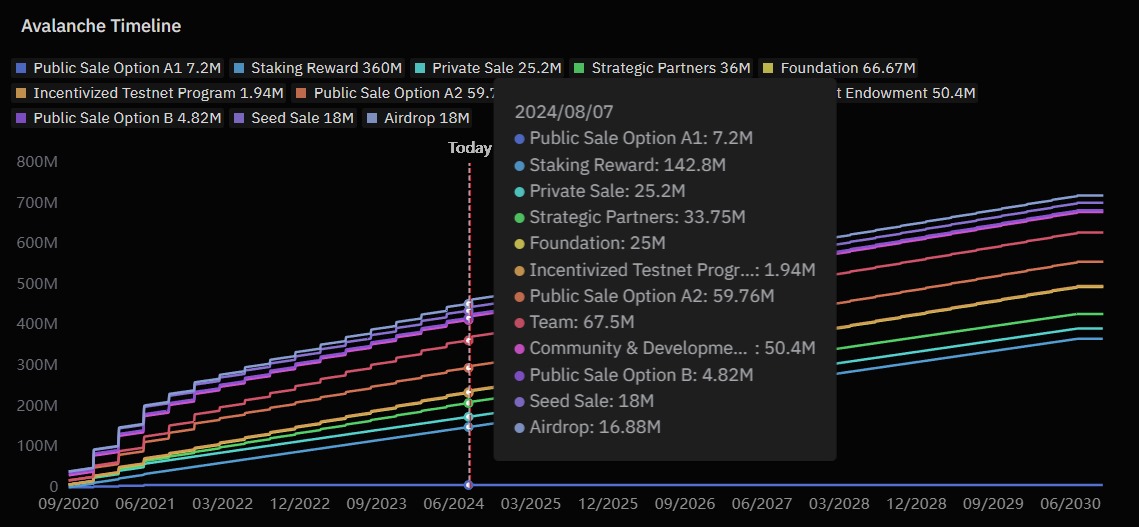

Cryptocurrency enthusiasts are buzzing about the upcoming major token unlock event on the Avalanche (AVAX) network. Scheduled for August 20, this event will release $240 million worth of new AVAX tokens into the market. Investors and analysts are eagerly speculating on how the AVAX price will react.

22% Drop Risk for AVAX

The Avalanche team and strategic investors will hold a total of 7.75 million AVAX tokens. When these tokens are released, they could trigger a wave of sales, potentially causing a 22% drop in AVAX price. Such token unlock events typically increase the circulating supply, negatively impacting the price.

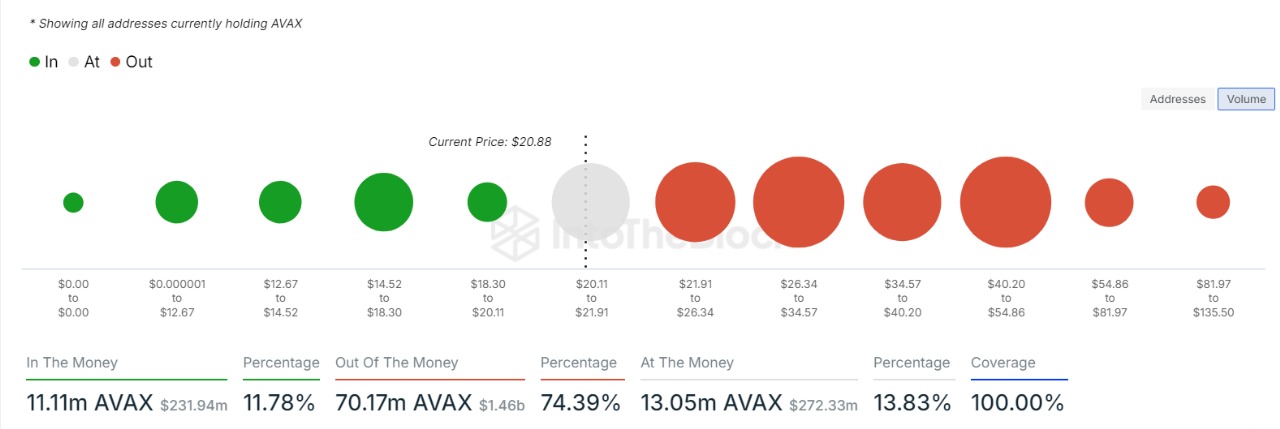

According to IntoTheBlock data, 74.39% of AVAX holders are currently at a loss, with only 11.78% in profit and 13.83% breaking even. If the price falls below $15, a total of $143 million worth of AVAX tokens could move into the loss zone.

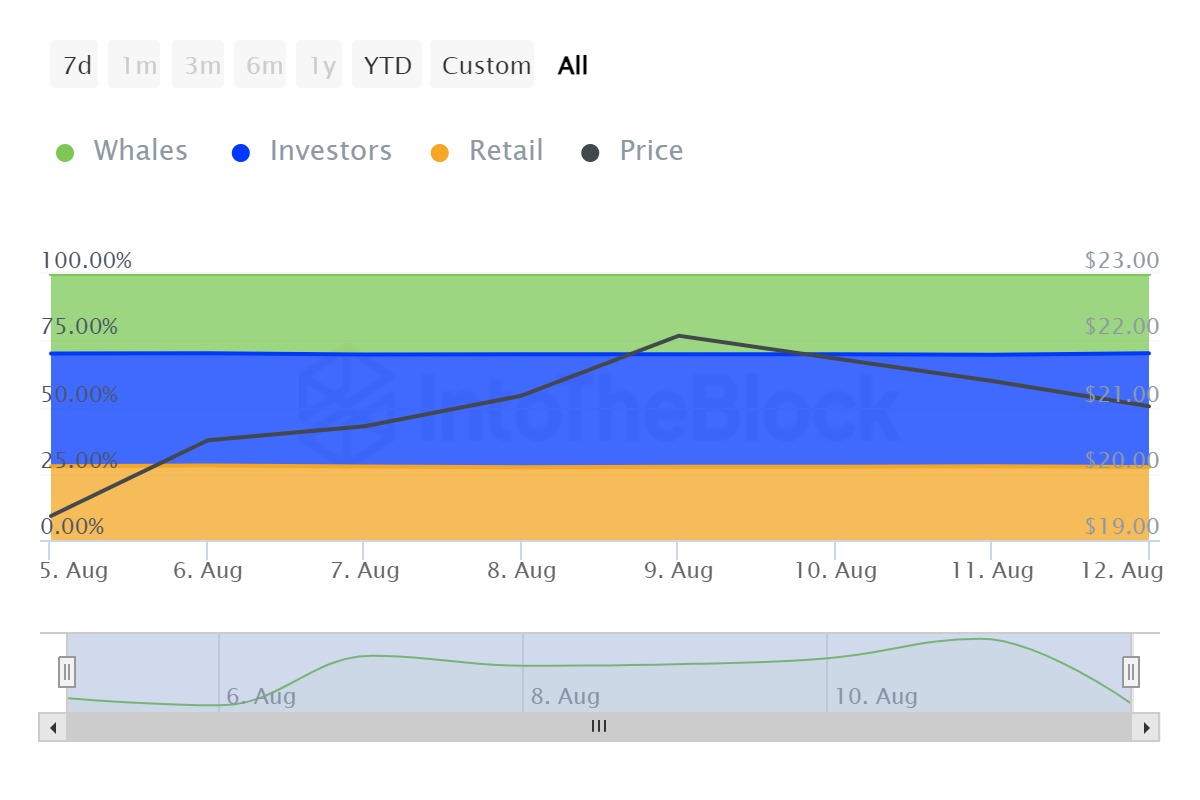

Whale Activity Could Impact Price

Despite the major unlock event, whale activity around AVAX has notably increased. Large transactions reached $131.91 million, but whale accumulation of AVAX dropped from 30.37% to 29.83%. This indicates significant sales by large investors. However, in the past week, large investor purchases increased by 75.5%, while exits remained at 30.65%. This net positive flow suggests that smart money is betting on a price increase post-token unlock.

On the technical analysis front, AVAX price is in a downtrend. The price is below the 50-day exponential moving average (EMA) of $25.86 and the 200-day EMA of $31.06, reinforcing the bearish trend. Resistance levels include $25.86 and $31.06.

On the other hand, AVAX price is currently testing the support level at $20.67. If it falls below this level, the next significant support levels are $15.63 and $9.47. The price is approaching the peak of a falling wedge formation. If confirmed by an upward breakout, a potential bullish reversal could occur. However, this confirmation has not yet happened.

AVAX price prediction suggests that if a breakout above the falling wedge formation and the 200-day EMA occurs, the current bearish thesis could be invalidated. If the bullish momentum continues, the price could reach $43.07 in the short term and approximately $60.14 in the long term.

Türkçe

Türkçe Español

Español