Data regarding Ethereum suggests that implementing the dollar-cost averaging (DCA) strategy by investing $100 per week starting from 2023 would not be a profitable strategy for the second-largest cryptocurrency.

Specifically, DCA involves investing at regular intervals, buying equal amounts of cash regardless of the price. It is a popular method among new investors as it minimizes the impact of volatility and psychology on overall investment, unlike trying to time the market entry.

What Would Your Ethereum Be Worth?

However, despite the implementation of this method, DCA has its shortcomings because it relies on the assumption that prices will always rise after a certain point. But when this is not the case, such a strategy leaves investors vulnerable to falling market prices, as seen with Ethereum. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

When applying this method to Ethereum in 2023, i.e., buying $100 worth of ETH every week from January 1, 2023, according to the latest data from cryptoDCA on September 20, the $3,800 investment (38 weeks) would be worth $3,618.97 today, or 4.76% less than the amount invested.

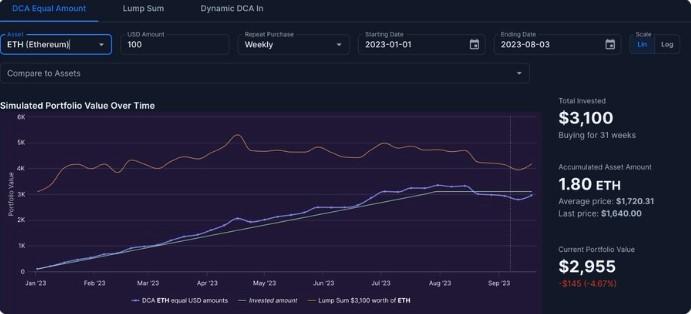

Previously, crypto analyst Benjamin Cowen shared his calculations covering the period until August 3, 2023 (31 weeks) and obtained similar results, stating that investors using the $100 weekly DCA strategy in Ethereum would incur a 4.67% loss.

In addition, applying the same method to Bitcoin (BTC), i.e., spending $3,800 over 38 weeks, would have resulted in profitable returns, with a DCA value of $4,016.30 and a 5.69% investment gain as of September 19.

Ethereum Price Analysis

Meanwhile, Ethereum continued to trade at $1,627.05 at the time of writing, indicating a 1.17% decrease in the past 24 hours. According to the weekly charts, there was a 1.7% gain, but the current situation showed a 2.62% decrease over the previous month.

Furthermore, in an article shared by crypto trading expert Ali Martinez on September 15, it was mentioned that there was a net capital outflow in the market, and based on previous data, Ethereum lost $13 billion in net capital last week.

Türkçe

Türkçe Español

Español