According to a report prepared by the cryptocurrency analysis platform CCData, the monthly decline series in the market value of stablecoins, a type of altcoin, has reached its 16th month with the month of July. The market value of stablecoins has dropped to its lowest level since August 2021. The report states that investors are gradually exiting stablecoins.

The Market Value of Stablecoins Decreased by 0.82% in 16 Days

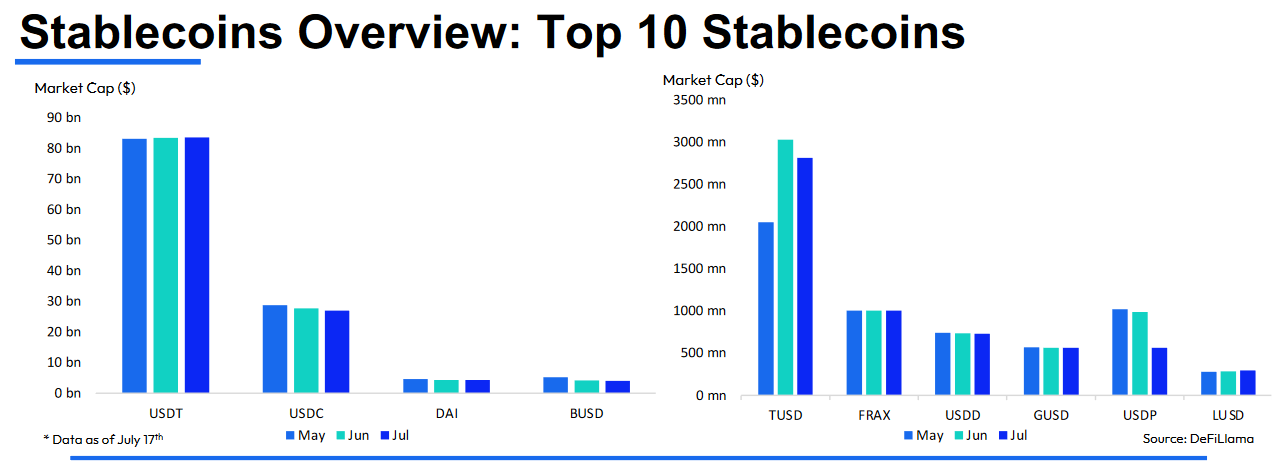

According to CCData’s report, the market value of stablecoins reached $127 billion with a 0.82% decline from the beginning of July to July 17. The dominance of stablecoins on the market also decreased slightly from 10.5% in June to 10.3%.

Pax Dollar (USDP) experienced the biggest decline among the top ten stablecoins, dropping to $563 million, the lowest level since December 2020, with a 43.1% decline in July. This decline is primarily associated with MakerDAO’s decision to withdraw 500 million USDP from its reserves due to a lack of additional income.

Tether (USDT), the largest stablecoin by market value, reached an all-time high market value of $83.8 billion on July 17, increasing its dominance on the stablecoin market to 65.9%. However, the market values of USD Coin (USDC) and Binance USD (BUSD) decreased by 3.01% and 4.57% respectively, reaching $26.9 billion and $3.96 billion, and USDC’s market value reached its lowest level since June 2021 after seven consecutive months of decline.

Despite Decreasing Market Values, Transaction Volumes Increased

Despite the decrease in market values, the transaction volume of stablecoins increased by 16.6% in June, reaching approximately $483 billion, marking the first monthly increase since March. CCData attributed this increase to the lawsuits filed by the U.S. Securities and Exchange Commission (SEC) against Binance and Coinbase and the increase in applications for spot Bitcoin exchange-traded funds (ETFs).

In June, the SEC’s lawsuit against Binance resulted in the suspension of fiat transactions on the cryptocurrency exchange’s U.S. arm, Binance.US, and a discount of approximately 27% and 18% for USDT and USDC, respectively, as they lost their peg to the U.S. dollar.

On the other hand, the decentralized stablecoin market, including Dai (DAI), Frax (FRAX), and USDD, reached a market value of $7.52 billion in July, an increase of 0.43% and the first positive month since February. However, the market value is still 78.1% below the all-time high of $34.3 billion in April. The downward trend in the decentralized stablecoin market began with the collapse of the Terra ecosystem and the near 100% depreciation of the algorithmic stablecoin TerraClassicUSD (USTC).

Türkçe

Türkçe Español

Español