Ethereum‘s leading Layer-2 scaling solution Polygon’s supporting MATIC price reached a 60-day peak. Last week, MATIC’s price increased by 28% as investors anticipated the upcoming token swap from MATIC to POL. As of the date of this writing, MATIC is trading at $0.52. The double-digit price increase over the past seven days is partly due to increased whale activity during that period.

Continued Intense Interest in Polygon

Data from IntoTheBlock shows that the net flow of the token’s large holders increased by 43% during that period. Large holders refer to investors who hold more than 0.1% of an asset’s circulating supply. Their net flows measure the difference between the assets they purchase and the amount they sell over time.

When the net flow of large holders of an asset rises, it means whale addresses are accumulating more assets. This is generally considered a bullish indicator that can lead to a price rally. As individual investors observe large investors increasing their positions, their confidence typically grows, encouraging additional purchases and sustaining price momentum.

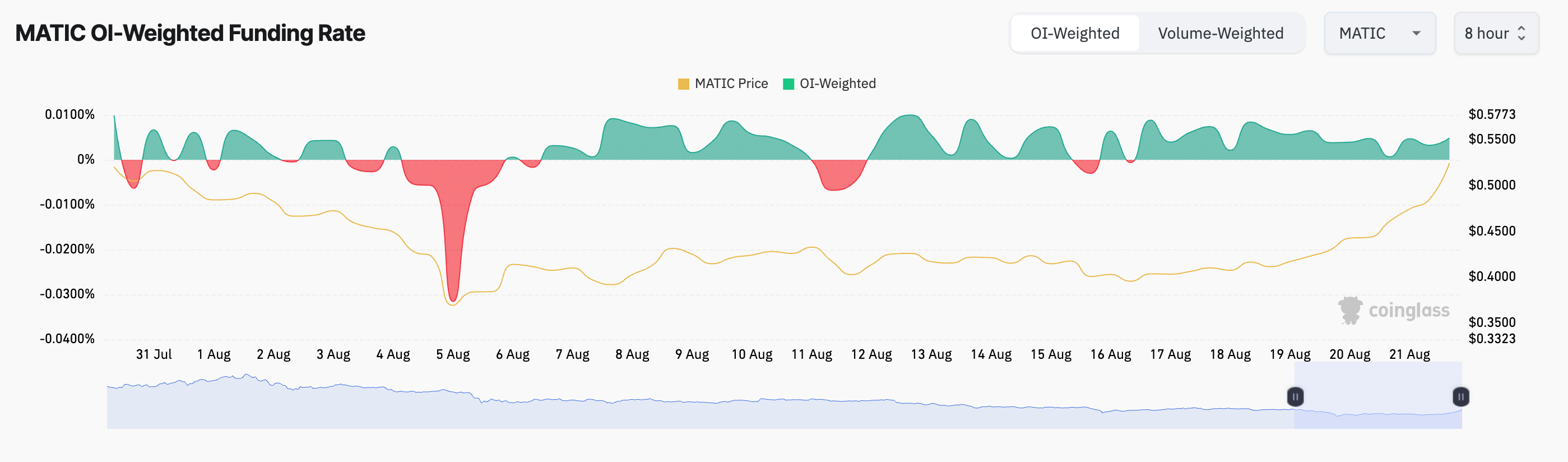

Moreover, MATIC futures investors consistently showed demand for long positions. This is reflected in the altcoin’s positive funding rate since August 17, indicating that investors are willing to pay a premium to maintain bullish positions in the futures market. When an asset’s funding rate is positive, there is more demand for long positions. This means more investors are predicting a price rally than those expecting a decline.

MATIC Chart Analysis

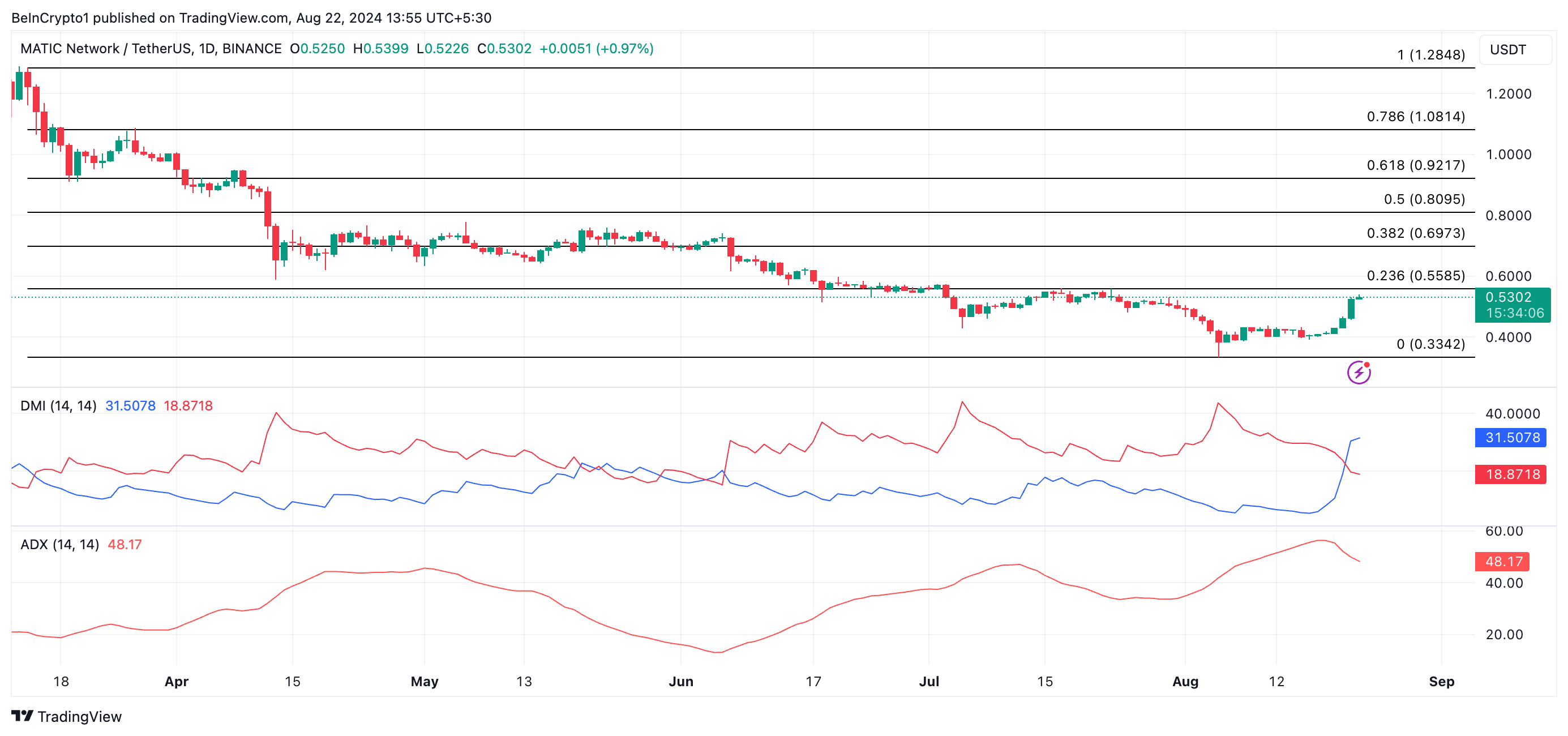

MATIC’s Average Directional Index (ADX) confirms the current bullish trend is strong. Evaluated on a daily chart, the indicator is in an uptrend at 48.17. The ADX measures the strength of a trend regardless of its direction. At 48.17, MATIC’s ADX indicates that the current trend is very strong.

MATIC’s Directional Movement Index setup shows the trend is on the rise. As of the date of this writing, the token’s Positive Directional Indicator (+DI) is above the Negative Directional Indicator (-DI). When +DI is above -DI, it means the market trend is bullish and buying pressure is dominant. Maintaining the current trend could push MATIC’s price to $0.55. However, profit-taking could exert downward pressure, potentially lowering the price to $0.33.