Looking at the past two years, it has become more apparent that the performance of Bitcoin (BTC) and the overall cryptocurrency market is closely related to the S&P500. Therefore, growing economic concerns have also had a negative impact on the performance of Bitcoin. Based on this information, many people may think that Bitcoin may have lost its purpose.

Is Bitcoin a Good Investment?

Will Clemente, the founder of Vero Data, continues to share posts stating that Bitcoin can still be one of the best assets to hold in the long term, especially as the US economy seems to be sinking further into debt.

In a recent post, Clemente shared with his followers that the only way for the US to avoid a financial crisis is to have higher economic growth than debt. However, debts in the US are increasing faster than economic growth. According to analysis, holding Bitcoin could be a reasonable motive for debt and value loss.

According to Clemente, the devaluation of the currency with increasing inflation may strongly indicate the need for an alternative monetary system. This situation could pave the way for people to embrace cryptocurrencies, especially Bitcoin, as a long-term protection against inflation.

Bitcoin Challenges the Market

Inflation and increasing debts seem likely to continue to burden the US economy and consequently the rest of the world. In this case, the demand for Bitcoin may continue to rise.

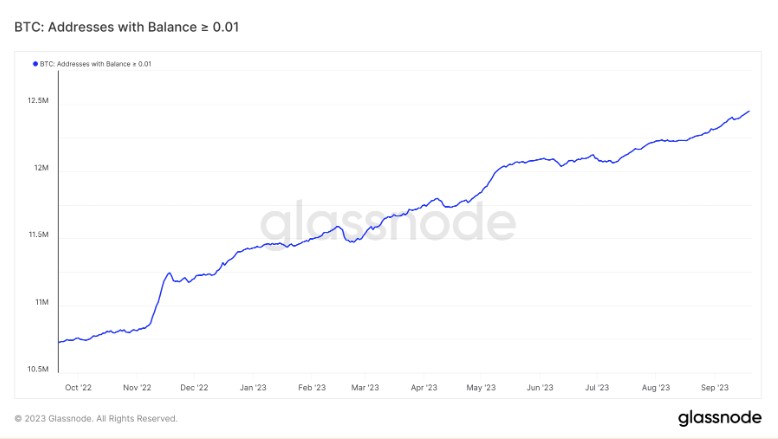

We can see evidence of this in broader time frame analysis. For example, the number of addresses holding at least 0.01 BTC has steadily increased in the past 12 months. According to the same metric, the number of new addresses joining this category is over 1.71 million in the last 12 months. In addition, the amount of Bitcoin in exchange reserves is decreasing.

Based on the above data, we can see that the long-term demand for Bitcoin continues. However, it still remains vulnerable to short-term effects. The latest concerns revolve around the potential impact of interest rate changes on Bitcoin’s price movement. This is because interest rates can be considered as determining the accessibility of liquidity. However, Bitcoin has the potential to overcome these drawbacks in the long run, especially when the next bull market begins, it can also overcome its correlation with the S&P500.