In the US, increasing optimism for the approval of at least one spot Ethereum ETF significantly boosted momentum in the cryptocurrency market. The upward momentum particularly triggered the liquidation of short position investors who were expecting a decline.

Spot Ethereum ETF Expectations Impact Investors

Bloomberg analysts recently increased the likelihood of at least one spot Ethereum ETF approval in the US from 20% to 75%, creating a positive atmosphere in the market. This expectation led to significant gains, with Bitcoin (BTC) surpassing $71,000 for the first time since early April and Ethereum (ETH) rising by up to 20% to $3,700.

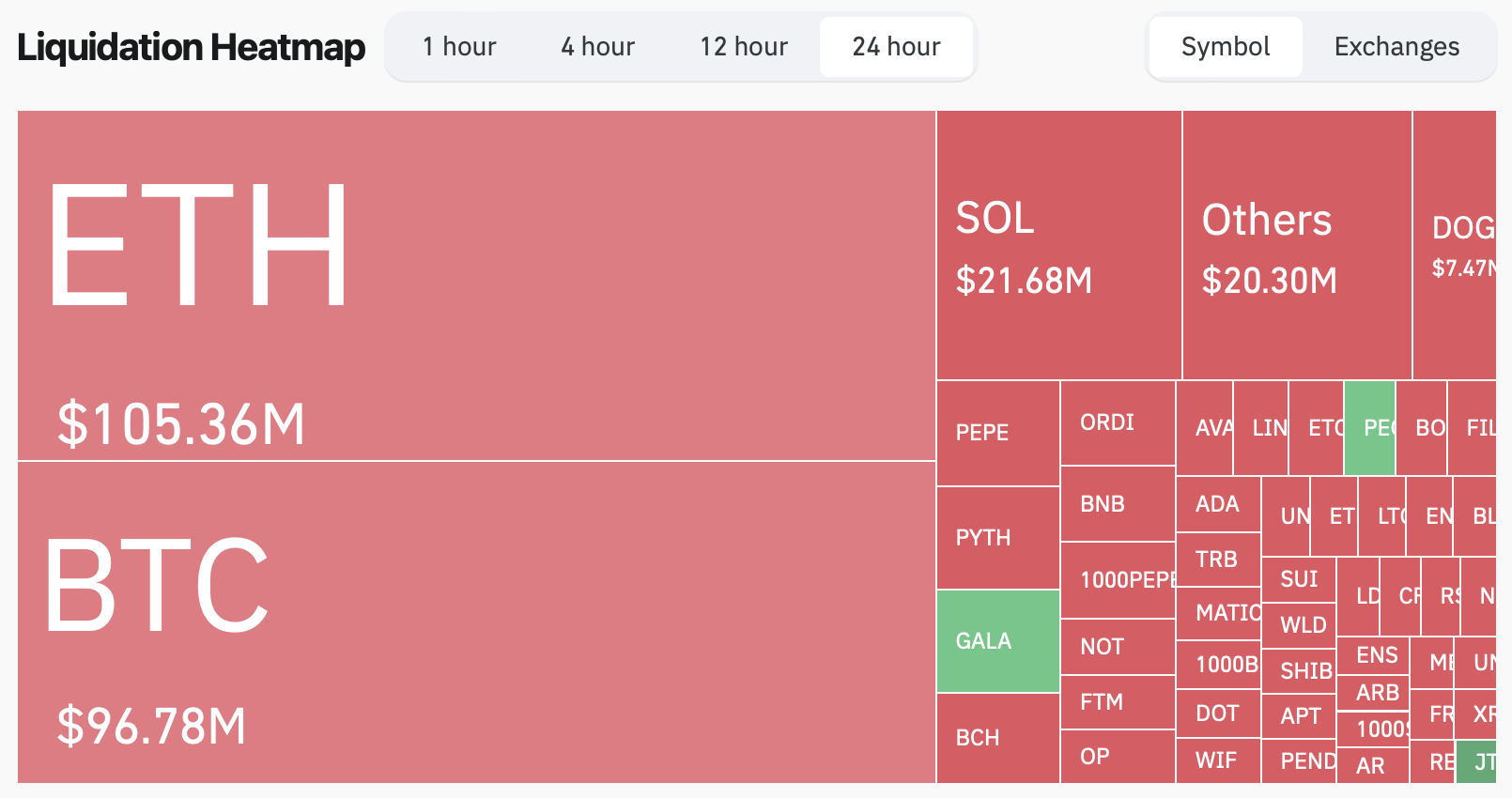

Other major altcoins also recorded significant increases. According to the data and price platform CoinGecko, Ripple’s XRP, Cardano’s ADA, Solana’s SOL, and Dogecoin’s DOGE rose by more than 5%. This surprising upward price movement resulted in the liquidation of over $260 million in short positions across the market, the largest since February 28. According to Coinglass, short positions in ETH saw losses exceeding $100 million, while Bitcoin short positions saw losses just over $99 million.

The cryptocurrency exchange Binance recorded the highest liquidation, exceeding $130 million, followed by OKX with $118 million and Huobi with $51 million. Short positions are essentially opened with the expectation that the price will fall, and liquidations occur when exchanges forcibly close leveraged positions due to insufficient margin, leading to significant losses for investors.

The rally in the cryptocurrency market began late on May 20 after Bloomberg analysts Eric Balchunas and James Seyffart raised the likelihood of spot Ethereum ETF approval to 75%. The US Securities and Exchange Commission (SEC) requesting exchanges to update their 19b-4 applications for spot Ethereum ETF applications before a critical deadline is seen by experts as a potential approval.

Market participants view the approval of a spot Ethereum ETF as a bullish event that could potentially open doors to significant institutional capital. The spot Bitcoin ETF, launched in January, has already attracted a total of $12 billion in inflows with the participation of top trading firms and state funds. The potential approval of a spot Ethereum ETF is also expected to have a similarly positive impact on the market.

Price Could Rise to the $4,000 Threshold

Some investors foresee further price increases for ETH. Singapore-based QCP Capital suggested that an ETF approval could push ETH’s price closer to $4,000, while a rejection could pull the price down to $3,000. The accelerated updates requested by the SEC for 19b-4 applications indicate that approval may be closer.