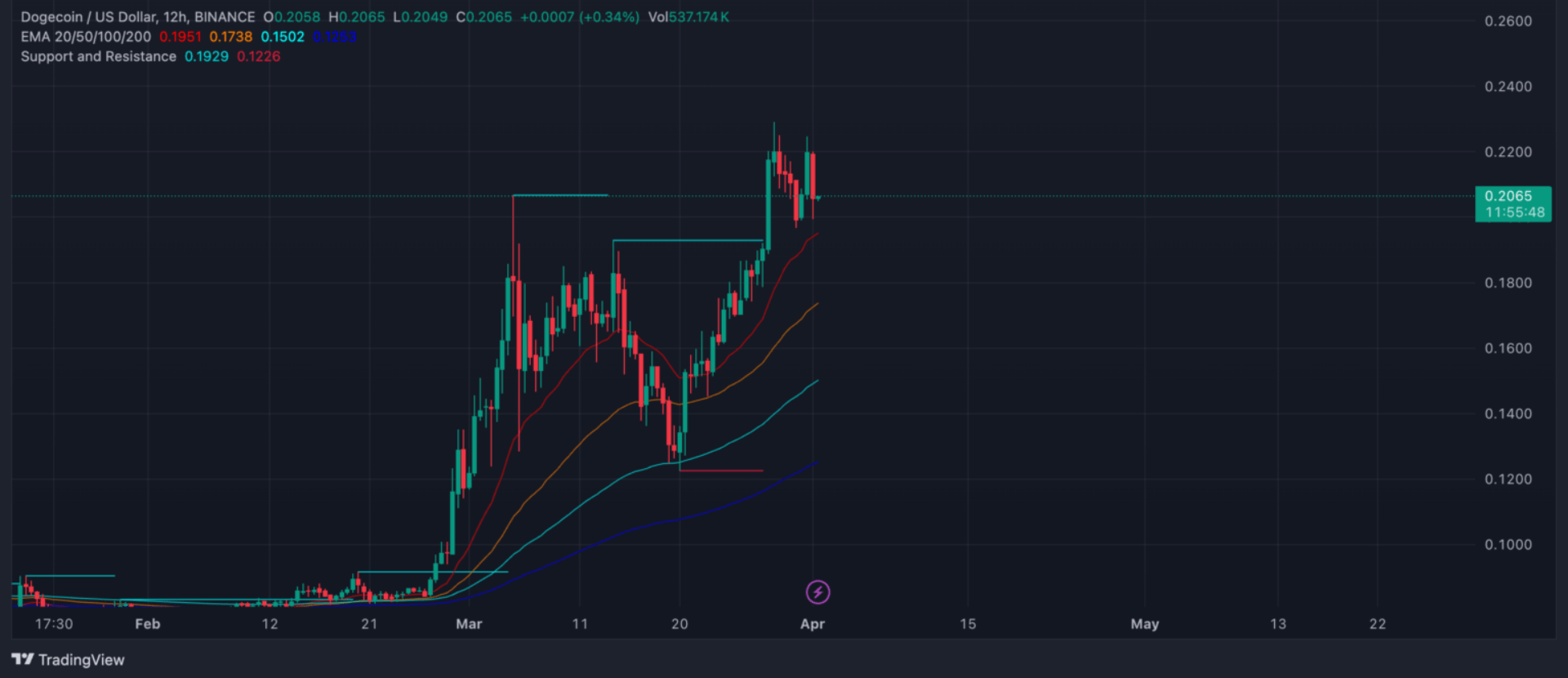

DOGE Price Prediction

Since EMAs remain above long-term averages, we are not yet seeing strong signals of a downturn from the technical analysis perspective. However, other indicators suggest that the price may be entering or about to enter a consolidation phase.

Accordingly, DOGE investors may see the price moving between $0.17 and $0.20 in the coming days. If selling accelerates, DOGE could face the risk of falling to $0.12. Conversely, in the scenario of closing above $0.23, $0.29 could be tested.

Türkçe

Türkçe Español

Español