ORDI’s price recorded a significant increase at the beginning of the week as the broader crypto market experienced a slight recovery. However, in addition to the general market trends, consistent support from investors managed to keep ORDI in an upward momentum. The recent price increase of ORDI can be attributed to several factors, with investor determination being a significant element.

What is Happening with ORDI?

The Chaikin Money Flow (CMF) indicator shows that the altcoin has seen consistent inflows since the end of June. These inflows are crucial in maintaining ORDI’s resilience against the recent downward trends in the broader market. If these inflows continue, ORDI could be well-positioned for more gains in the near future. The continuous capital movement towards the altcoin indicates that investors trust its potential and could lead to additional price increases, provided the broader market conditions remain favorable.

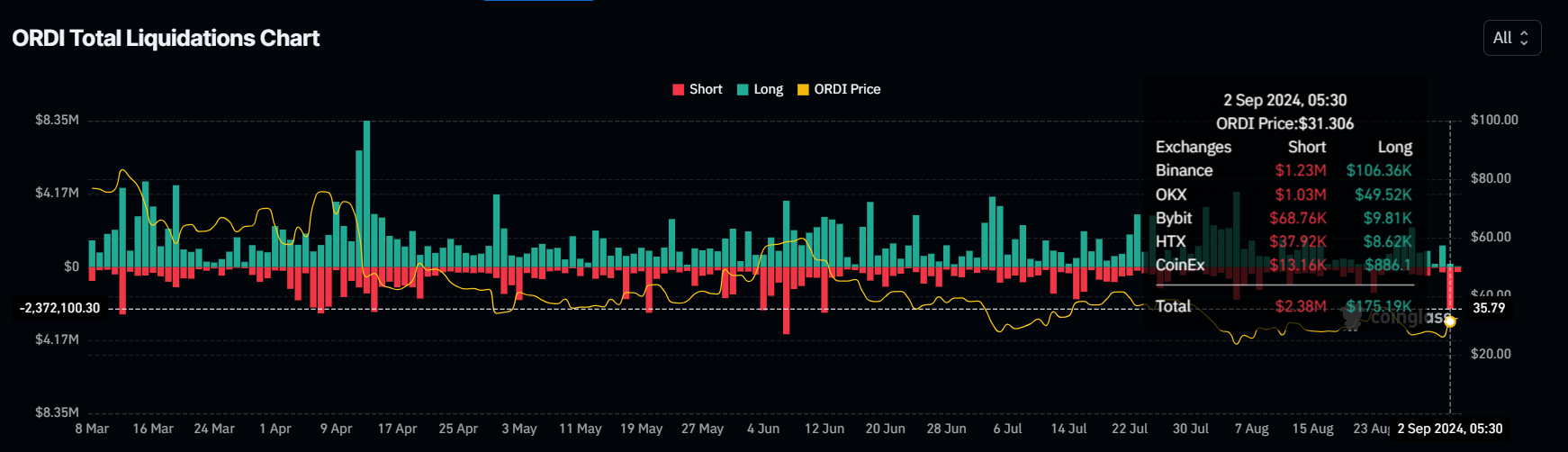

Conversely, bearish investors holding short positions may need to reassess their strategies in light of recent developments. Yesterday, ORDI experienced a short liquidation process of $2.38 million, the largest since mid-June. This significant liquidation event could prompt short-term investors to reconsider their positions.

Historically, increases in short-term liquidations have typically followed recovery periods for ORDI. This pattern suggests that the altcoin could be on the verge of an upward trend as short-term sellers are forced to exit their positions, reducing downward pressure on the price and paving the way for potential gains.

ORDI Chart Analysis

Currently priced at $32.40, ORDI’s price increased by 23% in the last 24 hours after falling to the support level of $25.55. If positive factors continue, the altcoin could surpass the resistance level of $35.56. Once this level is established as support, ORDI could rise significantly.

Historically, $35.56 has served as a strong support level, and from this point, an upward trend could push the altcoin to $40 and higher. The next major resistance is at $46.53, and reaching this point requires strong and consistent bullish signals. However, if ORDI fails to surpass the $35.56 level, it could face a decline as investors may sell to secure recent gains. This could lead to a drop to $30.00 and further declines could invalidate the bullish outlook.

Türkçe

Türkçe Español

Español