Cryptocurrency markets are far from their bright days in the 2021 bull season, and investors have been struggling with extreme sell-offs for the past 2 years. This actually shows that making profits in cryptocurrencies is not as easy as it is voiced during the bull season. Many investors, who considered themselves highly skilled while everything was rising, have been waiting for profits for 2 years due to their inability to sell at the right time.

Litecoin (LTC) Review

The anticipated halving took place this month. Let’s remember the warnings made by experts about Litecoin. Many experts voiced that the price was at risk of decline as the August halving date approached, with still 2 months remaining. Significant declines in price were observed in the previous two halving periods. Now, with the support of the decline in BTC price, LTC Coin price is experiencing the same fate.

Again, for the past 2 months, it has been suggested by experts that the price could go through a depression period for months at the $40 level. Since only 1 month has passed since the halving, it is difficult to predict where the price is heading. However, if BTC does not experience a significant recovery, they may be right about this as well. In our evaluation of the relationship between Litecoin halving and price, we clearly see why historical data should not be ignored.

Should You Buy LTC Coin?

The $65.47 price of LTC represented a 63% premium from the lowest price point during the crypto winter. On the other hand, it represented a 43% discount compared to the highest price point in July. Although the discount of LTC compared to the highest levels in July represents a healthy discount, it was much steeper considering its historical peak. Based on ATH discounts, we can conclude that LTC has appreciated more compared to its counterparts.

Note that Litecoin bears seem to have taken a break since July. The price is also sending oversold signals and is at a support level previously tested in March. Technically, considering the support and oversold conditions, as well as the significant discount, we may see some accumulation in this area.

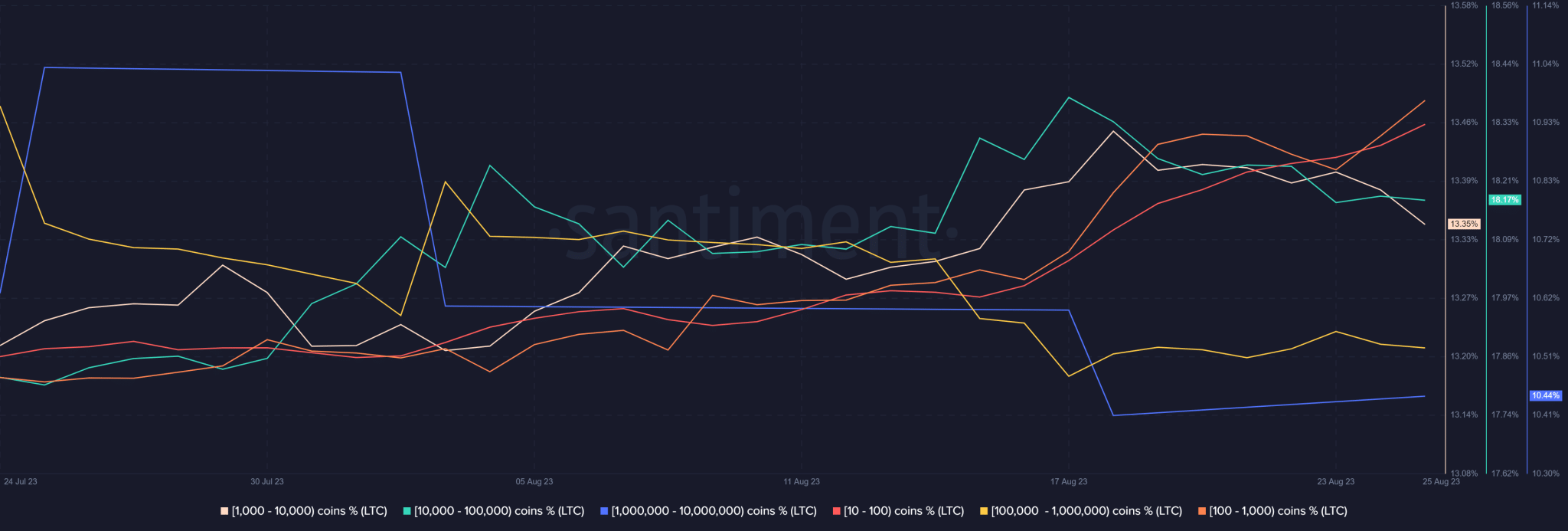

On the other hand, the group of investors holding between 10 and 1000 LTC has started accumulating. However, the daily active address count, which fueled negativity, has significantly decreased compared to the beginning of August. The MVRV ratio also supported the possibility of an uptrend.

In conclusion, the price may be expensive according to historical data. According to the same historical data, experts have been talking about the possibility of a long depression period for the price at the $50 level for the past 2 months.

Türkçe

Türkçe Español

Español