Bitcoin closed the week on September 24th above $26,500. According to analysts, the main reason for this is that Bitcoin investors continue to accumulate regardless of the price. Data from TradingView shows that Bitcoin maintained its price stability over the weekend, while factors such as the decline of Wall Street and macroeconomic data from the US became other topics of interest in the crypto market.

Investors Keep Accumulating Bitcoin

Price data obtained from TradingView indicates that Bitcoin’s price stability remained intact over the weekend. The topics that attracted the attention of the cryptocurrency market this week, under the leadership of Bitcoin, were the decline in Wall Street and macroeconomic data from the US.

Following all these developments, popular trader and analyst Credible Crypto shared the BTC order book data taken from Binance, the world’s largest cryptocurrency exchange, and pointed out that investors continue to accumulate Bitcoin:

“It seems like we are not ready to make a move yet. Meanwhile, two more bid blocks just filled up, and accumulation continues. Maybe we’ll have a slow weekend and start seeing some movement on Monday. Let’s see what tomorrow brings!”

On September 23rd, another prominent investor Skew tweeted through X, hoping that this situation would be a liquidity hunt, but at the time of writing, this has not yet happened.

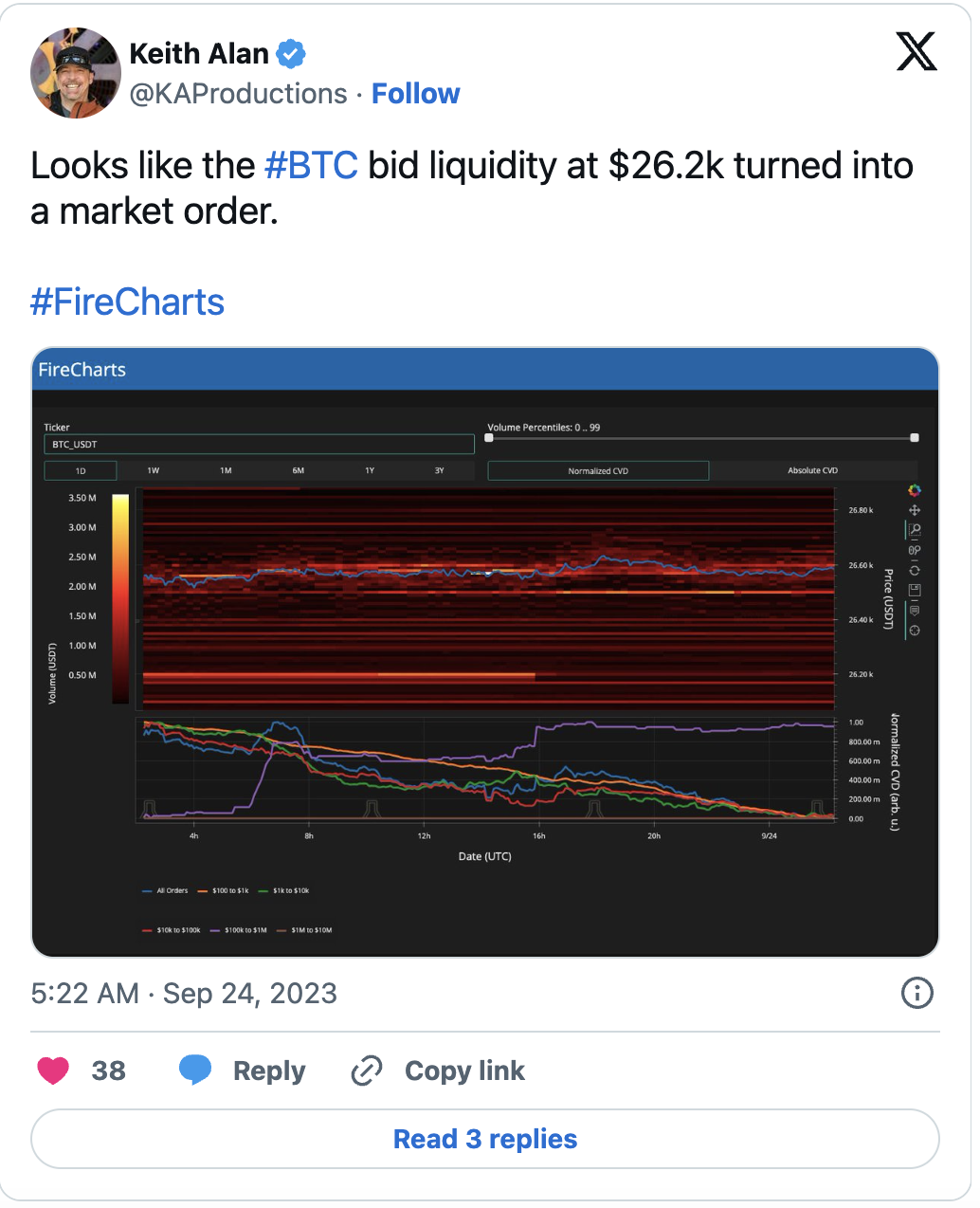

These notable data in the Binance order book were not observed to have a positive impact on spot prices by many analysts. This information was shared through X by Keith Alan, co-founder of Material Indicators.

Noteworthy Data in Bitcoin Market

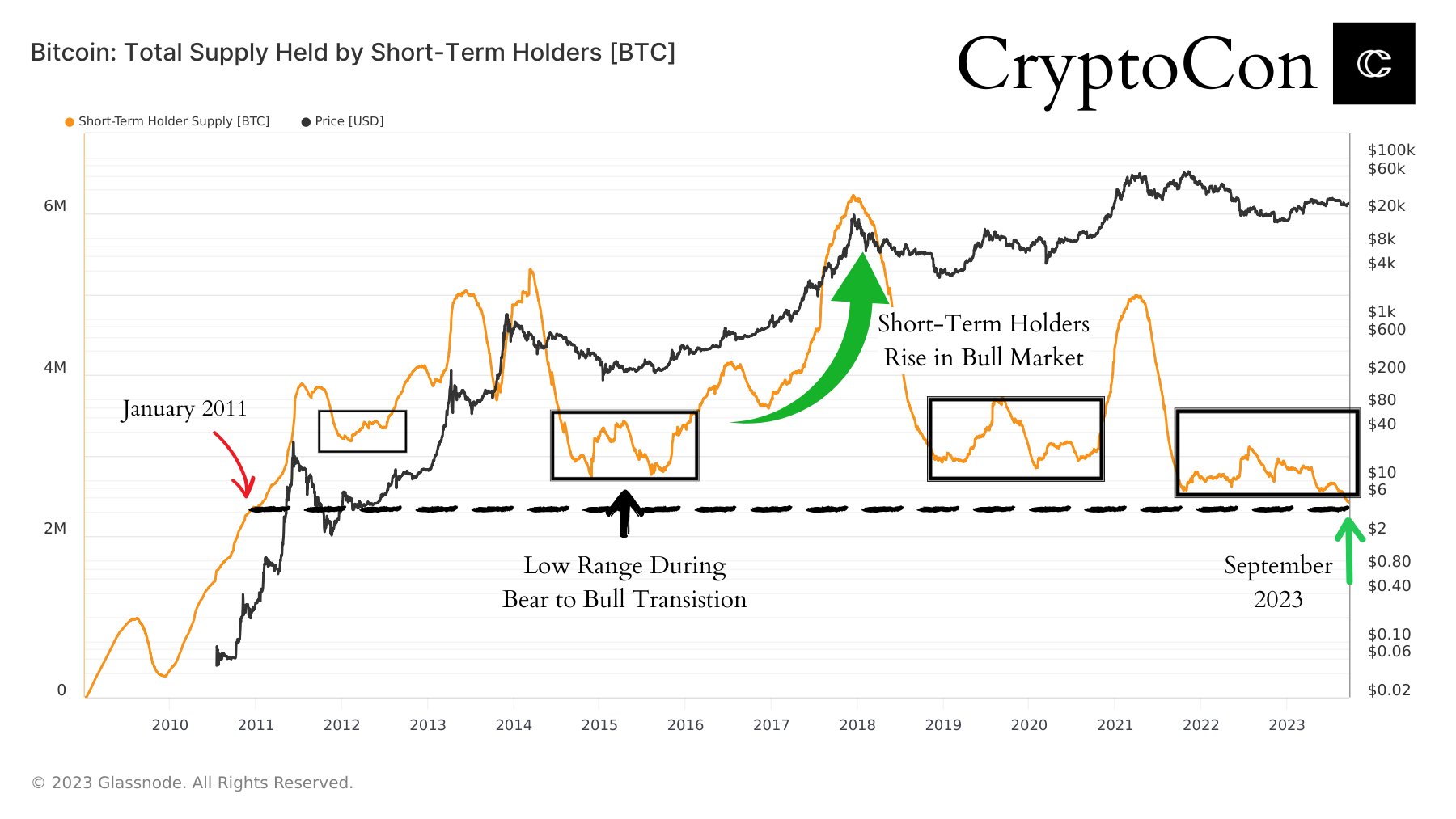

Popular investor and analyst CryptoCon continues to inform his followers on X about active market participants in the Bitcoin market. According to his latest tweet, speculators in the Bitcoin market have been significantly liquidated.

The data of short-term BTC holders, who have held their Bitcoins for 155 days or less, continues to move towards the lowest level in the past ten years. This means that Bitcoin holders continue to hold onto their assets, regardless of the price. CryptoCon, who drew attention to the data from on-chain analysis company Glassnode, evaluated the short-term holder data as a thin layer:

“In other words, there are more strong Bitcoin holders than ever before!”

Türkçe

Türkçe Español

Español