Ethereum (ETH), the second largest cryptocurrency by market value and also the largest altcoin, may be on the verge of a significant decline, as analysts express concerns about its current price levels. According to prominent crypto analyst Ali Martinez, the altcoin king ETH is not able to withstand the selling pressure in the overall market that affects most cryptocurrencies, which poses a great risk for investors.

Ethereum’s Price at a Critical Point

Crypto analyst Ali Martinez suggests that Ethereum’s trading price of $1,680 could potentially open the way for a drop to $1,200, emphasizing the need for concern. He states, “The price of Ethereum dropping below $1,680 is a significant cause for concern, as it could lead to a drop of up to $1,200.”

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

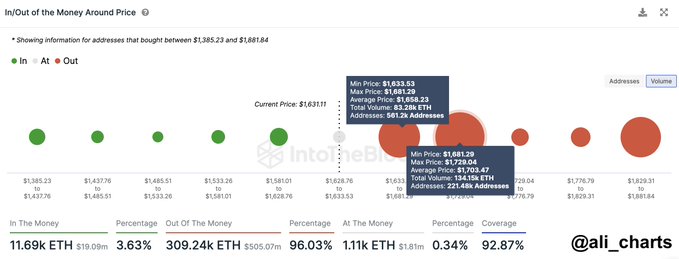

Martinez highlights that the number of wallet addresses purchasing Ethereum within the range of $1,285 to $1,681, based on data from crypto data and analysis platform IntoTheBlock, is quite limited. This limitation in investor numbers, coupled with declining investor interest at current price levels, indicates a potential drop of up to $1,200.

Martinez’s statement aligns with the dominant market sensitivity, which witnesses Ethereum struggling to maintain its price above this critical level. Previously, Martinez warned ETH investors that it could drop to $1,000 and identified the $1,600 to $1,550 range as a significant support zone.

Martinez expects that a downward break of this important support zone could trigger a significant drop in Ethereum, ranging from 37% to 45%. According to CoinMarketCap data, ETH is currently trading at $1,635 with a 0.43% increase in the last 24 hours.

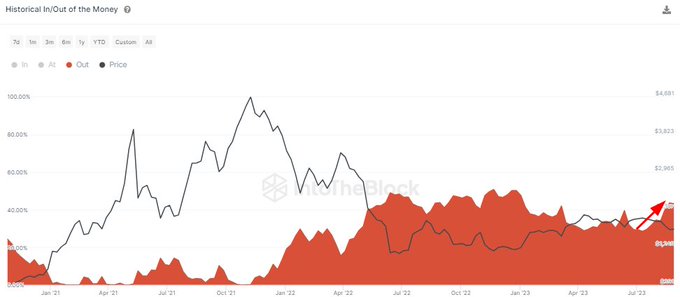

Percentage of Loss-Making ETH Investors on the Rise

Another significant factor contributing to the concerns of investors expecting a drop in Ethereum’s price is the increasing percentage of investors currently in a loss-making position. Data provided by crypto analysis platform IntoTheBlock reveals that the percentage of loss-making Ethereum investors has risen dramatically from around 27% in early July to 44.2% as of September 4. This represents the highest level seen since the beginning of the bear market, with the previous peak at approximately 50%.

The significant increase in the number of loss-making Ethereum investors raises questions about the overall health of the market and whether the downtrend is nearing a turning point. Historically, a large portion of investors being in a loss-making position triggers panic selling and further drives down the price.

Türkçe

Türkçe Español

Español