Matthew Sigel, the Director of Digital Asset Research at VanEck, announced that Bitcoin (BTC)  $81,845 has been the best-performing asset among all asset classes since the beginning of the year. Sigel highlighted that current data indicates a potential for upward fluctuations in Bitcoin’s future. This statement underscores Bitcoin’s continued strength as a robust option for long-term investors.

$81,845 has been the best-performing asset among all asset classes since the beginning of the year. Sigel highlighted that current data indicates a potential for upward fluctuations in Bitcoin’s future. This statement underscores Bitcoin’s continued strength as a robust option for long-term investors.

Bitcoin Maintains Strong Performance

In a post on X, Sigel discussed Bitcoin’s annual fundamentals, miner behaviors, volatility, the attractiveness of Exchange-Traded Products (ETPs), and the role of decentralized networks in a censorship-heavy world. These comprehensive analyses emphasized that Bitcoin’s performance demonstrates both short-term and long-term potential.

He particularly noted that the increasing interest of miners and ETPs could positively impact the future price movements of the leading cryptocurrency.

Rising Expectations for Bitcoin

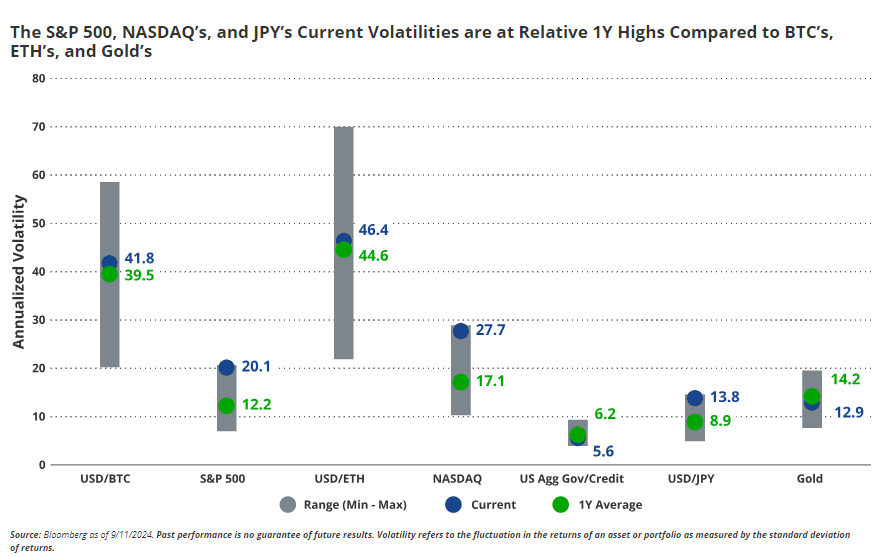

According to Sigel’s analysis, Bitcoin’s strong performance and the increase in market volatility bolster the likelihood of upward fluctuations. The decentralized nature of Bitcoin and its resilience against censorship further support these positive expectations. Additionally, the growing interest in ETPs indicates a rising demand from institutional investors, suggesting that prices may climb even higher.

Overall, the VanEck Research Director anticipates that Bitcoin’s superior performance since the year’s start will continue, with potential for upward price movements in the near future. This statement is viewed as a significant indicator for investors closely monitoring the dynamics of the cryptocurrency market.

With current data showing BTC trading at $63,440 after a 1.24% increase in the last 24 hours, Bitcoin has impressively risen by 9.64% over the past week.

Türkçe

Türkçe Español

Español