Toncoin’s price is retreating from its all-time high as investors move tokens to centralized exchanges. This ongoing profit-taking process could affect the altcoin price long-term and its potential for a new ATH. Toncoin’s price recently reached an all-time high of $8.2 following a steady upward trend in Telegram-based tokens.

What’s Happening with TON?

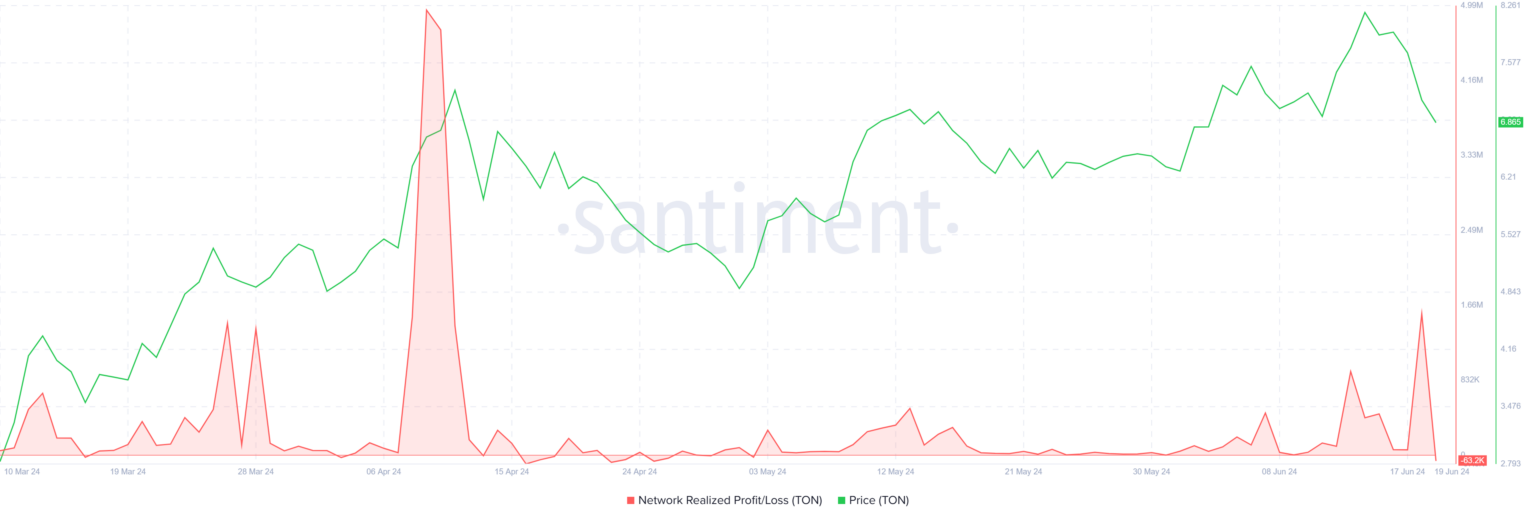

Investors waited until this milestone but have since focused on securing their gains. Profit-taking has increased across the network in the past few days. The sudden spikes in the realized profit/loss indicator signal that sales are rapidly increasing and may continue for some time.

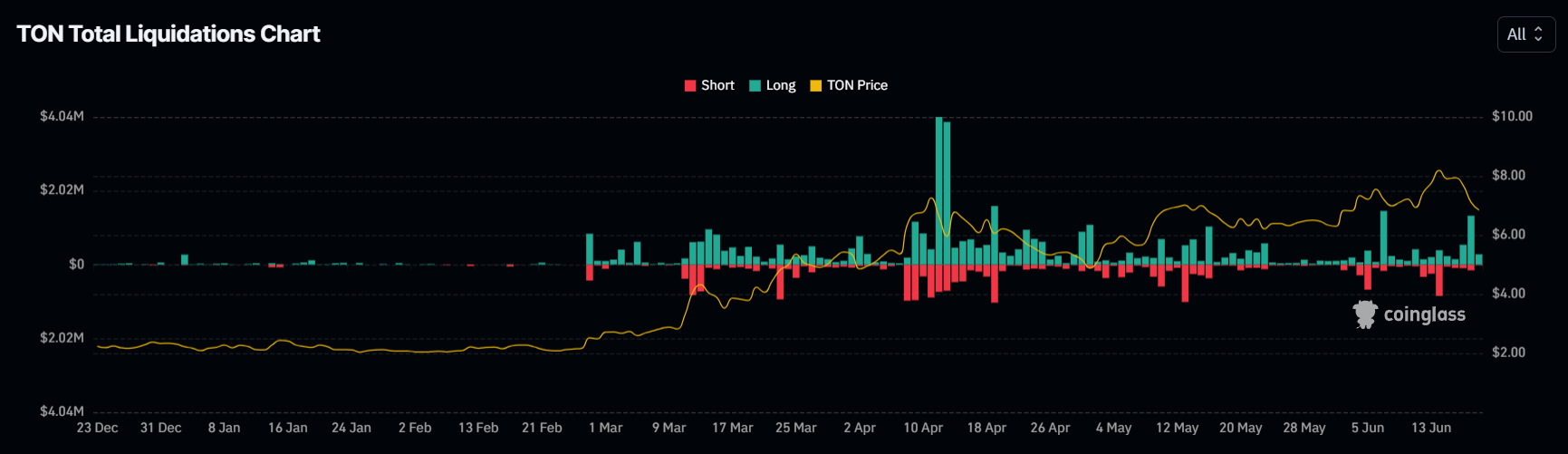

This profit-taking process is severely impacting future price movements, as indicated by network liquidations. Last week, more long contracts were liquidated compared to short contracts in the futures market due to the price drop.

This process shows that profit-taking is hindering attempts by investors to signal further increases in Toncoin price. Ultimately, investors predicting a rally may retreat due to losses, potentially causing a decline.

TON Chart Analysis

Toncoin’s price is trading at $6.8 from its ATH level of $8.2. The 16% drop recorded over the last four days caused the TON price to fall from multiple support levels of $7.5 and $7.0, now approaching $6.5.

This price point has been tested many times in the past, making it a crucial support to maintain. However, if profit-taking continues and intensifies, a drop below this level is likely, potentially sending the TON price to $6.0.

However, if the altcoin manages to turn $7.0 into a support base, it could continue its rise. Surpassing the $7.5 level will invalidate the bearish thesis and open up the possibility of another ATH for Toncoin.