Celestia’s (TIA) recent price surge has made it one of the best-performing assets this week and in the last 24 hours. However, instead of instilling confidence and optimism, this rally has inspired investors to take a different and downward path to reduce profits. Here are the notable data points and key levels in the TIA price analysis.

What’s Happening with Celestia?

As the altcoin recovered most of its recent losses, Celestia’s price showed a good rise this week. However, during this time, TIA holders were inspired to heavily short the altcoin. The same trend is evident in open interest and funding rates.

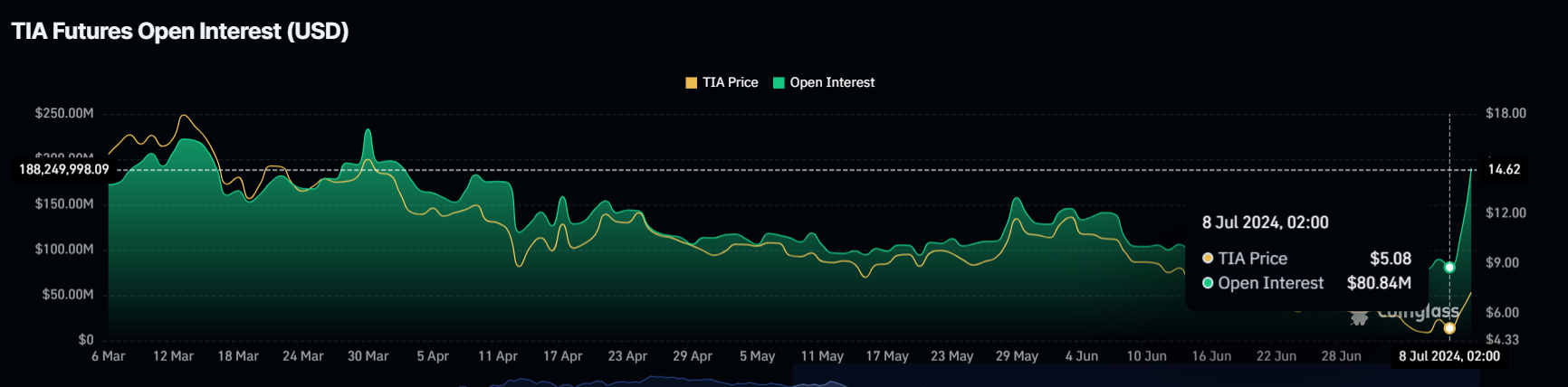

Celestia’s open positions have significantly increased over the past two days, doubling from $80 million to $190 million. This sharp increase indicates a significant rise in altcoin trading activities and investments. The rapid rise in open positions generally underscores growing interest and confidence among traders and investors. However, this is not the case with Celestia. TIA investors are expecting a price drop as indicated by the funding rate.

TIA’s funding rate has reached its highest point since inception, turning from positive to negative. A negative funding rate typically indicates that short positions are paying long positions in the futures market, reflecting bearish sentiment among investors.

When these two data points are combined, it becomes clear that the increase in open interest indicates a rise in short contracts, driving the funding rate to historic lows. This shows that TIA holders expect and demand a price drop following the rally.

TIA Chart Analysis

Celestia’s price can move in two directions. One is according to investor demand, and the other is according to market suggestions. If TIA follows investor demand, it may lose recent gains and drop to $4.9.

Trading at $6.6 could lead to a 24% drop, signs of which are already visible in the recent 8% decline. On the other hand, if the price rises again and turns $7.2 into a support level, a rise above $8.1 is likely. This could push Celestia’s price to $10, invalidating the bearish thesis.