The crypto market continues to experience notable developments. Investment firm Kerrisdale Capital argues that after the approval of several spot Bitcoin exchange-traded funds this year, there may be little reason for investors to buy and sell MicroStrategy shares with the purpose of investing in Bitcoin. MicroStrategy’s Chairman of the Board, Michael Saylor, disagrees.

Report on MicroStrategy Attracts Attention

Kerrisdale Capital stated in an analyst note dated March 28 that the days when MicroStrategy shares represented a rare and unique way to access Bitcoin are long gone, adding that they believe the MSTR price is overvalued. The firm also disclosed that it holds short positions in MicroStrategy shares and made the following statement:

“We have a long Bitcoin position and a short MicroStrategy position, which trades at an unfair premium relative to the crypto asset that determines its value.”

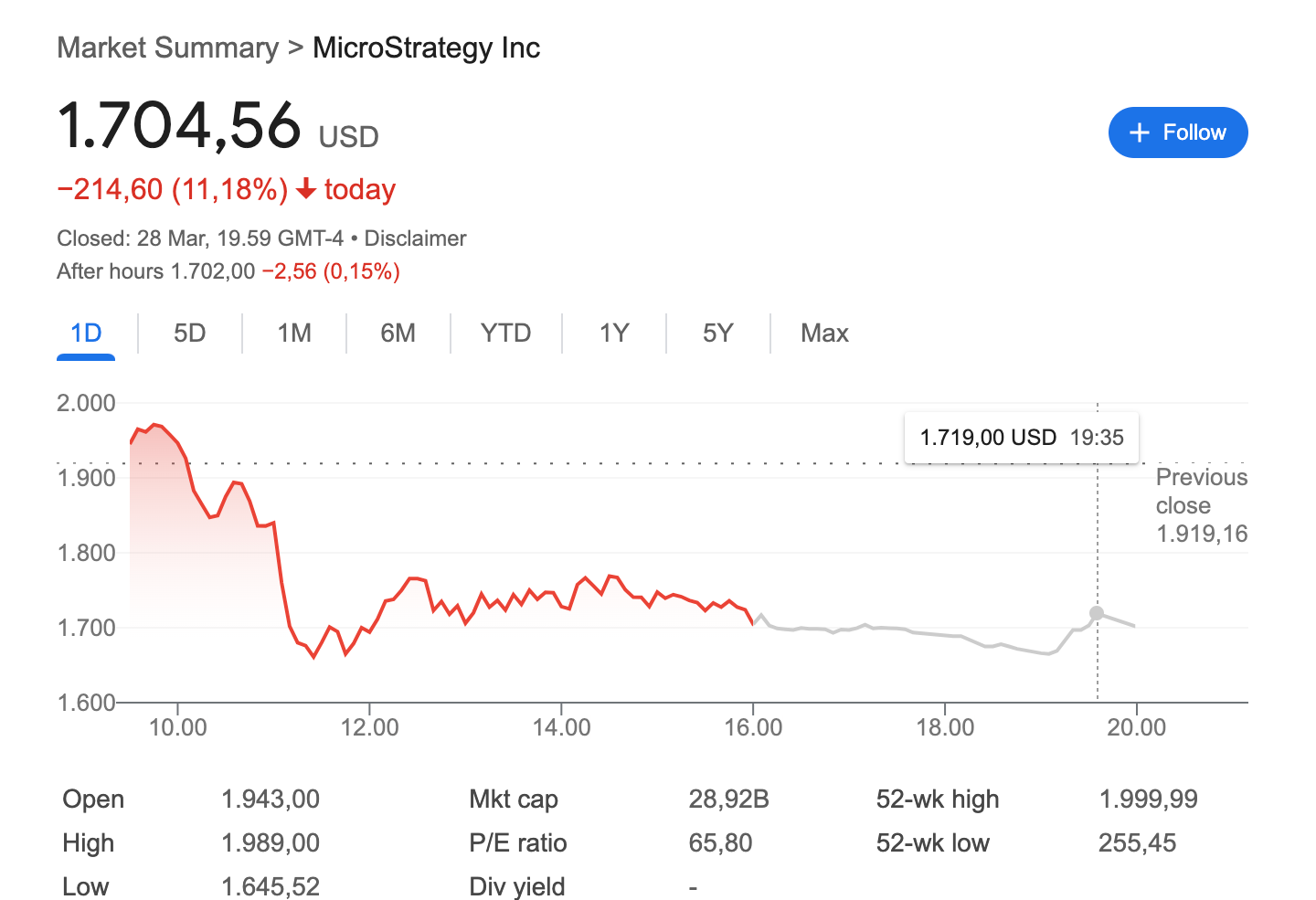

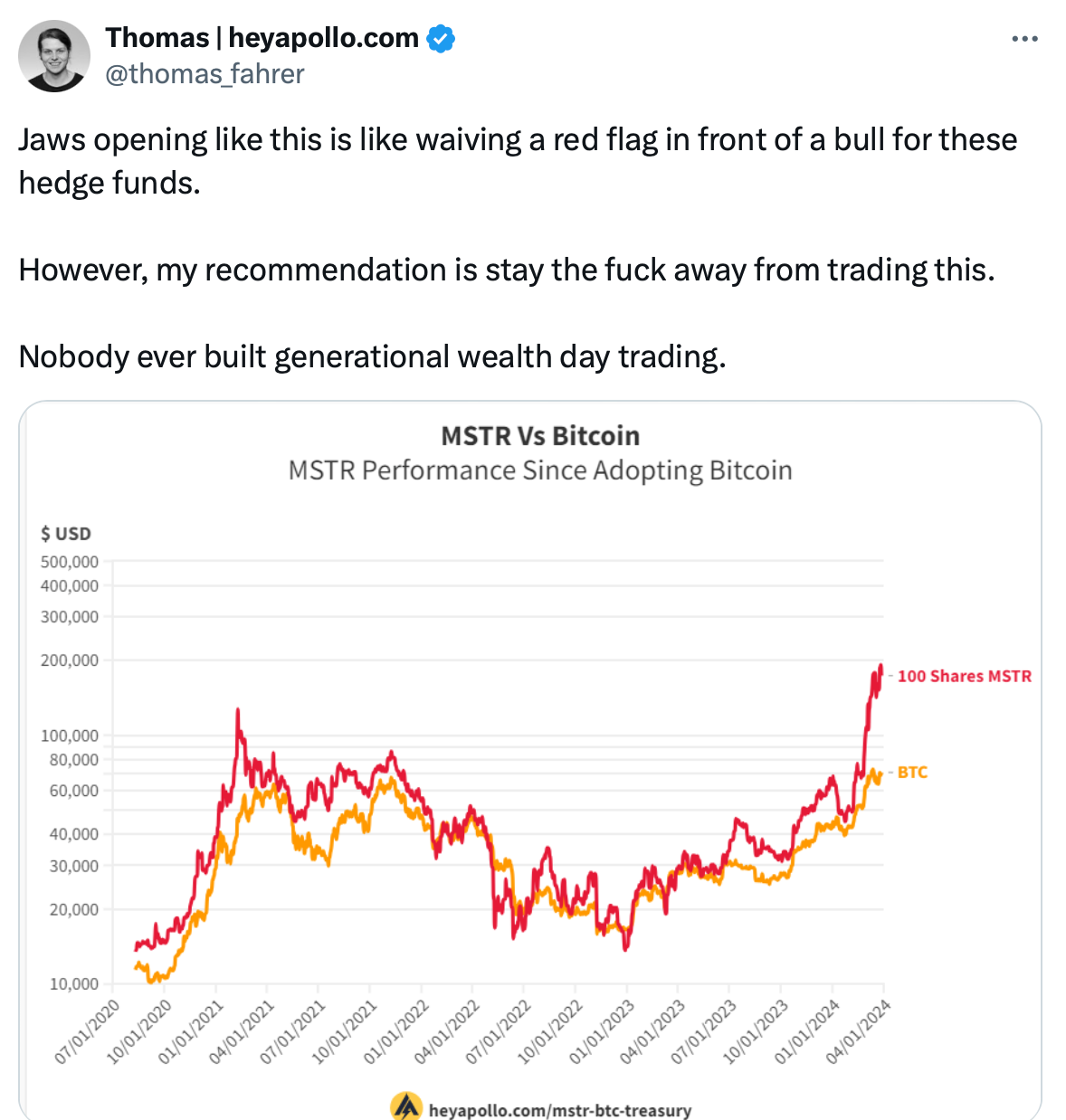

MSTR is currently trading at $1,704. It recorded a growth of 66.65% last month and approximately a 419% increase over the past six months. On the other hand, Bitcoin’s price is currently at $70,849. With a one-month increase of 15.8%, Bitcoin has risen by 163.31% over the last six months:

“MicroStrategy’s shares surged amidst the recent rise in Bitcoin prices, but as often happens in crypto, things got out of hand.”

The report also highlighted MicroStrategy’s increasing debt-to-asset ratio and the limited cash flow from its dormant software analytics business in 2023, which only amounted to $10 million. This figure constituted only 3% of the company’s total enterprise value.

Saylor Comments on Bitcoin

In an interview with Bloomberg TV in December, Saylor stated that his company would continue to offer a high-performance tool for individuals who have been investing in Bitcoin for a long time. Saylor shared the following in his statement to Bloomberg:

“ETF funds are unleveraged and charge a fee. We provide you with leverage and do not charge a fee.”

Saylor also recently announced that MicroStrategy is rebranding as a Bitcoin development company. In an interview with CNBC on February 12, Saylor shared his thoughts on the matter:

“Considering the success of our Bitcoin strategy and our unique status as the world’s largest public company holder, this was a natural decision for us.”

According to data from Bitcoin Treasuries, MicroStrategy holds 214,246 Bitcoins. This number represents an increase of approximately 54% compared to the 138,955 Bitcoins it held at the same time last year. Saylor added that MicroStrategy has more flexibility in managing its capital and operations as a business company than an investment partnership would have:

“We will develop software, generate cash flow, take advantage of capital markets, all for the benefit of our shareholders to accumulate more Bitcoin and also to promote the growth of the Bitcoin network.”

Türkçe

Türkçe Español

Español