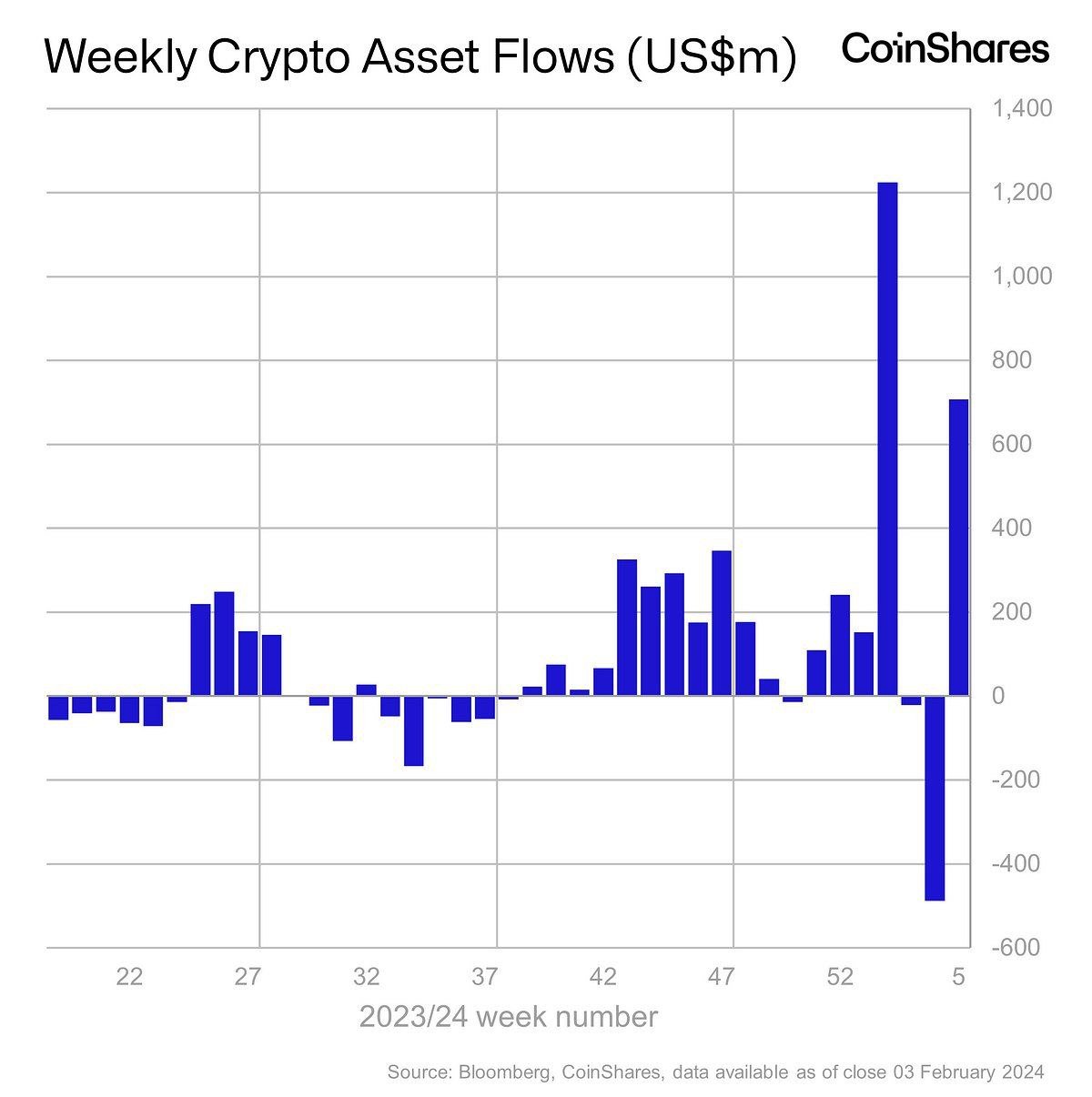

The current pivotal issue for cryptocurrency markets is the extent of institutional demand, as it will influence medium-term performance. Following the approvals of spot Bitcoin ETFs, there has been a noticeable influx of capital. But what about the demand for crypto ETPs? Which altcoins continue to garner institutional interest? As with every Monday, today we try to discern the latest outlook from the CoinShares report.

Cryptocurrency Institutional Demand

Crypto investment products experienced an inflow of $708 million last week. Since the beginning of 2024, the total inflows have exceeded $1.6 billion, indicating that the market has moved beyond the gloomy atmosphere of the bear market. The cumulative size of assets under management in crypto funds has reached the threshold of $53 billion. This is an extremely impressive figure that clearly demonstrates the potential.

Transaction volumes dropped slightly last week. The weekly volume of $10.6 billion was measured at $8.2 billion last week, but this is not an irrecoverable loss. Especially considering the weak average volumes of $1.5 billion in 2023, we can even say that it is quite satisfactory.

The largest regional inflow was in the United States, where spot Bitcoin ETFs were launched. The inflow of $703 million represented 99% of the total funds flowing into all crypto funds. Contrary to the negative price outlook, there was an outflow of $5.3 million from BTC short-selling funds.

Solana signaled its comeback with an inflow of $13 million. Ethereum and Avalanche, on the other hand, experienced outflows of $6.4 million and $1.3 million, respectively, last week.

Türkçe

Türkçe Español

Español