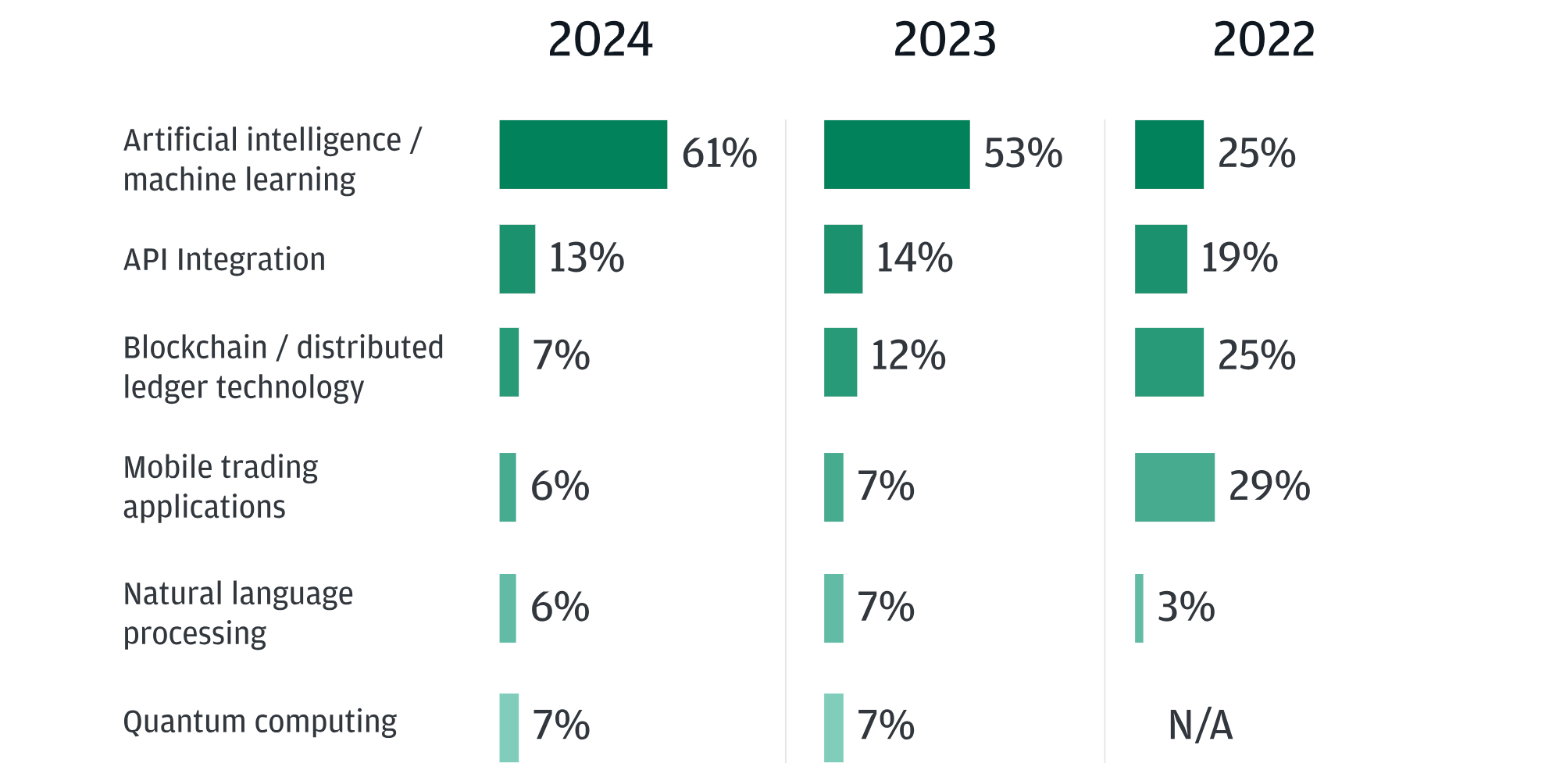

A recent survey by multinational investment bank JPMorgan reveals that institutional investors are increasingly recognizing the significant role of artificial intelligence (AI) in the future of trading. According to the latest data from JPMorgan’s “e-Trading Edit: Insights from the Inside” survey, 61% of the 4,010 institutional investors from 65 countries expect artificial intelligence and machine learning (ML) to emerge as the most effective technologies for trading within the next three years.

Emerging Technologies Reshaping the Trading Environment

Following artificial intelligence and machine learning in the survey rankings is application programming interface (API) integration, identified by 13% of participants as one of the key technologies shaping the future of trading.

Blockchain and quantum computing closely follow, each garnering 7% of participants’ preferences. Mobile trading applications and natural language processing are of interest to 6% of the participants.

The Evolution of Artificial Intelligence in Trading

Artificial intelligence and machine learning have been gaining steady interest in JPMorgan’s “e-Trading Edit” report over recent years, rising to a significance level of 25% just two years ago.

However, there is a noticeable shift in sentiment towards other technologies. As indicated in JPMorgan’s survey, institutions are becoming increasingly skeptical about the roles of mobile trading applications and Blockchain. Since 2022, Blockchain and mobile trading applications have witnessed a decline in investor interest as promising technologies for trading, by 18% and 23% respectively.

Impact on Finance and Trading

Artificial intelligence is reshaping the finance environment by offering various features such as real-time threat identification for trade predictions and market sentiment. According to a 2022 report by Nvidia, integrating artificial intelligence and machine learning has led to more than a 10% decrease in annual revenues for 30% of participants.

Despite the doubling role of artificial intelligence in trading, institutions surveyed by JPMorgan are less inclined towards cryptocurrency trading.

Shifting Attitudes Towards Cryptocurrencies

According to the survey results, 78% of institutional investors have no plans to trade cryptocurrencies like Bitcoin in the next five years. This rate had increased to 72% in 2023. However, there is a slight increase in the number of participants who are trading or wish to trade cryptocurrencies. Accordingly, it has risen from 8% in 2023 to 9% in 2024.

JPMorgan’s stance on cryptocurrencies has been controversial over the years. Despite CEO Jamie Dimon’s persistent criticism of cryptocurrencies like Bitcoin, the company participates as an authorized participant in one of BlackRock’s fastest-growing spot Bitcoin exchange-traded funds.

In conclusion, the survey highlights the increasing influence of artificial intelligence in trading, while also emphasizing evolving attitudes towards cryptocurrencies in corporate circles. As technological advancements continue to shape the financial world, institutions must adapt to remain competitive in the ever-changing market environment.

Türkçe

Türkçe Español

Español